Subrecipient versus Contractor Consideration for Coronavirus State and Local Fiscal Recovery Fund (CSLFR) and Beyond

As state and local governments continue to strategize on how to best utilize their share of $350 billion in Coronavirus State and Local Fiscal Recovery Funds (“CSLFR”), passing through these funds to other governments or not-for-profit organizations affected by the COVID-19 pandemic remains a popular option.

While the definition of subrecipients and the requirements of a pass-through entity to monitor its subrecipients has not recently changed, it is important that state and local governments adhere to the requirements under Uniform Grant Guidance when passing through these funds. There are important considerations for pass-through entities when distinguishing subrecipients from contractors and when establishing contract provisions for subrecipients.

Subrecipient versus Contractor (or Beneficiary)

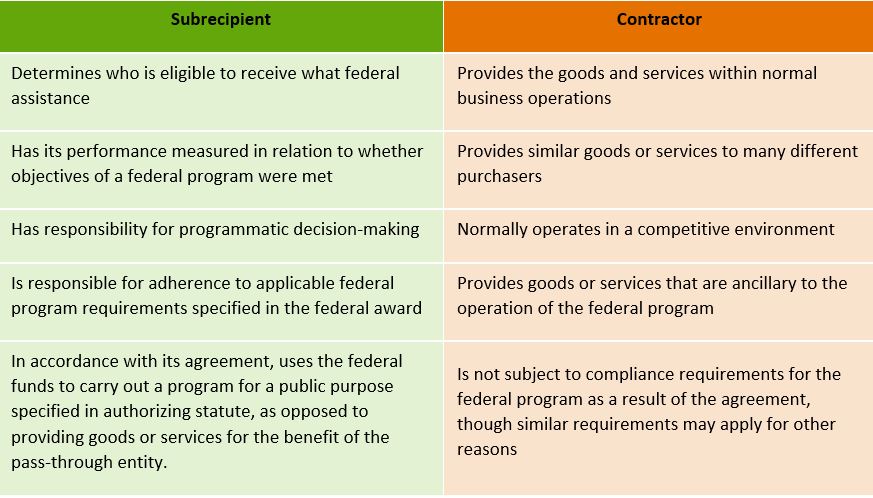

Title 2 CFR section 200.331 provides guidance on certain characteristics that are indicative of a subrecipient versus contractor relationship:

Source: 2 CFR section 200.331 – (a) and (b)

It’s common for a potential subrecipient to have both characteristics of a subrecipient and a contractor. Pass-through entities should apply professional judgement and consider the concept of “substance over form” when evaluating the terms of agreement to properly classify them as a subaward or a procurement contract.

