Cloudy with a Chance of AI-Generated Sunshine: Private Equity and the Technology Sector’s Silver Lining

Overview

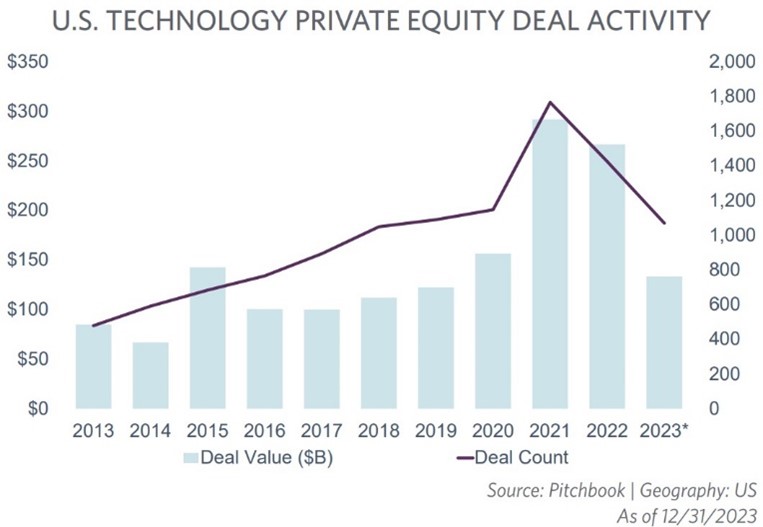

The overall decline in private equity M&A deal volume in 2023 was largely driven by a slowdown in the technology sector, with M&A activity down double digits year over year. The headwinds in the sector were generally reflective of a few core trends, including a higher-interest-rate environment, volatile valuations across both private and public markets for growth-oriented companies, increased financing costs for would-be acquirers, and an intractable valuation gap between buyers and sellers.

Despite these headwinds, technology deals still got done in 2023, particularly in mission-critical subsectors like artificial intelligence, cloud and data analytics, and cybersecurity. Carve out technology acquisitions also continued to be attractive to private equity buyers. However, unlike the “growth at any cost” era of 2021, technology deals in 2023 tended to be bolt-on rather than transformative platforms, took longer to get done, and required more creativity and bespoke structures.

Leveraging our research and daily work in the private equity M&A market, we explore these and other key dynamics that impacted the technology sector last year as well as the various factors that may spur increased technology sector dealmaking in 2024.

Technology Sector, Spurred by Developments in AI, Shows Positive Signs

Technology continues to be a key area of focus for private equity dealmaking, despite prolonged macro challenges. As 2023 came to an end, however, there were reasons to be optimistic. While technology deals declined 18% from 2022, smaller deals showed an upward trend with 368 deals completed in Q4 2023, representing a significant increase of 43.2% compared to the previous quarter and a steady growth of 9.8% compared to Q4 2022.[1]

The technology sector was rocked early in the year with the March 2023 failure of SVB, widely recognized as the lender and deposit institution of choice for both start-up and mature technology companies. The collapse marked the second largest bank failure in U.S. history after the 2008 failure of Washington Mutual and was seen as a sign of trouble for the broader technology sector. However, the U.S. government’s swift response and emergency measures helped to restore confidence in the banking system, stabilizing the market and avoiding contagion.

The SVB collapse notwithstanding, investors remained attracted to the industry’s long-term secular growth story, its relative resilience in the face of macro headwinds, and the growing integration of technology in sectors such as healthcare, finance, industrials, energy and others. Investors are exploring verticals including anything-as-a-service (XaaS), TransitTech, HealthTech, RPA, advanced CloudTech and AI/machine learning (ML).

Artificial Intelligence and Machine Learning’s Impact on Deal Activity

AI/ML are notably the standout sectors within technology M&A over the last 18 months. Microsoft, Google, Salesforce and Amazon Web Services have all made moves into AI and committed significant investment dollars to the space through either acquisitions, establishment of joint ventures or funding internal development efforts.

