Filing Status and ICFR Compliance Considerations for SPAC and IPO Transactions

Market conditions in 2021 continue to support public offerings as initial public offering (“IPO”) and Special Purpose Acquisition Company (“SPAC”) transaction volumes increase. As of the writing of this article in May, over 300 SPACs and over 450 IPOs have closed year-to-date. Along with that volume, many private companies hopeful for a shot at an acquisition or IPO are evaluating public company reporting requirements including internal control considerations. Public companies are generally required to maintain internal control over financial reporting (“ICFR”) and disclosure controls and procedures (“DCP”) pursuant to Securities Exchange Act of 1934 Rules 13a-15(a) and 15d-15(a). However, considering how frothy the market is and the gross proceeds of the public offerings, accurately gauging internal control requirements governing a transaction requires a little conservatism in addition to knowing the rules. We continue to have conversations about these rules with our clients so we figured an article might be helpful for those companies considering a SPAC or IPO and for current public companies that may be near the market cap and revenue thresholds requiring transition to a new filing status.

Filing Status & EGCs

Internal control requirements are a function of a company’s filing status. In March 2020, the SEC adopted amendments to the “accelerated filer” and “large accelerated filer” definitions in Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange Act”). The result of the amendments is that low-revenue issuers may not be subject to Regulation S-K Item 308(b) attestation by an independent auditor as required by Section 404(b) of the Sarbanes Oxley Act. Howver, emerging growth company (“EGC”) qualifications complicate the matter. Considering much of the SPAC (and some of the IPO) volume is driven by smaller high-growth companies, let’s start our consideration of internal control requirements with EGCs.

A company qualifies as an emerging growth company if it has total annual gross revenues of less than $1.07 billion during its most recently completed fiscal year and has not sold common equity securities under a registration statement as of late 2011. (There are a few other criteria specific to debt, but let’s omit those for now to keep things simple.) For most SPAC and IPO candidates, this is a pretty low bar and a reasonable expectation to begin our consideration of ICFR requirements. For a recent IPO or SPAC, EGC designation provides the benefit of scaled-down disclosure requirements and relief from auditor ICFR attestation requirements and should generally get a company through the year of transaction without incurring 404(b) requirements; this buys an organization sufficient time to formalize its system of internal control before external auditor attestation requirements kick in. Note, that management’s quarterly DCP and annual internal control assessment requirements pursuant to 404(a) take effect immediately – so proper planning and internal control are still required prior to and immediately subsequent to an IPO and SPAC.

If an organization is positioned as an EGC, the next question to ask is how long will the EGC status carry the company until more rigorous reporting requirements kick in? The answer is generally the earlier of five years or tripping the $1.07 billion revenue threshold or large accelerated filer criteria defined by Rule 12b-2 of the Exchange Act.

