Private Equity Industry Report: 2022 Trends and 2023 Outlook

Introduction

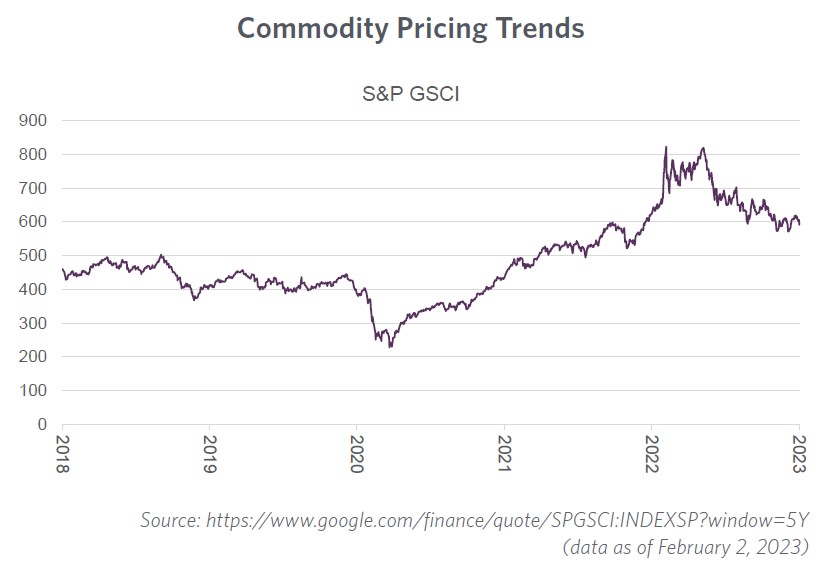

What a difference a year makes. Just twelve months ago, M&A activity had set all-time records, valuation multiples faced seemingly unlimited expansion and deal makers had access to almost endless levels of inexpensive credit. Since that time, the S&P 500 has declined by more than 19% (the worst decline since 2008), inflation has surged to its highest point in over 40 years, and the Federal Reserve has instituted a series of aggressive and unprecedented rate hikes (which may not be over). In many cases, private equity borrowing rates are currently twice as expensive as they were just a year ago. The Russian invasion of Ukraine contributed to geopolitical uncertainty and created a ripple effect across global energy and commodity markets. Throughout most of 2022, economists forecasted a pending U.S. recession.

Private Equity 2022 Challenges

While a full-blown recession has yet to materialize, private market valuations began to experience a contraction for the first time in many years, albeit not to the same extent as their public equity counterparts. This, in part, contributed to adjustments in capital deployment strategies for many private equity firms. Their ability to adapt to shifting market conditions while adjusting their deal focus allowed some firms to capitalize on opportunities, including an aggressive pursuit of add-on deals, while those who were slower to react often found themselves sitting on the sidelines—taking a more cautious approach to deal markets.