Technology developers in the AI/ML sector are focused on creating chatbots and personal assistants, deploying and orchestrating large language models, and maintaining model architecture. This includes OpenAI and its ChatGPT service along with Anthropic’s Claude. The hype in these kinds of generative AI sectors stands in contrast to the general-purpose middleware segments like audio, video and content creation; a sector where many venture capital firms see opportunity.

“Last year, technology companies’ growth and profitability stalled as interest rates rose and investors stopped funding ‘growth at any cost.’ Nonetheless, deals were still getting done. With macro headwinds subsiding and investors look to deploy their record capital in the burgeoning AI sector, there is cautious optimism that the pipeline will once again start flowing.”

— Sean Geoghan, Partner | Deal Advisory Services

Software Company Valuations

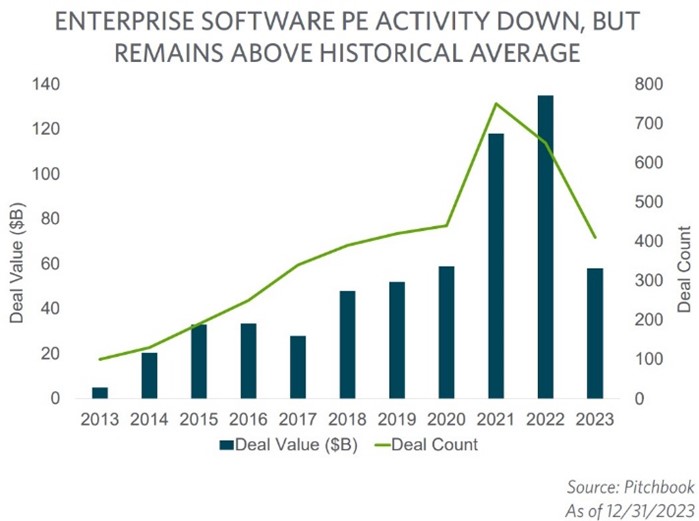

Technology software companies with a “recurring revenue” business model remained a notable area of focus for private equity investors. As software valuations declined sharply as part of a broader technology sell-off that emerged in 2022, sponsors launched a number of public company buyouts targeting the space. The most notable examples include Silver Lake and the Canada Pension Plan Investment Board’s $12.5 billion acquisition of Qualtrics; Clearlake Capital and Insight Partners’ $4.4 billion acquisition of Alteryx; and Blackstone’s $4.6 billion acquisition of Cvent.

Cisco’s $28 billion offer for the enterprise cloud protection company, Splunk, was the biggest enterprise software deal in 2023, but that deal was an outlier in terms of deal size. 2023 saw a sharp decline in the aggregate value of software M&A activity as buyers were less willing to bet on future growth, resulting in significantly smaller ratios of enterprise value to revenue, as compared to 2022.

With nearly $140 billion in deals, 2022 was a high-water mark for software private equity. The aggregate deal value plunged in 2023, but remained slightly above the historical average. According to Pitchbook, investors remained relatively active in 2023 with nearly $60 billion total value through the first three quarters, with a decline of about 30% in deal count when compared to the record activity seen in 2022. Yet, relative to the pre-pandemic average of 2017 to 2019, 2023 was up 18.3% by value and 15% by number of deals.

Technology Sector Outlook

Looking ahead, the technology sector seems primed for an M&A rebound, as strategics prioritize gaining or expanding exposure to mission-critical technology, inflation and rate hike expectations hold or subside, the syndicated debt market dethaws, boards and management teams reorient themselves around current valuations rather than 2021 highs, the technology IPO window (hopefully) reopens, and private equity sponsors reenter the sector in force.

Continue Reading the Full Report: Private Equity 2023 Year-in-Review and 2024 Outlook: Clearer Skies Emerge for Private Equity Amidst Challenges

[1] PitchBook 2023 Annual PE Breakdown – US