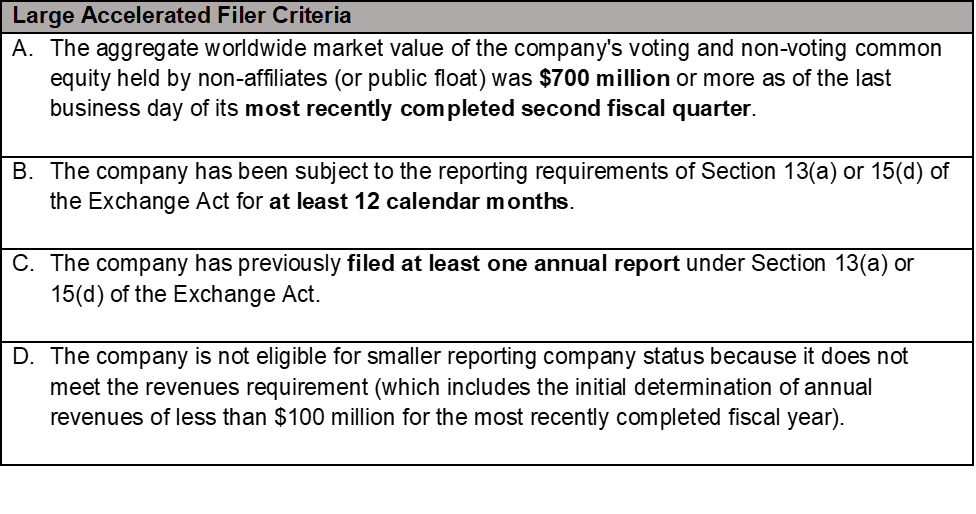

The table below from the SEC summarizes the large accelerated filer requirements. All requirements must be met to become a large accelerated filer and exit EGC status.

Criteria A stipulates a non-affiliated market value measurement at initial offering and at the end of the company’s second fiscal quarter. The $700 million threshold is clear, but more interestingly for those weighing whether to invest in internal controls now or later is the time period implicitly built in between the transaction date (initial public float determination) and the public company’s second fiscal quarter. In theory, this gives a company up to six months more time to weigh ICFR requirements. For companies on the bubble, conservatism is highly advised.

Criteria B is the 12 Month Rule. Put simply, you have a full year from the transaction date before 404(b) is required. The first fiscal year after going public should be used to bootstrap your system of internal control. You do not have to comply with 404(b) your first year-end, but you should be well on your way if the $700 million non-affiliated float threshold is nearby.

Criteria C reinforces Criteria B. Under the Annual Report Rule you have to complete one annual report before qualifying for large accelerated filer status. Use that first year wisely.

Criteria D is a little more nuanced. Companies with less than $100 million in revenue and less than $700 million in non-affiliated public float are excluded from accelerated and large accelerated filer definitions under Rule 12b-2. For pre-revenue and investment phase companies, these criteria may leave you classified as a Smaller Reporting Company and squarely within the EGC qualifications. Once non-affiliated public float exceeds $700 million, you will soon trigger large accelerated filer status, exit EGC, and be subject to ICFR attestation requirements.

