KEY OBSERVATION:

Incorporating voice of the customer methodologies into the commercial due diligence process can help businesses realize the full potential of their growth strategy. By using fact-based market analyses and asking the right questions, you can improve frontline performance, raise barriers to switching, grow profits and drive value accretion.

When undertaking a new acquisition, it is oftentimes critical to know more about their customers than their Net Promoter Score (NPS). Knowing customer pain points and, more importantly, how to resolve them can improve the overall deal thesis and accelerate post-acquisition growth.

How To Enhance the Commercial Due Diligence Process by Incorporating Voice of Customer

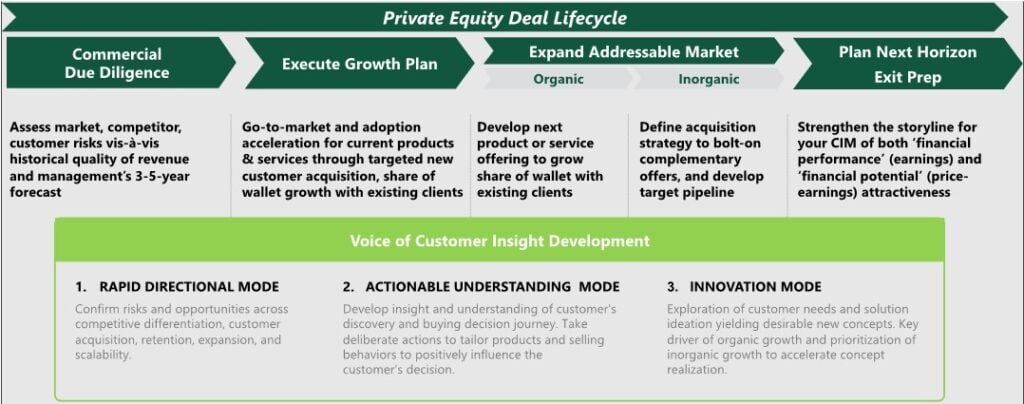

Employing a voice of the customer (VoC) approach with due diligence can help organizations identify and prioritize the issues that can affect an acquisition target’s quality of revenue or inform other business-critical decisions that drive growth and innovation. There are three VoC modes to develop commercial intelligence and insight:

- Rapid Directional Mode: Customer insight that is incorporated into investment and planning decisions by leaders who seek to understand and confirm risks and opportunities, including competitive differentiation, ability to scale beyond founder- or charisma-led sales and potential for customer retention and expansion.

Rapid directional mode is often spurred by the need for urgent or deliberate decision making. These are moments when strategy requires action and the leadership team has a vision for growth, or there is an immediate acquisition opportunity. These decisions are typically informed by in-depth financial due diligence to confirm current assets and potential risks, and to understand an organization’s processes, or lack thereof, to track assets and confront and minimize operational risks. This insight can typically be developed in days to a few weeks. - Actionable Understanding Mode: Leadership aims to accelerate organic growth by developing insights into a customer’s buying journey and purchasing decision process. Through this knowledge, leaders take deliberate actions to tailor customer experiences and influence their decision to buy a certain product or service.The knowledge developed from customer journey research can inform:

- Decisions of organizational specialization, sales and service recruiting, onboarding and training

- Customer segmentation, pricing tiers and service levels

- Product enhancement prioritization

This analysis can typically take anywhere from several weeks to a few months to develop.

- Innovation Mode: Leadership aims to use VoC analysis to drive growth from the development of new or enhanced products, services and solutions. To evolve and drive innovation to stay competitive in today’s economy, businesses often require a deeper understanding of their customers’ needs and alternatives.

The innovation mode research can range from a few weeks to a few months to develop and can often lead to the creation of a specialized and dedicated innovation-based organization.

Develop Insight and Actionable Plans throughout the Private Equity Deal Lifecycle

Practical Applications of Voice of the Customer in Commercial Due Diligence

A typical and prudent M&A due diligence process will confirm that customers exist, business transactions were real and sales proceeds were received. However, using voice of the customer in commercial due diligence can add depth and value to the overall diligence conclusions, validating the deal thesis and driving post-transaction growth. Two recent case studies from our Strategy & Transformation team exemplify how the deployment of rapid directional mode can be applied to confirm and “right size” a deal’s financial and contractual assumptions.

Case Study One

Target: Engineering services firm with $150M in revenue

Fact-Based Voice of the Customer Analysis: The team compiled VoC data through a representative sample of more than 50 end-customer and industry expert interviews, blinded management interviews and an analysis of forecast sources of revenue (new customers, existing customers, new products, etc.). The fact-based analysis yielded inconsistent customer experiences and a heavy reliance on existing relationships. This did not match a revenue forecast that was heavily weighted towards new customer acquisition and cross-selling for future growth and expansion.

Resulting Implications and Strategy Recommendations: Based on the VoC findings, we recommended a reduction in the 10-year organic growth forecast for the target. Although this rapid directional analysis did not change the ultimate acquisition decision, it did impact leaderships’ willingness to pay the purchase price and plan for post-acquisition business growth investments.

Case Study Two

Target: Dental services and software solutions company with strong customer acquisitions and referrals and a near perfect ideal customer overlap with the acquiring company (Company)

Fact-Based Voice of the Customer Analysis: Going beyond typical earnings diligence, a representative sample of the target’s customers was broken down by region. The analysis demonstrated that the target was well-respected among the customer base, was often selected over competitors and was routinely referred to others by customers. This made the target highly attractive. However, by taking the analysis a step further to understand how customers decided to buy and refer the target, our team discovered that in each winning example, the target’s founder played a significant role in acquiring the customer and providing initial support, which highlighted a serious scalability problem.

Resulting Implications and Strategy Recommendations: Based on the results of the customer analysis, it was concluded that for the acquisition to be successful, the Company would need to transform and transfer charismatic founder-led sales to a broad network of the Company’s sellers. The recommendation called for the Company to secure the commitment of the target’s founder to stay with the Company post-acquisition and continue their role. In addition, it was recommended that leadership should invest in codifying and training “the way to sell” to realize the initial deal thesis post transaction.

Let Us Guide You Forward

In each of these cases, the leadership and investment teams were able to use VoC insight to make significant transaction decisions. Cherry Bekaert’s recommendations also allowed them to appropriately plan and fund future success. The rapid directional VoC analysis can often highlight real risks to maintaining current business and achieving future growth.

By having deeper conversations with our clients, and applying a thoughtful and comprehensive due diligence approach, we can help to more accurately forecast revenues, plan management portfolios and arm you with reliable business intelligence.