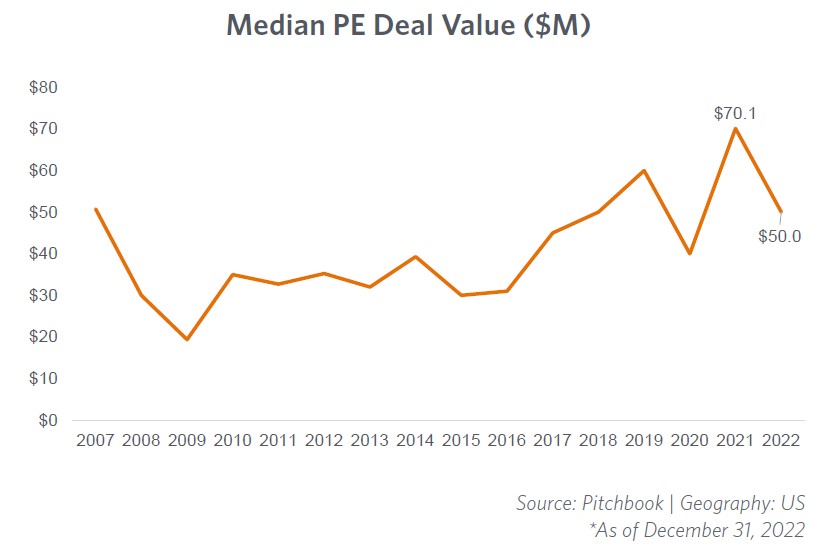

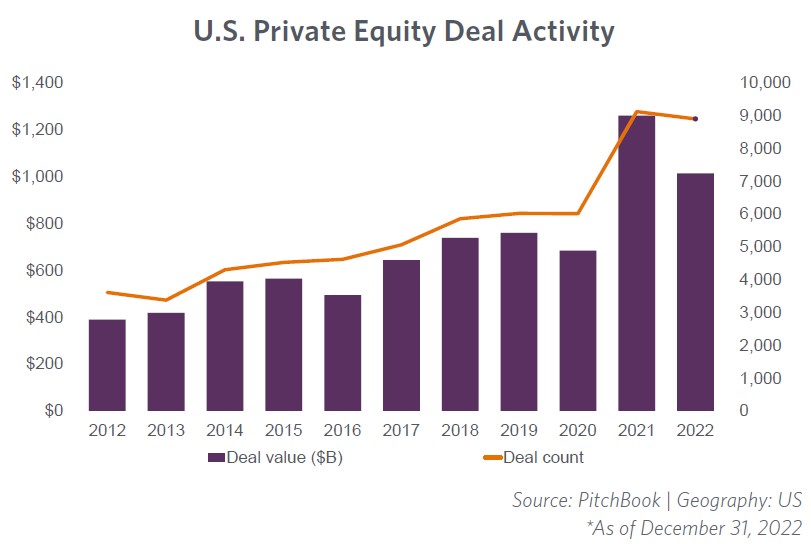

These are just some of the challenges private equity firms faced in 2022. By most accounts, fund managers met these challenges with a high degree of resiliency. Media reports on the banner level of 2021 deal flow continued into early 2022 before a degree of economic pessimism began to take hold. It was not until the second half of the year that deal markets finally succumbed to the impact of broader economic pressures and M&A volume began to slow. Keep in mind, over the course of just 36 months, private equity endured the highest of highs but also tested some historic lows. While 2022 U.S. private equity deal making finished below the 2021 COVID-induced frenzy, M&A still finished the year higher than 2019 pre-pandemic levels. Fund managers now seem to be well positioned to respond to what many are calling “the new normal” in deal markets. Our detailed report covers these and other trends in 2022 and an outlook as to what might be expected in 2023.

“The maturing of the private equity industry has led to fund managers being much better positioned to not only respond to, but in some cases, capitalize on opportunities during an economic downturn. The shear level of dry powder at their disposal means funds could view contracting private company valuations as a buying opportunity.”

– Scott Moss, CPA, Managing Partner, Private Equity and Transaction Advisory Services

Private Equity Deal Activity Down from Record 2021, but Higher Than Pre-pandemic 2019

2022 PE Deal Trends

Not surprisingly, overall U.S. middle-market private equity deal activity declined when compared to the record 2021 levels. The decline can be attributed in large part to shifting economic conditions which caused private equity investors to take a more conservative approach when it came to capital deployment during 2022.

