GASB 87 Lease Accounting Implementation Tool for Governments

In June 2017, the Governmental Accounting Standards Board (“GASB”) issued a new single lease reporting model to help state and local governments report leasing arrangements.

Per GASB No. 87, Leases, governments that act as lessees must report a liability for the contract, as well as report an intangible right-to-use lease asset indicating their ability to use the leased item. For government entities that are lessors, they must disclose a receivable for the lease and a deferred inflow of resources.

With the issuance of GASB No. 95, the effective date of implementation has been postponed 18 months and now must be applied to financial reporting periods starting after June 15, 2021, with early adoption still permitted.

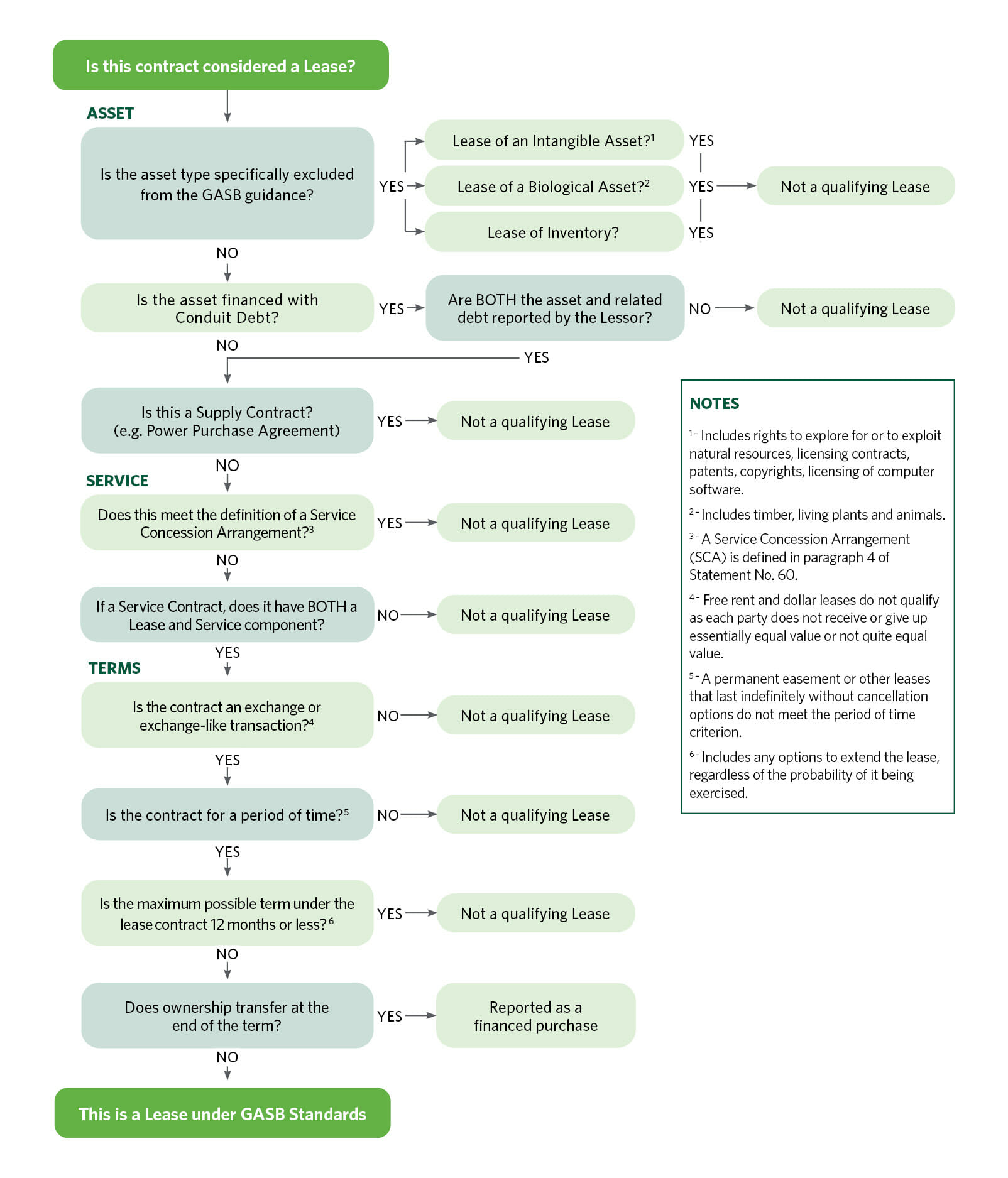

To help with the implementation of the new lease standard, Cherry Bekaert has released a flow chart to help government lessees and lessors determine if a contract is truly a lease under the standard.

Related Resources