Investment Tax Credits for Georgia Manufacturers and Communications Companies

Georgia is one of the more business friendly states for business tax credits and incentives. The state continues to help businesses succeed with new legislation for manufacturing and telecommunications businesses that invest in the state.

Maximize Your Investments With the Georgia Manufacturing Investment Tax Credit

Georgia provides a time-sensitive opportunity for certain businesses to use the Manufacturing Investment Tax Credits to offset their Georgia payroll withholding tax liabilities. This opportunity is available for tax credits carried forward from prior years and any new tax credits generated before January 1, 2025. A credit transfer request must be filed by May 31, 2023, to take advantage of this opportunity.

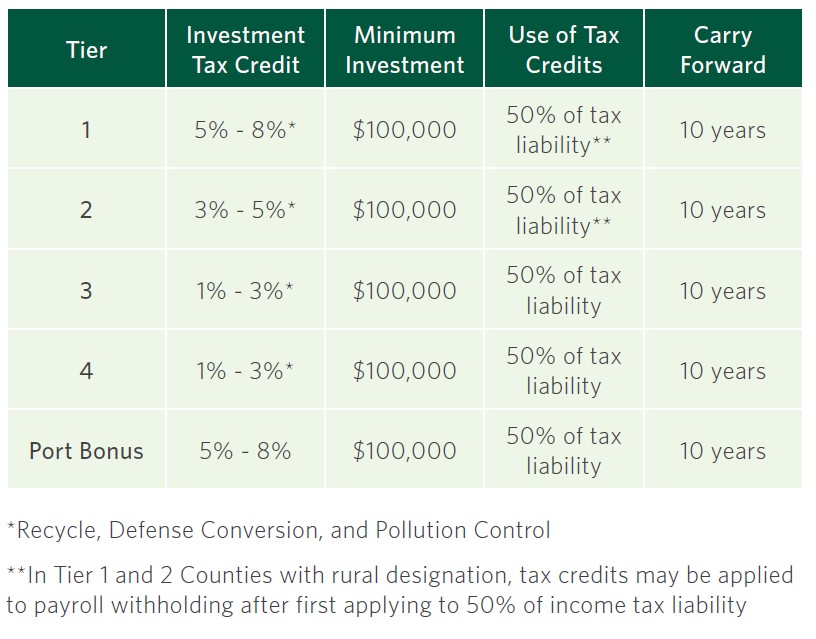

The Georgia Manufacturing Investment Tax Credit is available to manufacturing or telecommunications companies that have operated in Georgia for the prior three years and have made qualified investments in the state. The tax credit is calculated as a percentage of the qualified investment, depending on the county in which the facility is located. Prior to the revised regulations, the tax credit could only be used to offset up to 50% of a company’s Georgia income tax liability, and then the unused tax credit could be carried forward up to 10 years.

How To Claim the Georgia Manufacturing Investment Tax Credit

Businesses may claim either job tax credits or investment tax credits for a project. The project cannot exceed three years, unless it was preapproved by the Georgia Department of Revenue (GA DOR) Commissioner. To receive the investment tax credit, businesses must first receive an approval from the GA DOR on the project plan and the expenditure amount.

Businesses will claim the credit by attaching Form IT-IC and the approval letter to the state tax return. Once the tax credit is applied against 50% of the company’s income tax liability, eligible businesses located in Rural Tier 1 or 2 Rural Counties may apply excess tax credit against their payroll withholding tax. Rural Counties have a population of less than 50,0000 and poverty in excess of 10%. The counties are ranked on an annual basis.