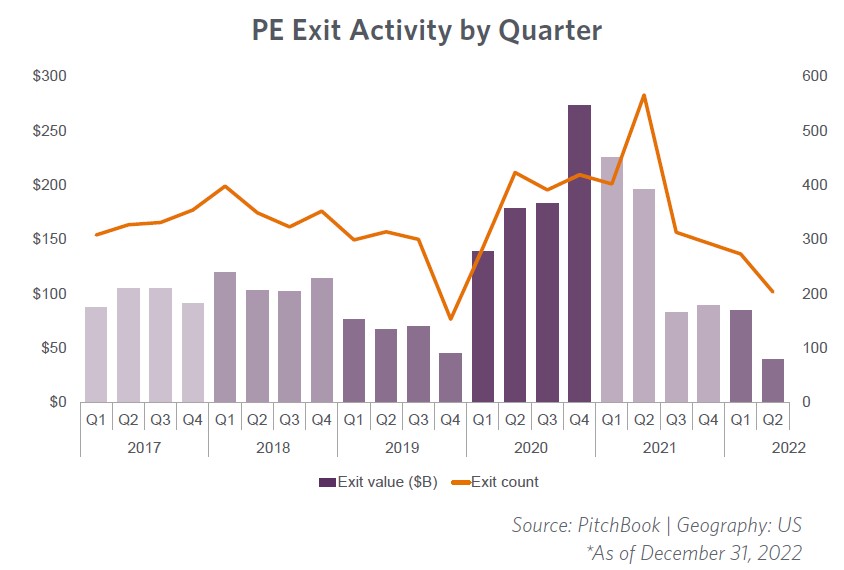

From the peak deal volumes recorded one year earlier, Pitchbook reports that fourth quarter deal count and deal activity declined by 23.4% and 41.8%, respectively. Private equity exit activity, which was sliding all year, finished well below pre-COVID levels. Clearly, these trends indicated the effects of tightening government economic policies that were being felt across deal markets.

Industry Analysis

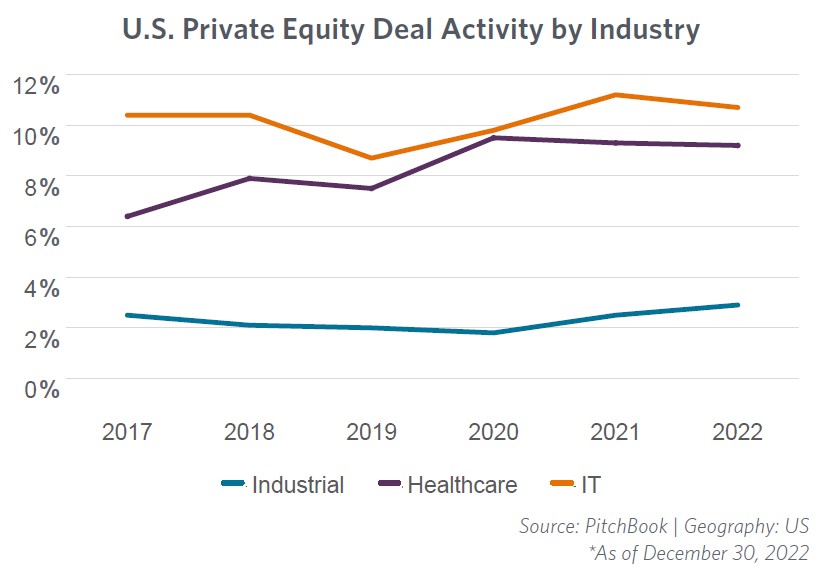

While deal activity was down for the year, the cooling effect was not felt equally across all industries. Not long ago SPACs were all the rage in the M&A market, and they were noticeably absent from deal activity in 2022. Other key industries that deserve a deeper dive include Technology, Healthcare and Industrials.

Technology

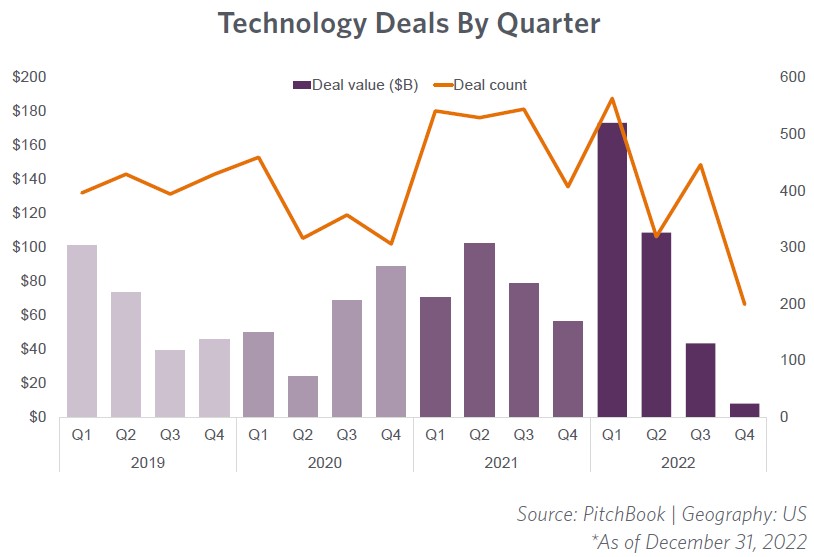

While the technology industry was a shining star during the COVID down-turn, the same cannot be said about the sector in 2022. As predicted in our 2021 US Middle-Market Report, rising interest rates had an adverse effect on technology industry M&A. The interest rate environment caused the prospect of future earnings, or in some cases the lack thereof, to be subject to higher discount rates thereby resulting in lower deal valuations.

