2021 US Middle-Market Private Equity Report

Record 2021 and Outlook for 2022

The final chapter of 2021 U.S. middle-market private equity activity could have been written well in advance of December 31. The year started out extremely active and consistently gained momentum in each successive quarter. By October 31, dealmaking activity had already reached new record highs at over $760 billion in aggregate deal value, well surpassing 2020’s annual aggregate deal value of just over $690 billion.

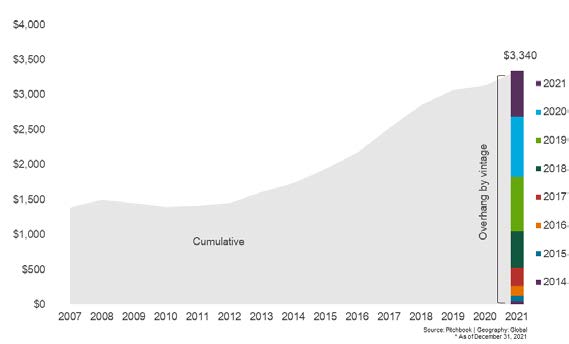

At the start of 2021, global private equity dry powder was at an all-time high of $2.1 trillion. As fundraising reached near-term highs in 2021, the stockpile of dry powder grew to an astounding $3.3 trillion by year’s end. Strong investment returns combined with a sustained low interest rate environment in the U.S. resulted in many limited partners (LPs) increasing their investment allocations in the private equity investment class.

In every respect, 2021 private equity performance smashed all previous records and successfully capitalized on what has turned out to be near ideal market conditions.

Global Private Equity Capital Overhang ($B)

Middle-Market Deal Activity Surges Past Previous Highs

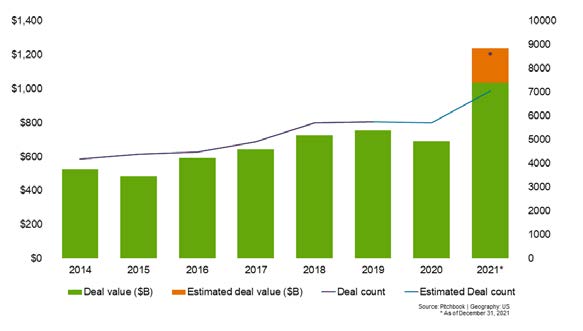

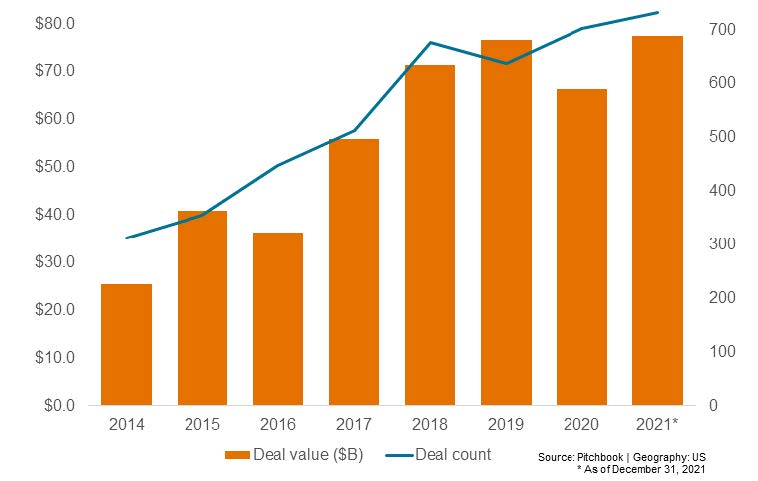

Positive dealmaking trends that first became evident in early 2021 continued to accelerate throughout the balance of the year. In comparison to 2019, the previous record year for dealmaking, 2021 surpassed it in both deal count and aggregate transaction value.

U.S. Private Equity Activity

During the first half of 2021, the market was flush with deal opportunities, some of which had been put on the shelf during the peak of COVID-19, while others were indicative of sellers’ desire to complete deals in advance of expected tax law changes, which were anticipated to result in less favorable tax consequences for sellers. Both of these situations added fuel to an already hot deal market. Buyout deal activity in Q1 2021 reached record quarterly highs for volume and value—only to be broken in Q2 and again in Q3. Total 2021 buyout deal value of $1.2 trillion was 50% higher than the previous annual record for deal value. Volume for H1 came to 3,535 deals, compared to 2,200 in H1 2020. Q4 2021 saw a modest decline in activity with 1,627 deals reported, but a record capital investment of $405.7 billion — the most in any single quarter on record—as larger deals dominated the quarter.

