What are New Markets Tax Credits?

What Are New Markets Tax Credits?

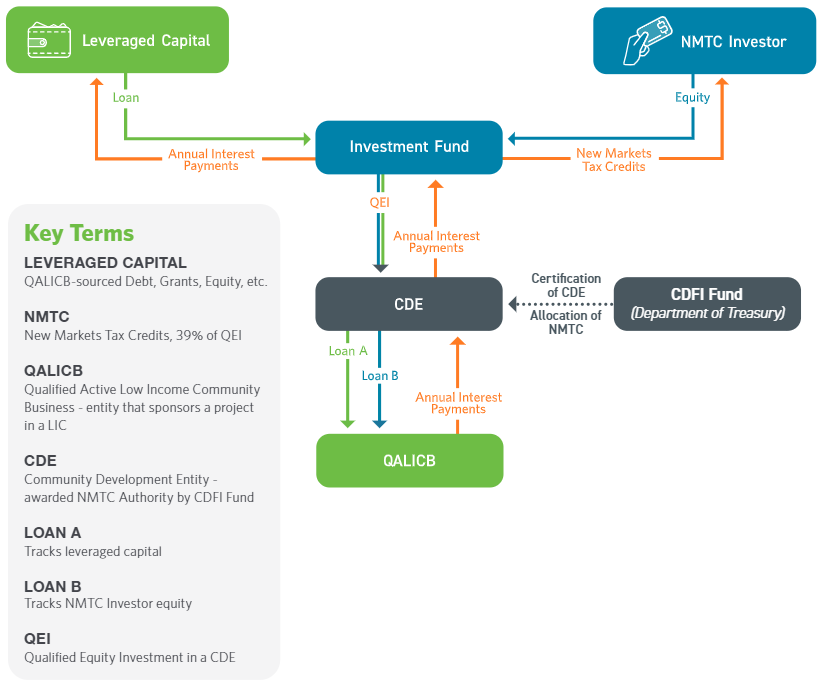

The Federal New Markets Tax Credit (NMTC) Program was enacted as a part of the Community Renewal Tax Relief Act of 2000 to revitalize Low-Income Communities (LICs). NMTCs are federal tax credits used to assist in the funding of neighborhood changes, job creation, commercial real estate projects and new or existing businesses located in low-income census tracts. LICs sometimes have difficulty attracting investments, leading to dormant or vacant buildings and businesses, inadequate access to healthcare and education, and lower property values. NMTCs provide an opportunity for investors to not only invest in these “distressed” communities, but to do so in a way that minimizes investment risks and optimize returns.

- Through the Community Development Financial Institutions Fund, a division of the Department of Treasury, the federal government grants authority to private Community Development Entities (CDEs) to issue seven years of federal tax credits to investors in exchange for equity investments.

- CDEs use the equity investment received from tax credit investors to issue low-interest, interest-only, subordinated loans (NMTC Loans) to geographically qualified projects in exchange for certain community impacts.

- The NMTC Loans can cover as much as 15-20% of total project costs.

- The CDE and Investor typically sell the NMTC Loans to the project sponsor for a nominal fee, thus the NMTC capital can be left in the project.

- The NMTC Loan may be subject to cancellation after the investor exits.

New Markets Tax Credits Chart and Terms to Know