The rout in public technology stocks that occurred in 2022 also placed significant pressure on private technology company valuations. Both public and private company technology valuations had soared during the previous two years. A belief had taken hold that the tech sector, with its attractive historical growth trends combined with the sector’s ability to drive significant productivity enhancements for customers, provided a level of insulation against an economic downturn. After outpacing the market for the last several years, public technology stocks declined faster than any other sector in 2022. The technology industry experienced a 25% year-over-year decline in deal volume, with a steep decline in the fourth quarter of 2022. Some technology companies began workforce layoffs signaling a further shift in market dynamics was underway. Technology, previously the darling of private equity investing, significantly pulled back, returning to moderated M&A levels. At first glance this would seem to be a bubble, but the reality is more nuanced and, in some ways, less dramatic.

The technology industry’s previous bull market was driven by many different factors, most notably the changes brought on by stay-at-home policies necessitated by the pandemic, combined with access to relatively cheap money resulting from years of historically low interest rates, which dropped even further due to the COVID fiscal response. As monetary stimulus programs began to dry up and inflation surged, the adverse business impacts were felt by both public and private technology companies alike. It is not clear what downstream, ripple effect Q1 2023 layoff announcements from Microsoft, Google and others may have on privately held technology companies, but it is clear market dynamics are unsettling and could remain that way throughout 2023.

Healthcare

Historically, private equity investment in healthcare services focused on consolidating medical specialties such as dentistry, dermatology and vision, with returns driven primarily by multiples arbitrage, financial leverage, and the development of ancillary business lines. Firms have also looked for opportunities to finance de novo expansion in provider categories with favorable supply-demand dynamics, such as behavioral health. Across provider categories, scale enables not only fixed cost efficiencies but market power. By increasing market share in a given region, a platform can position itself to negotiate more favorable vendor and payer contracts. For categories that are not primarily referral based, scale also helps to increase brand awareness, thereby driving patient volumes.

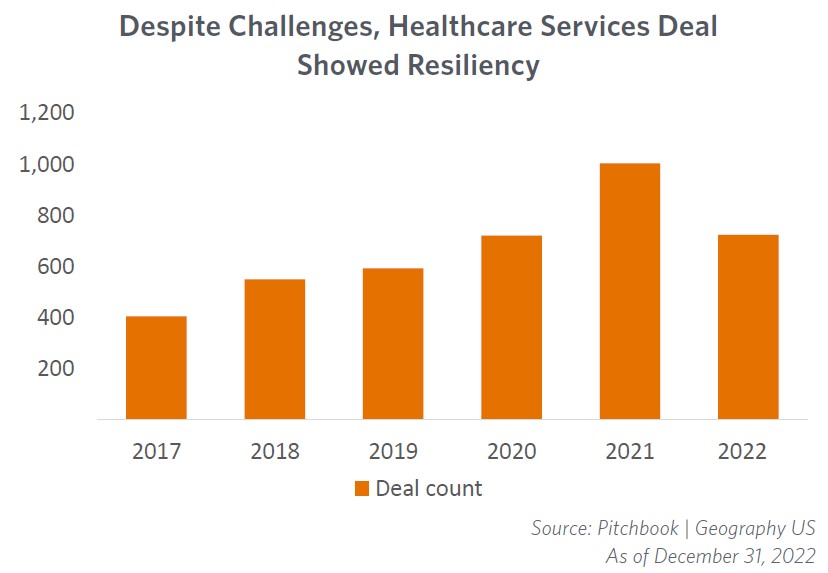

Amid the macroeconomic turmoil, healthcare services deal activity showed resiliency in 2022, especially in the lower middle-market space. The record setting pace of deal activity in 2021 continued well into 2022. While the impacts of economic uncertainty did eventually catch up to the sector in the second half of the year, 2022 will still be recognized as the second-largest year on record for healthcare services private equity activity.