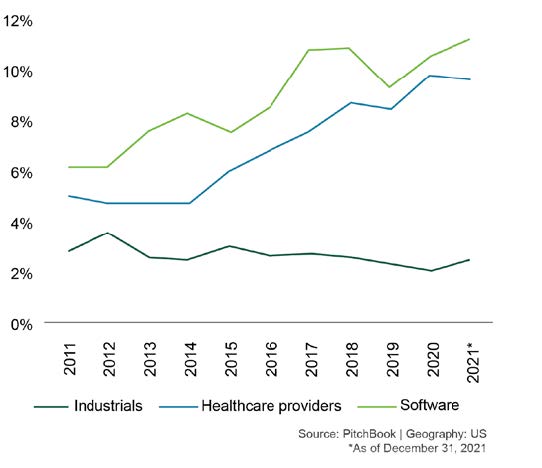

While many industry segments benefited from private equity’s appetite to close deals in 2021, the overall impact varied industry to industry. Three industries illustrated this trend more than others and they include industrials, technology, and healthcare – especially healthcare services.

Industrials

Over the past decade, deal volume in the industrial segment as a percentage of middle-market deals has basically remained flat. This trend continued into 2021 as industrial companies battelled supply chain interruption challenges and labor shortages, both of which became progressively worse throughout the year. These factors dampened the industry’s ability to ramp up production and expand its workforce, which slowed the segment’s recovery from COVID-19 lows. That said, there may be huge opportunities for growth in this sector, particularly with the passage of the Bipartisan Infrastructure Investment and Jobs Act. Furthermore, industrial companies that adopt digitalization strategies and embrace virtual sales and distribution models will likely fare better than their counterparts. Nevertheless, there are concerns about contraction on the horizon for the industrial and manufacturing industry as it remains to be seen how the sector will respond to one of the first inflationary and rising interest rate environments the U.S. has seen in quite some time.

Technology

The attractive growth prospects of technology companies combined with the predictability and resiliency of the software-as-a-service (SaaS) business model resulted in this segment being one of the darlings for private equity investment in 2021. With its often virtual workforce, the technology sector was well positioned to respond to work from home mandates put in place at the start of the global pandemic. The industry’s ability to thrive during periods of economic uncertainty positioned it favorably in the eyes of investors. However, a rise in interest rates in response to inflationary pressures could result in valuation declines in this sector. This is in part due to enterprise value being driven from future earnings prospects which would be subject to higher discount rates in an inflationary environment with rising interest rates. However, there is a belief the significant productivity enhancing aspects of technology companies can act as an inflationary hedge because they can successfully pass increased costs on to customers—more so than other segments. The fact is, technology is a fundamental component of the modern economy, and this alone likely buffers any near-term valuation concerns.

U.S. Private Equity Deal Activity by Sector

Healthcare

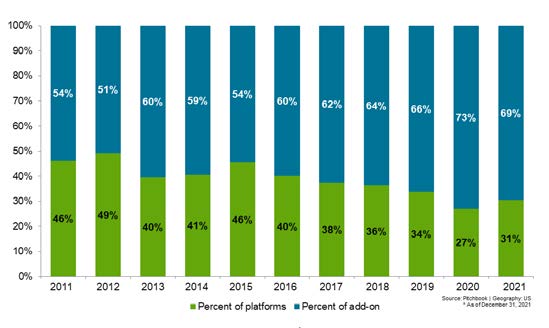

Healthcare services focused private equity funds have been able to navigate the complex regulatory environment of the sector while capitalizing on buy and build strategies. The healthcare services sector which includes segments such as orthopedics, behavioral health, dentistry, and vision experienced a significant uptick in deal activity in 2021. A large portion of this increased volume was represented by add-on deals, which provide the opportunity to grow, professionalize many business functions, and realize economies of scale. These factors ultimately lead to improvements in business performance. In fact, approximately 70% of the 2021 middle-market healthcare private equity deals were add-ons.

