Cost and Revenue Management Solutions for Higher Education

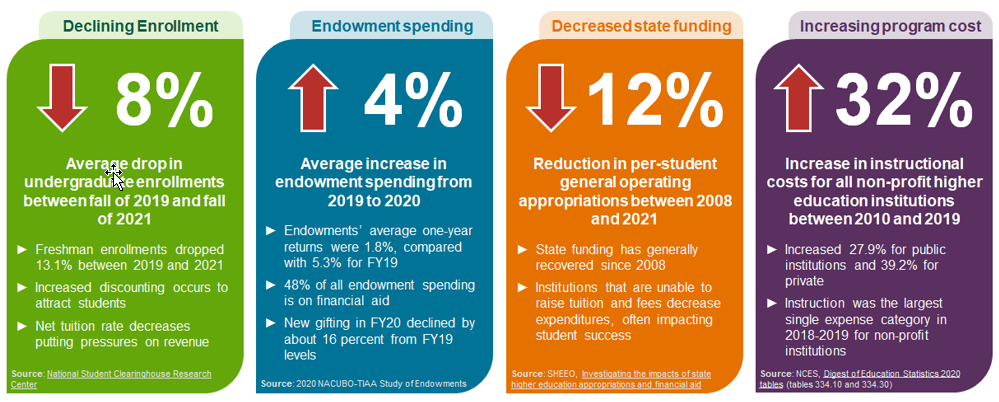

Higher education institutions have faced increasing financial pressures for many years, with COVID significantly accelerating these pressures. In spring of 2020 as COVID lockdowns took effect, higher education leaders looked to their CFOs for answers as institutions considered the economic impact of numerous scenarios that were being considered.

Most institutions’ CFOs scrambled to acquire data that would support the economic analysis of the various scenarios being evaluated. However, institutions that had a robust cost and revenue analytics capability were able to readily access data and conduct extensive analyses immediately. COVID demonstrated a need for higher education leaders to have a better handle on the drivers of cost and revenue at their institutions. Costs are increasing, revenues are flattening, and students and their families are starting to question the value of a traditional higher education experience, and higher education institutions need to develop strategies to address these trends.

All of this leads to a “perfect storm” for higher education. In fact, some would argue that the storm has already hit. Regardless of the timing, those institutions that have a firm understanding of their cost and revenue drivers are more effective at cost and revenue management and will be better prepared to weather the storm. By developing a solid cost and revenue analytics capability, institutions are better able to:

- Identify the relationship between inputs (resources) and institutional outputs in support of improved budgeting and planning activities, including developing new program estimates that are consistent with historical precedent.

- Determine if programs are generating enough revenue to both cover costs and allow for desired investments, supporting program investment and divestment discussions.

- Understand how indirect costs are impacting instructional, research, and auxiliary outputs, thereby helping the institution be more efficient with shared resources.

- Evaluate the impact of significant shared resources, like facilities and space policies and ownership, on a program.

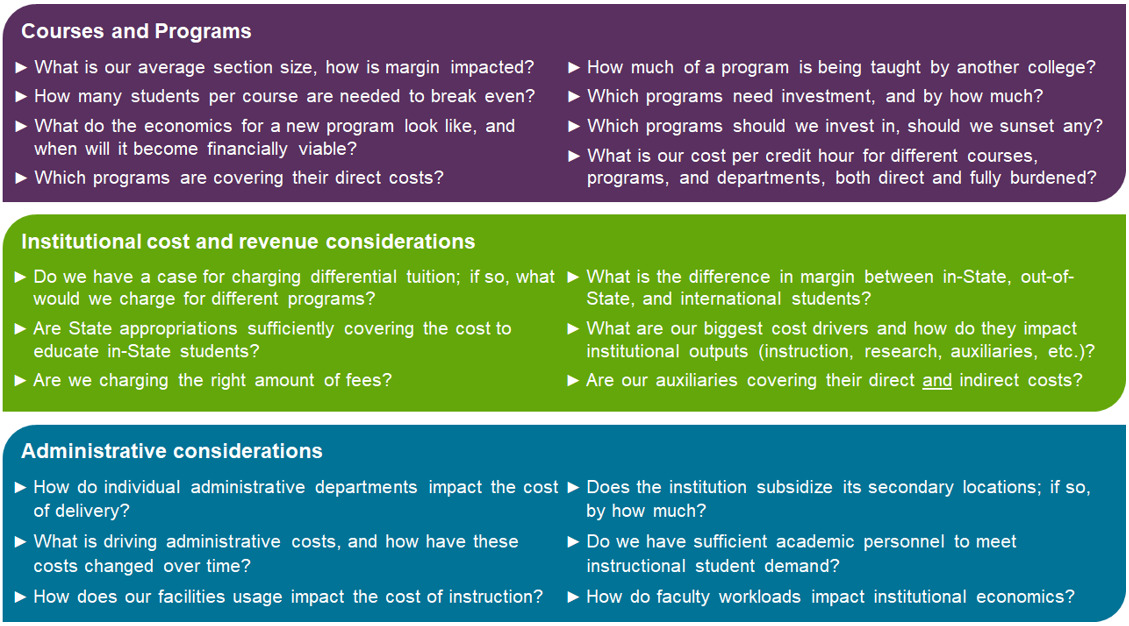

- Combine financial and non-financial information to conduct analyses on courses and programs, including determining course breakeven points, uncovering the contributions between colleges, comparing the cost impacts of different teaching modalities, and evaluating course and program cost versus “success” metrics.