Qualified Investments Made On or After January 1, 2020:

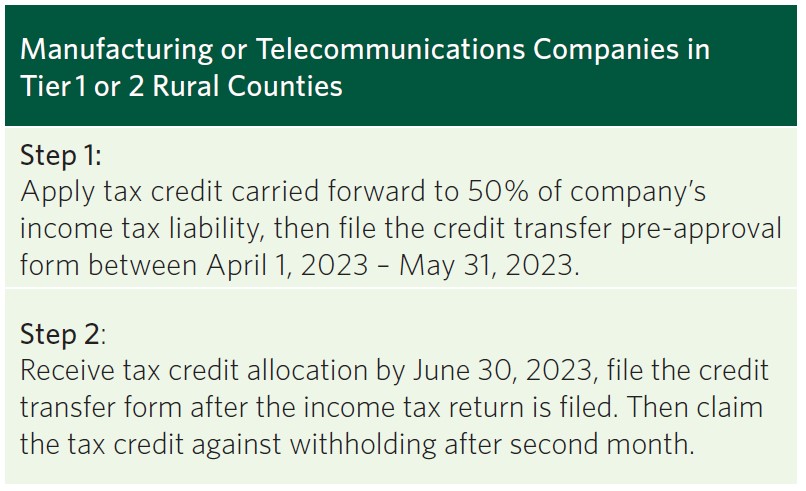

To claim the excess tax credit against the company’s withholding tax liability, the business must submit the credit transfer pre-approval form (IT-WHRZ-APP) through the Georgia Tax Center (GTC) between April 1, 2023, and May 31, 2023. The GA DOR will notify each taxpayer of the tax credit allocation by June 30, 2023.

The business will then submit the credit transfer form (IT-WHRZ-RPT) through GTC to report that the income tax return has been filed, and the excess tax credit will be eligible to be claimed against withholding tax in the second month after the return is filed.

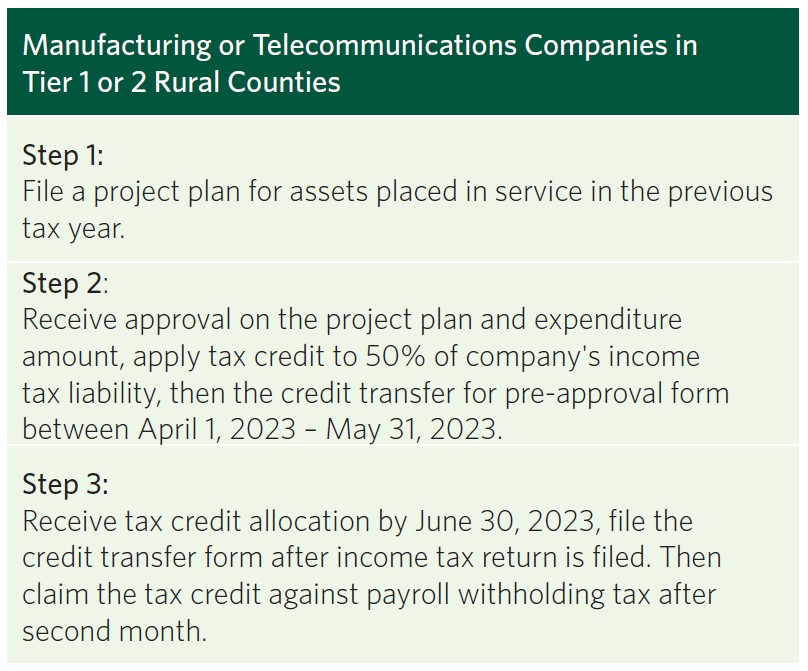

Qualified Investments Made Before January 1, 2020:

To claim the excess tax credit against the company’s withholding tax liability, the business will follow the same steps as filing for qualified investments made on or after January 1, 2020. The business must also meet the additional requirements outlined below.

Rural Counties Located in Tier 1:

- Maintain at least 100 full-time jobs, and

- Make at least $5 million of qualified investment.

Rural Counties Located in Tier 2:

- Maintain at least 100 full-time jobs, and

- Make at least $10 million of qualified investment.

Revised regulations allow the excess tax credits to be applied to payroll withholding up to $1 million per company per year. The maximum amount for all taxpayers is capped at $10 million per year. If the total requests exceed the cap, the amount will be prorated for each eligible company.