Add-ons as a Percentage of U.S. Healthcare Services Deal Activity

U.S. Healthcare Services PE Deal Activity

“The healthcare sector continues to attract record levels of PE investment. However, healthcare has many unique complexities, and those PE funds that specialize and have a deep healthcare knowledge base will likely be the ones to provide investors the largest returns.”

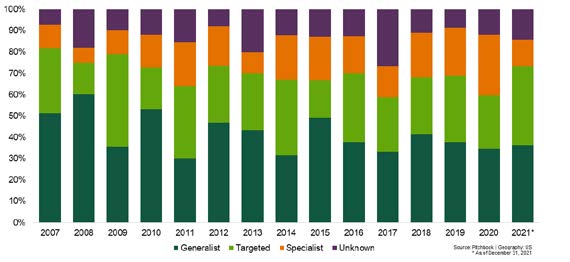

Continuation of Style Drift

To win more middle-market deals in a highly competitive environment, private equity funds have continued to advance their focus on specialization, also referred to as style drift. This phenomenon is most evident in the technology and healthcare sectors. Deals executed between 2010 and 2021 in these sectors produced some of the highest internal rate of returns (IRRs) in realized outcomes. During this timeframe, healthcare posted IRRs of 27.3%, and technology returned 24.3%. The median IRR for all private equity deals during this timeframe was 21.9%. Healthcare has long been recognized as a segment less vulnerable to inflation and economic downturns—though, this thesis was strongly tested during the COVID-19 contraction.

U.S. PE Fundraising Value by Style ($B)

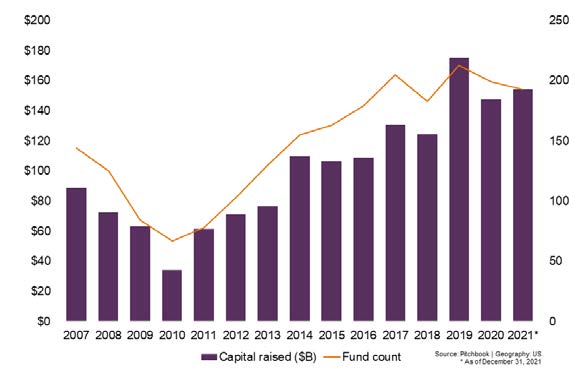

Fundraising

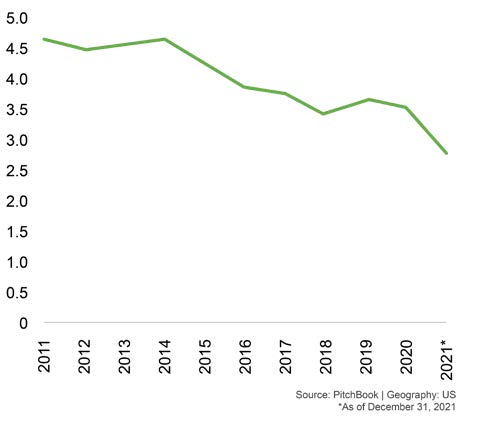

While 2021 fundraising outperformed the prior year, it fell short of the record highs reached in 2019. Private equity distributions from exits and dividend recapitalization, however, were on an accelerated pace in 2021. Private equity’s ability to accelerate value realization means many LPs have been able to achieve their investment goals ahead of pace, and LPs are opting to reinvest those proceeds into new funds. This has contributed to reduced times to close a new fund.

Middle-Market PE Fundraising Activity

In fact, the average time to complete fundraising is now at 12 months, down from a high of 15 months in 2015. Manager success is also reducing the time between funds from four years in 2012 to now just three years. Both of these statistics are likely lower than the published results if you focus only on funds with established track records that are adding a new generation to their family of funds. In fact, two-thirds of the 2021 fundraising dollars were committed to the fifth or later fund in a family of funds.

Emerging fund managers (those in Funds I to III) and first-time fundraising groups successfully bounced back from the challenges they faced during COVID-19’s grip on the sector during 2020.

