Section 45L New Energy Efficient Home Credit

The Section 45L New Energy Efficient Home Credit is available for the construction of qualified new energy-efficient homes that are leased or sold prior to December 31, 2032.

Intended to offset the cost of building energy-efficient homes, apartment buildings and other residential dwelling units, the credit allows the contractor who built the home to take the credit to reduce their tax liability in the year the home is first leased or sold.

What Qualifies for Section 45L?

- Single family residences, apartment buildings, townhomes, condominiums, assisted living facilities, student housing and other facilities designed for individual(s) occupancy all qualify for the credit.

- The building must be no more than three stories above grade and must meet the appropriate requirements for energy star single-family or multifamily new homes’ national and local programs.

- A preliminary design analysis and certification by certified the Home Energy Rating System (HERS) raters is required before and during construction and involves regular field site visits and consultation from groundbreaking to completion.

How Much Is the Credit?

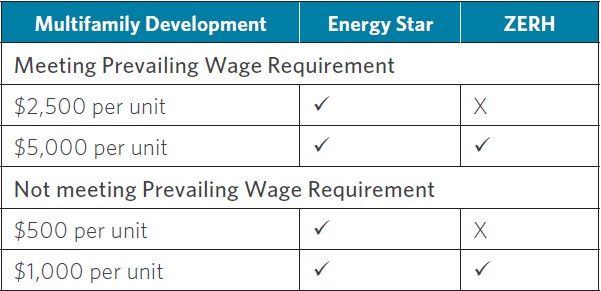

For properties placed into service after December 31, 2022, the maximum credit available is:

For those placed into service prior to 2023, the maximum credit available is:

- $2,000 per qualifying multifamily or single-family unit

- $1,000 per eligible manufactured home

Who Can Take the Credit?

Only the taxpayer that develops or owns the property and then either sells, leases or uses the property for themselves is eligible for the credit.

What Is the Eligibility Timeframe?

New homes or dwelling units must be substantially completed and sold or leased prior to December 31, 2032.

What Is Required Prior to Construction?

- Design phase construction drawing review

- Energy Star program registration

- ZERH Program registration

- Prevailing wage requirements during construction

How Do I Claim the Credit?

The credit is claimed by filing Form 8908 with the taxpayer’s either timely filed return or an eligible amended return. Taxpayers generally have up to three years to amend prior year returns. The credit received reduces the basis in the property, so it may impact the amount of depreciation taken against the property.

What Information Is Needed to Estimate the Eligible Credit?

- Building Addresses

- Number of Units

- Site Contact Information

- A Full set of Architectural Plans and Specifications

- Information on Insulation Values, Doors, Windows, and HVAC

What do I get from a Section 45L review?

As part of our no-cost estimate, Cherry Bekaert will evaluate the plans and specifications to determine the requirements for meeting Energy Star and Zero Energy Ready Home (ZERH) program criteria to obtain the 45L Credit and provide the fee and Return on Investment (ROI) analysis to help taxpayers understand their expected return.

Next Steps

Reach out to your Cherry Bekaert tax advisor today, and see what energy tax credits may be available to you.