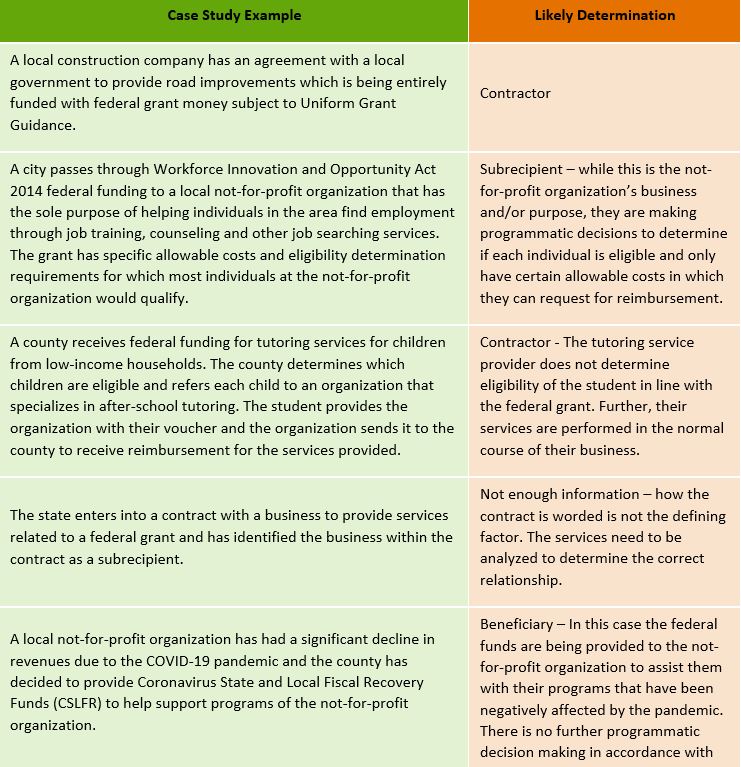

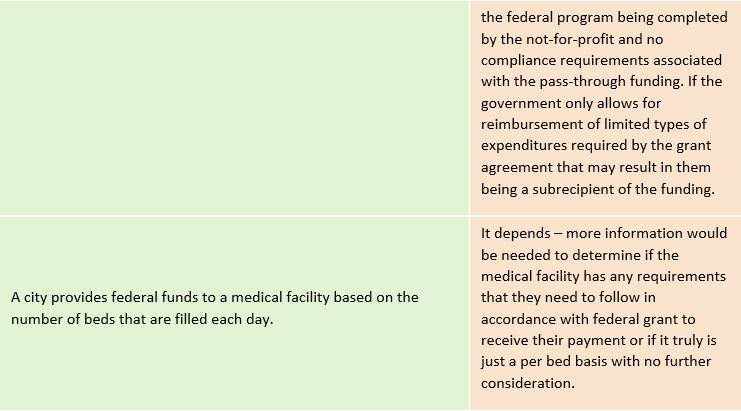

The following are common situations we have seen at our state and local governments:

The above situations have limited information and the determinations may vary based on additional facts and circumstances. Every potential subrecipient relationship needs to be analyzed separately and professional judgement must be applied to each agreement.

With the pass through of COVID-19 funding such as CSLFR to not-for-profit organizations affected by the pandemic the consideration if an entity is the ultimate beneficiary of the grant funding also needs to be considered. If a not-for-profit organization receives a pass through of CSLFR to help fund their mission based on a decline in revenue due to the pandemic, the state or local government may have come to the determination that they are eligible to receive funding but that they could use that funding for any purpose within their organization’s general mission or purpose. In such a case they would most likely be neither a contractor nor a subrecipient. Instead, they are the ultimate beneficiary of the federal funds A.

A: The definition of a Subaward in Title 2 CFR section 200.92 states “It does not include payment to a contractor or payments to an individual that is a beneficiary of a Federal Program.”

Subrecipient Subawards

If determined to be a subrecipient, the pass-through entity has certain requirements as it relates to the form and content of the subaward agreement. Required information in Title 2 CFR section 200.332 includes the following:

- Subrecipient name

- Subrecipient unique entity identifier

- Period of Performance

- Amount of funds passed through

- Project description

- Name of Federal Awarding Agency

- Federal Assistance listing number

- All requirements imposed by the pass-through entity to the subrecipient

- Indirect cost rate, if applicable

The list above is not comprehensive. State and local governments must refer to Title 2 CFR section 200.332 for the entire list of requirements.

Subrecipient Risk Assessment

Once a subrecipient is identified and a subaward is executed a state and local government may want to move into the monitoring phase, however, it is critical and essential that the pass-through entity perform a risk assessment of the subrecipient prior to performing their monitoring procedures.

A state or local government has likely passed through funding to a subrecipient for many reasons including lack of internal resources to carry out the program themselves and/or the subrecipient may have an expertise in the type of funding received that is required to properly administer the program. A proper risk assessment will allow the pass-through entity to identify specific risks that will allow for a more efficient and effective monitoring of the subrecipient without having to reperform every transaction.

When completing a risk assessment, the risk of noncompliance with the subaward terms should be considered first and foremost. In determining the levels of risk, the pass-through entity should consider the subrecipients prior experience with the same or similar subawards; the results of previous audits conducted in accordance with Uniform Grant Guidance or previous monitoring results, the experience of the personnel involved in the granting process, the controls structure of the entity, and/or changes in the federal program being subawarded.

A proper risk assessment will help determine the nature, timing and extent of procedures the pass-through entity will be performing for their monitoring procedures. While the risk assessment should start at the beginning of the grant process it should evolve over the granting period based on the results of each monitoring activity.

Subrecipient Monitoring

When monitoring a subrecipient, a pass-through entity should utilize their risk assessment to determine how often as well as what and how many items will be reviewed each time. A monitoring must include a review of financial and performance reports required to be filed by the subrecipient, follow up on any deficiencies identified as part of the pass-through entity’s monitoring procedures or another third parties report issued, and resolution of audit findings relates specifically to the subaward.

Other forms of monitoring may include providing a subrecipient with training and technical assistance on program-related matters, performing on-site reviews of the subrecipients program operations, or arranging for an agreed-upon -procedure to be performed by an external third party.

While a pass-through entity can contract with a third party to perform monitoring procedures it is the pass-through entity’s responsibility to review any reports issued and to take action on any deficiencies identified, if applicable. This should be clearly documented in a letter issued by the pass-through entity to the subrecipient detailing the issues noted and requiring a corrective action plan to be completed by the subrecipient.

While passing through funds to subrecipients can help with the burden of administering a federal program, pass-through entities still have significant requirements that must be followed and adhered to when passing through federal funds.

For more information about how Cherry Bekaert may be able to assist with subrecipient considerations including any of the topics discussed above, contact your Cherry Bekaert advisor or visit our website.