As private equity investors continue to develop industry focused specialization strategies, there has been a steady pace of newly established funds focused on healthcare. In fact, Prequin 2022 data points to the creation of more than 300 healthcare focused private equity funds for the second year in a row. However, labor shortages, continued wage inflation and changes in reimbursement rates are squeezing virtually every type of healthcare organization.

Healthcare industry focused funds appear to have enough earmarked dry powder to fuel healthy levels of buy-out activity in 2023. As new platform healthcare service deals are completed, this will drive further consolidation in the sector and push additional add-on deal activity. Contracting multiples could provide an opportunity for investors to jump in with all equity deals, which could be especially true in the add-on space.

“Healthcare activity in 2022 bucked the trends of the broader M&A market. While staffing shortages and rising wage rates continue to challenge the segment, the year still produced robust levels of private equity investments.”

– Steve Stang, Partner, Healthcare Deal Advisory Leader

Industrials

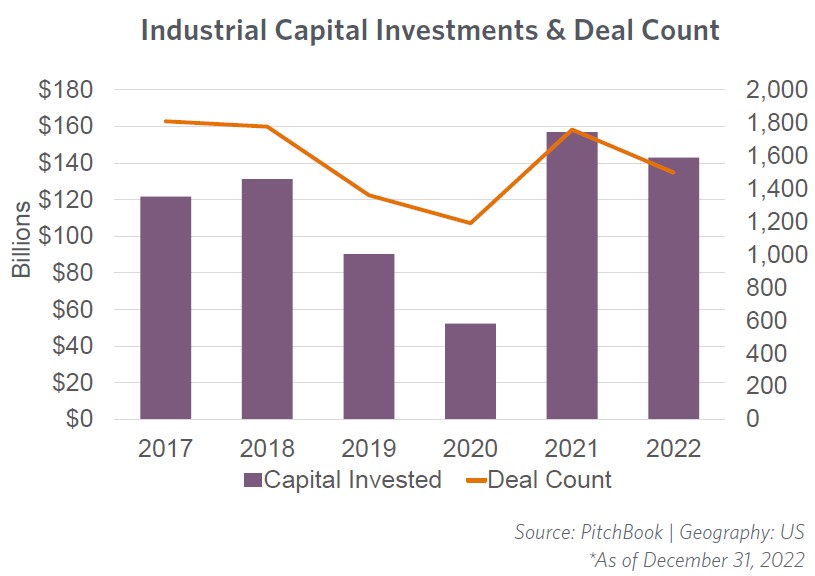

The Industrial segment proved to be a bright spot for M&A and private equity investing during 2022. As was highlighted in our December 2022 Report: Private Equity Looks to Spark Industrial Growth, excluding a slump at the onset of COVID-19, historic deal volume in the industrials segment as a percentage of overall middle market deal activity had been flat for more than a decade. That trend showed signs of reversal in 2022.

While supply chain interruptions and labor shortages have dampened deal activity, the industry has been the beneficiary of an array of positive sentiment arising from COVID-related stimulus programs, including the Infrastructure Jobs Act of 2021, and most recently the Inflation Reduction Act of 2022. The advancement of Smart Manufacturing combined with a sector well positioned to realize the benefits of digital transformation are also factors contributing to private equity’s renewed interest in the space.

Carve-outs

Another deal segment which typically experiences an uptick during periods of economic challenges are carveout transactions. As corporations grapple with economic pressures and the reality of lower earnings growth, it is anticipated they will try to right-size operations by divesting of non-core assets and divisions. These divestitures are often considered corporate orphans because they have not received an adequate level of attention or capital as part of a larger, diversified organization. While carve-out transactions typically have a greater level of complexity and uncertainty, they also offer attractive opportunities for private equity investors to produce transformative growth and profitability in neglected business segments.

Portfolio Companies

Potential for Asset Write-downs Today, fund managers are sitting on a historically high number of portfolio companies under their control. The combination of the sheer number of deals completed at near peak market conditions over the prior two years combined with declining economics means fund managers could be looking at portfolio valuation write-downs for the first time in many years. Should economic conditions not show signs of near-term improvements, fund managers could also be facing longer hold periods. To combat both of these situations, fund managers are taking more active steps to drive improvements in the financial performance of their portfolio companies.

