On February 21, 2023, the Internal Revenue Service (IRS) released a new Form 7205, which requires documentation for the Energy Efficient Commercial Building Deduction.

The Section 179D Energy Efficient Commercial Buildings Deduction (Section 179D) is a tax incentive for commercial building owners and designers who construct or make energy-efficient improvements to eligible commercial buildings. The Inflation Reduction Act (IRA) of 2022 expanded eligible building types, and qualifying buildings are now eligible to claim up to $5.00 per square foot in tax deductions.

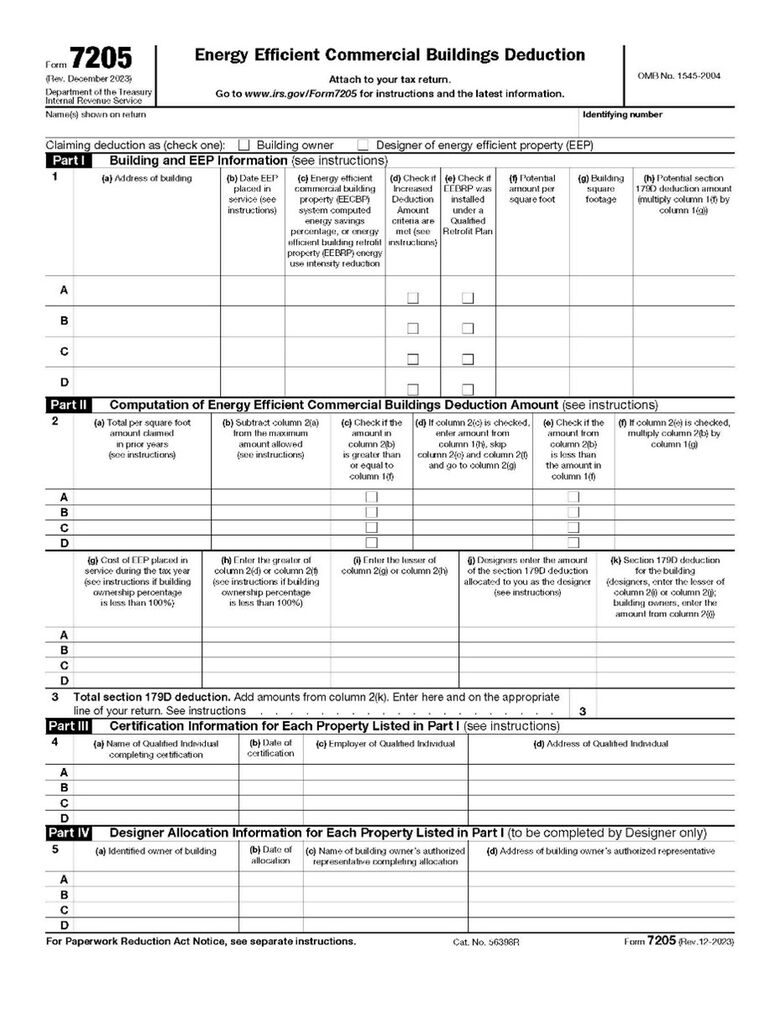

To properly document a claim to Section 179D for buildings placed in service in 2022, taxpayers must complete the new Form 7205.

With the passage of P.L. 119-21, commonly known as the “One Big Beautiful Bill Act,” on July 4, 2025, Section 179D has been repealed for projects that begin construction after June 30, 2026.

Projects that start construction prior to the sunset date will still be eligible to claim the deduction, making timing a key factor in tax strategy.

What Is Form 7205?

Form 7205 is designed to streamline the process of claiming the Section 179D tax deduction, strengthening compliance, and making it easier for taxpayers to provide the necessary information during tax filing. Designers (architects, engineers and design-build contractors) are required to use this form to provide:

- Building Owner Information

- Energy Modeling Analysis Results

- Previously Claimed Section 179D Deductions

- Third-party Professional Engineer Certification Details

- Date of In-person Certification

- Allocating Building Owner’s Representative

Form 7205 and the accompanying worksheet instructions help taxpayers accurately document their energy-efficient deductions. For tax years beginning in 2025, the deduction is $0.58 per square foot for a building with 25% energy cost savings, plus an additional $0.02 per square foot for each percentage point above 25% up to $1.16. When meeting prevailing wages and apprenticeship hour requirements, deductions start at $1.16 at 25% energy cost savings, up to $5.81 when achieving energy cost savings of 50% or more.

The version of Form 7205 that was revised in December 2022 must be used for energy-efficient commercial property placed in service before January 1, 2023. For qualifying property placed in service after December 31, 2022, designers can continue to use the December 2023 revision of the form.

Completing Form 7205: A Breakdown of the Main Sections

Form 7205 has four main sections, including:

- Building and EECB Property Information

- Deduction Calculation

- Certification Information

- Designer Allocation Information

Section 1: Building and Energy Efficient Commercial Building Property (EECBP) Information

The building owner or primary designer is required to provide information about the building, such as the address and the placed-in-service date of EECBP. This section also requires potential energy savings based on square footage and EECBP type.

Section 2: Computation of EECBP Deduction Amount

This section requires information to calculate the maximum allowable deduction according to the lesser of the cost of EECBP and the allocated or claimed Section 179D deduction amount pursuant to IRC Notice 2006-52, Section 2.2.

Section 3: Certification Information

Building owners and primary designers are required to list contact information of the third-party company retained to complete Section 179D calculations pursuant to IRC Notice 2006-52, Section 5.

Section 4: Designer Allocation Information

Primary designers who have received Section 179D allocations from government entities are required to provide the contact information of the authorized signers of their allocation letters pursuant to IRC Notice 2008-40, Section 3.

Additional Eligibility Requirements for Section 179D

In addition to completing Form 7205, taxpayers must also provide a report from a qualified independent third-party that has conducted an energy efficiency analysis of the building(s).

This report must be based on the guidelines established by the Department of Energy and include information such as the energy-efficiency improvements made to the building, the energy savings achieved and the methodology used to calculate the energy savings.

During audits, designers and architecture and engineering firms will have their Form 7205 compared against Audit Technique Guideline standards to ensure compliance.

Key audit focus areas include:

- Proper modeling of entire buildings

- Certification by qualified third parties

- Accurate allocation letters signed by authorized representatives

How Can Cherry Bekaert Help?

Cherry Bekaert’s Tax Credit & Incentives Advisory (TCIA) practice’s mission is to identify, calculate and document incentives specific to U.S.-based activities for which the tax code has provided cashflow and permanent tax benefits for U.S. businesses. Regarding Section 179D, we provide a streamlined and simplified process for taxpayers to take advantage of this powerful provision that promotes energy-efficiency in the commercial building sector.

Reach out to a Cherry Bekaert tax advisor today to guide you through applying and qualifying for the Section 179D tax deduction.