- Analyze non-financial data like room utilization metrics, demographic data, course “DFW” rates, and other success metrics to uncover insights that can help guide faculty and staff in more effectively managing the institution.

While cost and revenue management “systems” provide a wealth of analysis opportunities it is important to recognize that the analysis needs to be balanced. Focusing on cost or revenue in isolation will not create financial stability. Institutions need to balance revenues and costs, both direct and indirect, so as to maximize mission attainment. Therefore, it is important to understand cost drivers and revenue drivers – to understand the economics of the institution – and for institutions to strategically balance the two levers to achieve financial stability for the long-term. By understanding the overall economics of the institution, its leadership is better able to navigate these trying times.

What is Cost and Revenue Analytics?

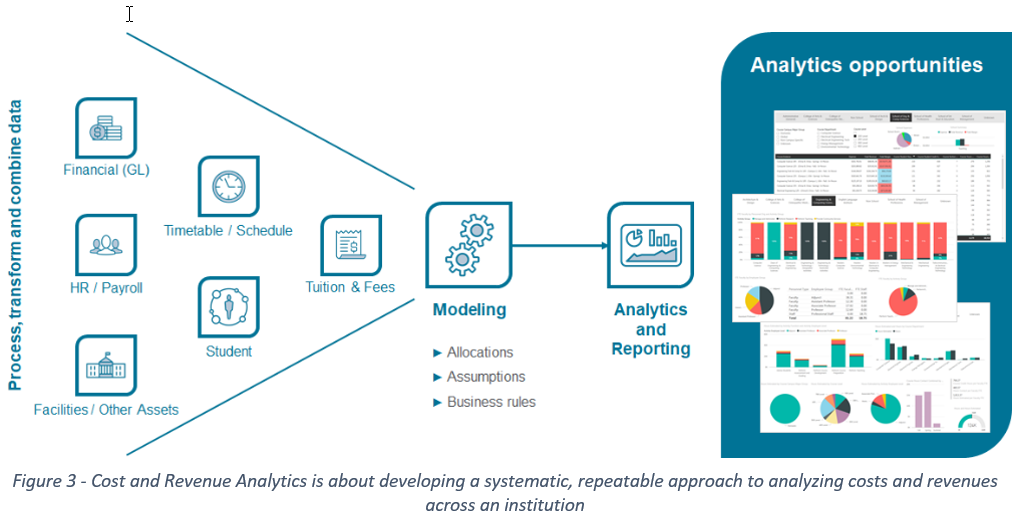

Achieving a cost and revenue analytics capability is about developing a systematic, repeatable approach to understanding and analyzing costs and revenues across an institution.

To effectively develop this capability an institution must combine multiple data sets that traditionally do not interconnect very well. Through the development of models, an institution can build business rules and assumptions that normalize and connect financial, human resource, student, facilities, course schedule, and tuition and fee data. These models produce powerful analytics and reporting data sets that provide institutions with significant analytics opportunities – both financial and non-financial. It is worth noting that the point of the exercise is not the modeling. The value to an institution is the analysis opportunities that the model provides, along with the subsequent transformation initiatives identified during the analysis.

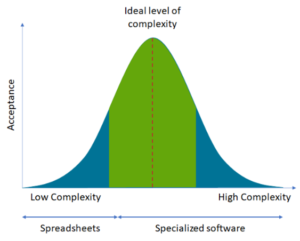

Beware of Using a Spreadsheet

Many institutions do some form of cost and revenue analysis already, typically using ad-hoc Excel spreadsheets. Unfortunately, spreadsheets tend to be error-prone, create analysis “islands” throughout the institution, are often divergent in their use of methodologies and assumptions, and often force a simplification of the modeling/analysis due to technology limitations. While spreadsheets have significant capabilities, they still require some level of simplification of the analysis being conducted, particularly in key areas like allocation methods. This results in overhead being allocated less accurately and in less causal ways, rendering decision-making more difficult. For example, to simplify the spreadsheet modeling and analysis, most institutions resort to simplified percentage allocations of overhead (if they include it at all) or resort to Student Credit Hour (SCH) allocations of overhead. SCH allocations tend to over-estimate the costs of large courses and underestimate the costs of small courses.