“The decline in public equity valuations throughout 2022 has a corresponding impact on private company valuations. With contracting deal multiples, PE firms could be facing portfolio company write-downs for the first time in many years.”

– Gus Perez, Partner, Valuation Services Leader

Portfolio Digitization and Transformation

As digitization transforms industry after industry, private equity investors are also using these same strategies to transform their portfolio companies. More and more, digital innovation and transformation across existing workflows are being seen as imperative for portfolio companies who wish to maintain a competitive edge in a tightening market. While specific sectors are in various stages of their digital transformation journey, 41% of respondents in a recent survey conducted by S&P Global said their firms were already executing a digital optimization strategy, mainly focusing on using Customer Relationship Management (CRM) and digital platforms for reporting. The broader adoption of information technology due diligence is also now serving as the roadmap for post-close digital transformation strategies, and the diligence process is being used to identify, unlock and accelerate value realization strategies.

The uncertainty in financial markets has also impacted how due diligence is undertaken. With most COVID-related impacts on business performance now in the rear view mirror, very little time is being spent on pandemic related adjustments. However, current trends point to longer periods of exclusivity to allow investors the opportunity to dig deeper into a target’s historical financial performance. This look-back approach is, in turn, being used to develop more robust financial forecasts which frequently are taking a more conservative outlook on growth prospects combined with a view that higher interest rates and elevated levels of inflation might stick around longer than originally anticipated.

Portfolio Add-on Deals

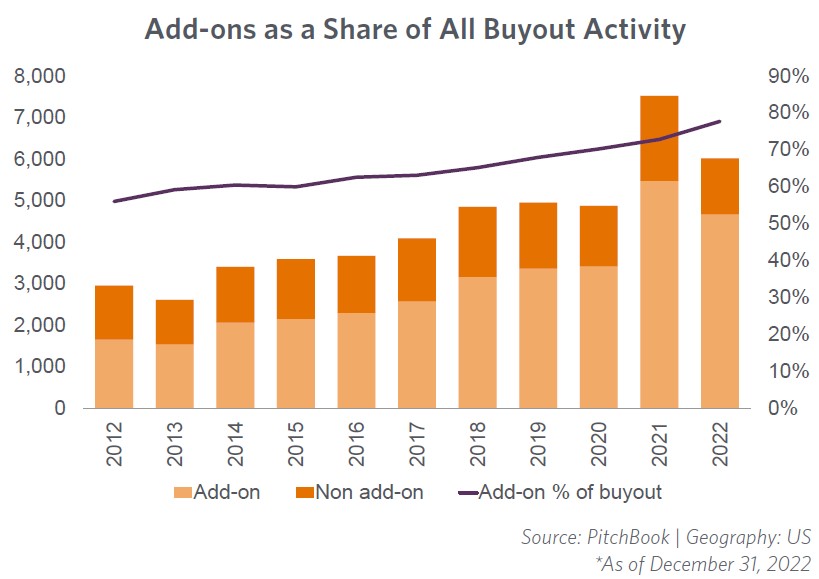

Consistent with past trends, private equity deal making is often bolstered by add-on transactions during periods of economic uncertainty. While add-on deals have long been a staple of the private equity buy and build strategy, they surged to near record levels of total buy-out activity in 2022. In fact, add-ons represented almost 80% of total deal activity during the year; jumping five percentage points from 2021 levels. While these transactions are smaller than their platform counterparts, they are often able to be completed at lower multiples. They are usually easier to finance, which allows private equity firms to continue to deploy capital while potentially generating revenue and cost saving synergies that can be realized across the platform investment.

These deals are common in the healthcare space. However, the surge in add-on activity will cut across most industry segments. With still relatively high levels of dry powder at their disposal, fund managers capitalized on the opportunity to expand market share through the tried-and-true bolt-on deal strategy. The longer economic pressures remain in place the greater impact it will have on contracting private market valuations.