Average Years Between PE Funds in Fund Family

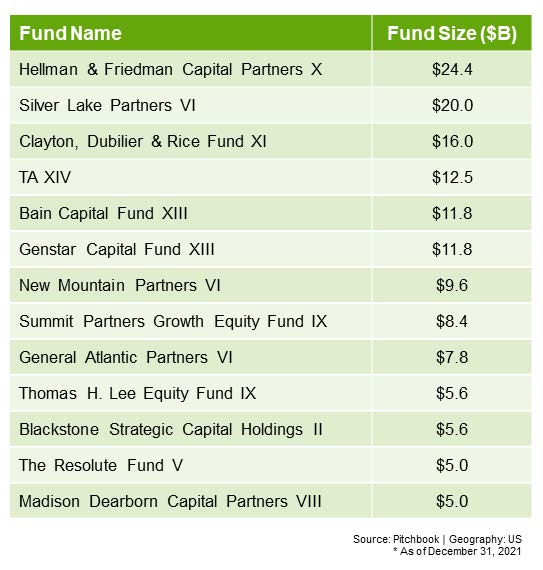

Another obvious trend in fundraising is the evolving concept that bigger is better. Larger funds are being raised, and they are being raised at a faster pace than ever before. Almost half of the 2021 fund raising dollars have been committed to mega-funds (those of $5 billion or more). Summit Partners which closed its latest fund, Summit Partners Growth Equity Fund XI, at $8.4 billion is just one of several successful mega- fund closings that took place in 2021. This trend is likely to continue into 2022 as The Carlyle Group, Thoma Bravo, Silver Lake, Vista Equity Partners, Advent International, and Platinum Equity have all announced mega-funds that are expected to close in 2022.3

Mega-Fund Closings in 2021

Trends point to larger funds being raised rather than more funds, meaning more dollars are being allocated to the largest and most successful funds. Mega-funds serve as an attractive, one-stop shop for LPs looking to streamline their portfolios. These mega-funds offer investors access to multiple sectors, including real estate, which reduces the number of managers an LP needs to employ.

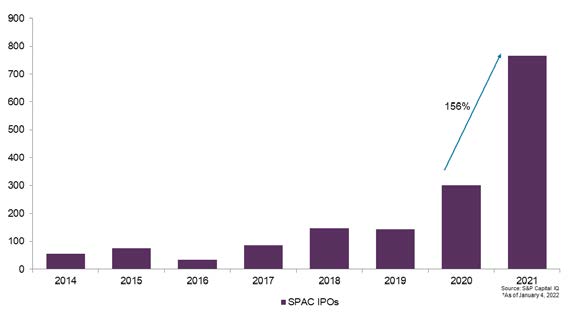

What about SPACs?

After all the hype Special Purpose Acquisition Companies (SPACs) received in 2020, one would think they fell off the map in 2021 because of decreased chatter. However, that could not be farther from the truth. In fact, SPACs raised capital in over 700 IPOs in 2021, outpacing 2020 by over 150%. With more than $100 billion of capital to deploy, SPACs will add to an already highly competitive M&A market and can compete head-to-head with most private equity firms. There is no doubt the April 2021 SEC Statement that required SPACs to reevaluate the accounting treatment of their warrants impacted the speed of SPAC deal activity in Q2. On an episode of Cherry Bekaert’s Drawdown podcast featuring a multi-part series on the state of the SPAC market, Cherry Bekaert partner, Scott Moss, discussed the Statement’s impact on activity, concluding that the market was adapting to the change and any slowdown was likely a temporary adjustment. This was borne out as the rest of the year saw numbers quietly increase on a dramatic scale with gross proceeds reaching over $170 billion.

SPAC IPO Activity

“From mega-fund closings to the voluminous SPAC activity, 2021 continued to exemplify a robust capital market environment.”

– Scott Moss, Partner

Private Equity and Transaction Advisory Leader

Where Does It Go from Here?

While the crystal ball is not perfectly clear, there is no doubt the combination of record levels of private equity dry powder, the remaining SPAC capital yet to be deployed, and a relatively strong economy will likely serve as the catalyst to contribute to continued robust dealmaking in 2022. However, it remains to be seen how deal markets will be impacted by the current inflationary environment, ongoing supply chain issues, labor shortages, and the prospect of a rising interest rate environment. Nevertheless, competition to get deals done will continue to be intense into the foreseeable future.

Outlook: Rough Waters Ahead?

There are always new challenges facing private equity. The balance between short-term (new deals) and long-term (portfolio value) priorities is critical to the industry’s continued success. Given the significant number of completed deals in 2021, private equity now faces increased pressure on integration while maintaining deal flow. In addition, digitalization and modernization of portfolio companies is morphing into a focal point of discussion as private equity looks to optimize investment performance, profitability, and value. Perhaps LPs will be increasingly viewing returns in the same light.