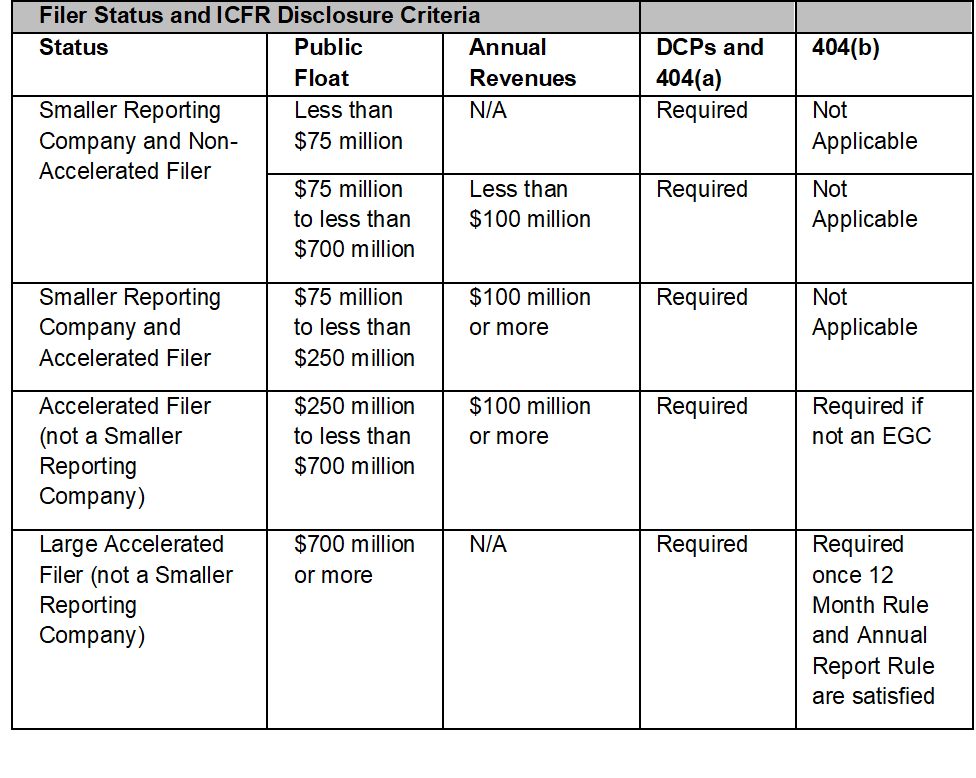

The table below, from the SEC, builds on information provided by the SEC and does a decent job of putting all this together. This information applies to all companies that may be contemplating a SPAC or IPO transaction as well as current public companies that may be close to the thresholds that would change their filing status.

Source: https://www.sec.gov/corpfin/secg-accelerated-filer-and-large-accelerated-filer-definitions

For more information on SEC guidance on SRC scaled disclosure requirements, visit the SEC website.

SPAC & Reverse Merger Considerations

SPAC transactions require a little further legwork to ensure compliance with expected timing of internal control reporting requirements. An SPAC is a form of reverse merger in which a private operating company merges with a listed shell to go public without the rigors of a traditional IPO. Reverse mergers are acquisitions, and the timing of an acquisition is an important factor that drives the timing of ICFR compliance and related disclosures under Regulation S-K Item 308. However, there are no bright-lines and we are subject to perspectives in SEC interpretive guidance and FAQs.

The SEC regularly updates its Compliance & Disclosure Interpretations (“C&DIs”) of Regulation S-K. Section 215.02, which is specific to Regulation S-K Items 308 and 308T addressing internal control over financial reporting, acknowledges that it might not always be possible to conduct an assessment of the private operating company or accounting acquirer’s internal control over financial reporting in the period between the consummation date of a reverse acquisition and the date of management’s assessment of internal control over financial reporting required by Item 308(a) of Regulation S-K. Section 215.02 also recognizes that the internal controls of the legal acquirer may no longer exist as of the assessment date or the assets, liabilities, and operations may be insignificant when compared to the consolidated entity. In the instances described above, the SEC “would not object if the surviving issuer were to exclude management’s assessment of internal control over financial reporting in the Form 10-K covering the fiscal year in which the transaction was consummated.” However, future annual reports should not exclude management’s report on internal control over financial reporting.

Paul Munter, the SEC’s Acting Chief Accountant, sums this up nicely for us in his recent article on SPAC reporting compliance. “It is important for management to understand the timing of when the first annual ICFR assessment is required, whether an auditor’s report on ICFR is required under Section 404(b) and situations where the [SEC] staff may not object to the exclusion of a company’s annual ICFR assessment, as well as what disclosures the staff would expect to accompany such an exclusion.” The basic rules are clear on timing of ICFR compliance, but the volume of M&A, IPO, and SPAC activity requires understanding of the interpretive guidance. It is timing that often gets newly public companies into a fire drill regarding ICFR compliance.

Read the SEC Control FAQ for further reference. Based on our experience, deferral of 404(b) requirements (precluding filing status considerations) is only successful when a transaction (acquisition, de-SPAC) occurs in the last six months of the fiscal year. Six months of ICFR preparation is rarely enough so active preparation and coordination with your attorney and the SEC Staff is critical.

Key points on timing to take away are to know the guidance and talk to your attorney. You may not need to be 404(b) compliant in the year you go public. Give yourself time to get sufficient controls in place and to give your team time to let those controls mature. If you invest pragmatically in internal controls, ICFR compliance becomes a de facto by-product of your risk management practices.

How Can We Help?

For assistance or questions regarding ICFR compliance, IPO readiness, and SPAC guidance, please contact Nick Stone, Partner and Leader of the Firm’s Risk Advisory practice or Peyton Black, Director in the Firm’s Risk Advisory practice.