Fundraising: Private Equity is Feeling the Effects of Record Levels of Capital Deployment

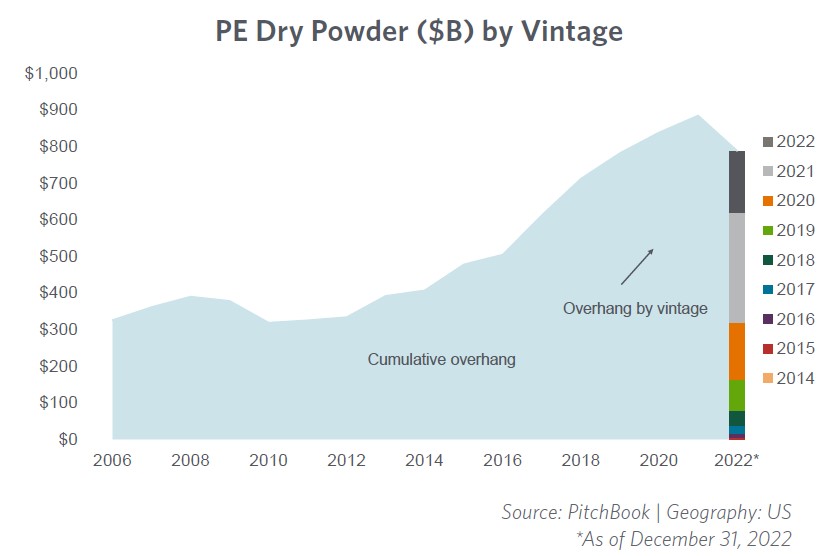

At the end of 2022, dry powder available to private equity firms shrank by a little more than 10%, the first notable decline since 2008. The inability to restore depleted levels of dry powder is not surprising considering the amount of capital deployed in 2021, and the elongated nature of the current fundraising environment. Slower exit activity also impacts fundraising as sale proceeds often eventually recycle into fundraising. The level of private equity exit activity also declined significantly from 2021. Overall, the potential impact of not being able to recycle these proceeds may not be felt for several years.

PE Fundraisers Grappling with LP Allocation Limits

From 2021 to 2022, total private equity capital raised dropped almost $20 billion year-over-year according to PitchBook’s 2022 Annual US PE Breakdown. Declines in public equity markets may mean many LPs are either fully allocated or over allocated to the alternative investment asset class.

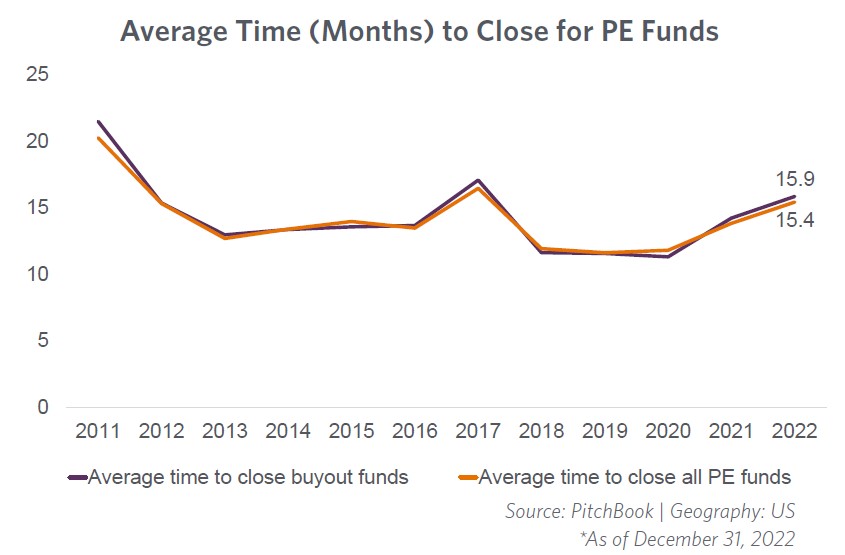

Given these dynamics, it is not surprising to see the duration to close a new fund ticked up to 15.4 months from the 13.8-month average seen in 2021. On the other hand, the average time between funds continues to tick lower and reached 3.0 years in 2022, down from 3.2 years in 2021.