Because it is easier, most spreadsheet analysis focuses solely on direct cost. However, most institutions’ overhead costs constitute more than 50% of their total costs, leaving a significant portion of institutional costs off the table. When considering only direct costs, courses and programs will typically have a positive margin and look financially sustainable. However, when indirect and overhead costs are included in the analysis, margins sometimes turn negative, indicating that the course or program is not covering its share of institutional support costs. For a program that recoups its direct costs but not its indirect costs, focusing on increasing enrollments could be a viable solution. For a program that does not cover its direct costs, it might be necessary to examine the program, evaluate its importance to the mission of the institution and restructure its delivery if possible. For programs with strong positive margin, there may be a decision to expand the program or increase investment in the program. The key being that analyzing direct and indirect costs is an important aspect to cost and revenue management, and spreadsheets make the inclusion of indirect costs difficult.

Benefits to an Institution

A well-constructed cost and revenue management model provides a single source of truth for an institution and allows an institution to help consistently answer a wide array of questions. While the number and type of questions that can be answered are nearly endless, examples include:

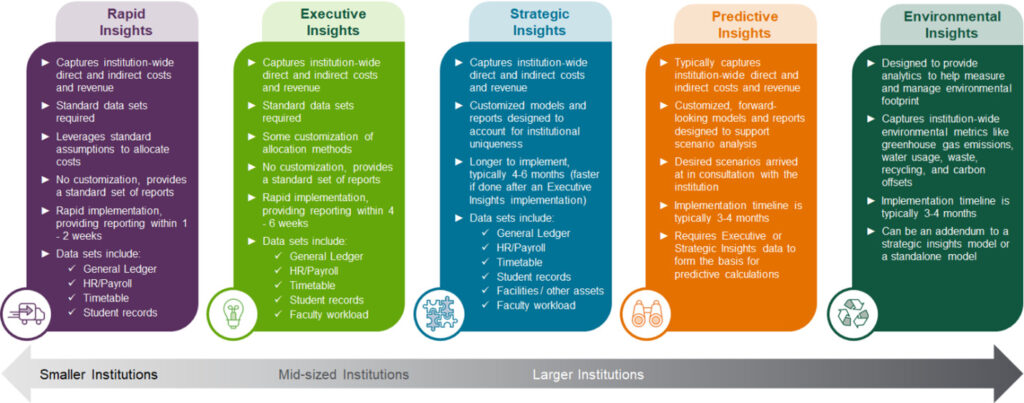

Every institution is unique, with different cultures, objectives, needs, systems, and the data within them. Cherry Bekaert has multiple cost and revenue management/analytics offerings that are designed to meet the need of any higher education institution. Each offering provides a wealth of analysis opportunities to help institutions identify opportunities to be cost efficient, enhance revenues, and maximize mission attainment.

Additional resources to help your institution leverage cost and revenue analytics:

Brochure: Cost & Revenue Management in Higher Education

Article: Digital Transformation in Higher Education

Brochure: Digital Advisory Services for Higher Education

Cherry Bekaert’s approach

Every institution is unique, with different cultures, objectives, needs, systems, and the data within them. As such, our approach to helping institutions with cost and revenue management is designed to meet the client where they are and develop solutions that are appropriately scoped and cost effective.

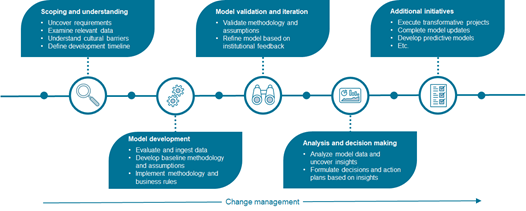

Our approach starts with a scoping study that allows us to balance requirements against available data to ensure that institutional expectations and needs can be met. After developing a model, we work with the institution to validate and refine the methodology and assumptions that were used in the initial model development. Once the model and its analytics output have been validated the institution needs to use the data to uncover insights and formulate decisions and action plans based on the insights. Throughout this entire process we make sure that the institution is recognizing institutional culture and ensuring that effective change management strategies are in place so that all stakeholders are aware of, and on board with, the initiative.

Cherry Bekaert has multiple cost and revenue management/analytics offerings that are designed to meet the need of any higher education institution. Our offerings range from simplified, high-level models through to complex and detailed predictive models. Each offering provides a wealth of analysis opportunities to help institutions identify opportunities to be cost efficient, enhance revenues, and maximize mission attainment. They can even accommodate environmental metrics to help analyze the interrelationship between cost, revenue, and environmental sustainability efforts.

Why Cherry Bekaert?

Through the Firm’s service to more than 75 higher education institutions, our not-for-profit industry group offers a unique combination of not-for-profit expertise and higher education experience. Our team understands the changing landscape facing higher education institutions and their related organizations. Our team offers the critical experience and thought leadership our clients deserve, with an unmatched depth of practical knowledge in the effective application of cost and revenue management.

We approach today’s toughest business challenges with a client-first mindset, working together with our clients to create exceptional value. We ignite growth with integrated, forward-looking industry

Contact

Anthony Pember – Director, Digital Advisory, anthony.pember@cbh.com

Robert (Bob) Misch – Principal, Digital Advisory, bob.misch@cbh.com