Mega-funds

Similar to 2021, mega-funds continued to garner a significant percent of total capital raised. The 13 mega-funds in the market brought in $178 billion or 52% of total fundraising dollars in 2022. Late in the year, Carlyle Group announced it would miss its original March 2023 deadline to complete fundraising for its latest flagship mega-fund. With $17 billion reportedly raised as of December 31, it is still markedly short of its $22 billion target. Carlyle’s experience may have a trickle-down impact to other mega-funds contemplating near term capital raise activities. With only so much capital available from LPs, it is expected other mega-funds may also push their fundraising activities as far into 2023 as possible.

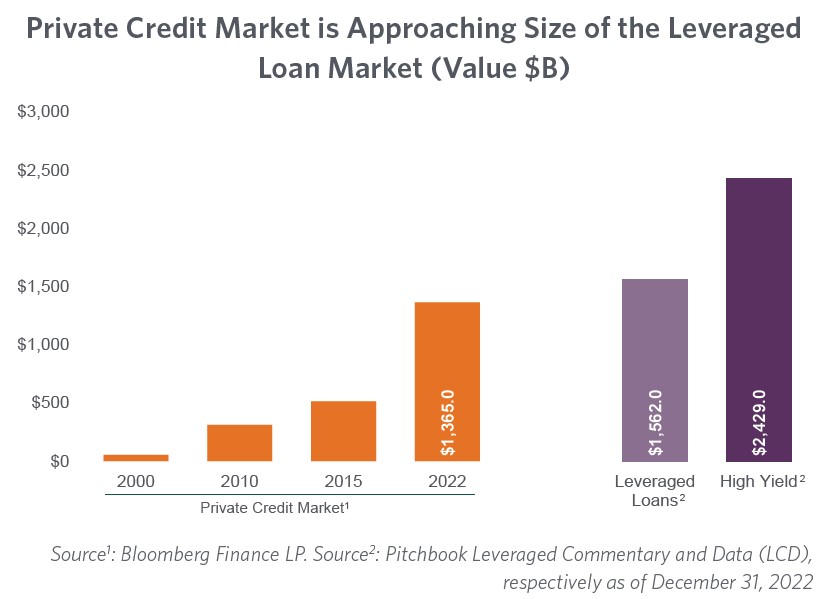

Evolution of Private Credit

Private credit became mainstream during the great financial crisis of 2008 when traditional lending sources dried up and private credit was positioned as the only available lender. Since that time, private credit has continued to adapt and evolve, now filling a valuable component of the debt stack in most leveraged transactions.

Private debt fundraising reached nearly $200 billion in 2022, short of the $225 billion seen the previous year. According to a recent report published by Preqin, private debt has been one of the fastest-growing asset classes in recent years. The data shows total assets under management (AUM) reached $1.2 trillion in 2022 and that AUM within the asset class grew at a compound annual growth rate (CAGR) of 15.7% from 2015 to 2022. This was the third-highest AUM growth rate among alternative asset classes, after venture capital and infrastructure. By the end of 2022, the number of private debt funds in the market grew from 710 to 837 – an increase of 18%. Over the same period, the amount of capital these funds were targeting remained practically unchanged, declining from $299 billion to $297 billion.

Despite the strength in overall private credit fundraising in 2022, a more delicate picture emerges when you examine the details. According to Pitchbook, the number of funds closed in 2022 declined by more than 30% (from 273 to 182). This suggests investors remain positive on the asset class but are becoming more discerning in their allocations, with larger commitments going to fewer fund managers. Nevertheless, there is strong indication that this trend will continue in 2023 if, and when, the path of central bank action becomes more certain.

Private Equity Outlook for 2023

There is no quick fix to the current economic cycle. The Federal Reserve has acknowledged being late to the game in changing monetary policy and spent much of 2022 in catchup mode. With a focus on reducing wage inflation below 5%, there is a risk the Federal Reserve could inadvertently overshoot their tightening efforts and push the economy into a deeper recession than would otherwise be predicted.

Macroeconomic conditions over the next year will likely test the resilience of the M&A market. The persistent drumbeat of challenging economic news, geopolitical tensions, supply chain disruptions, inflation, and rising interest rates naturally dampens enthusiasm for dealmaking. However, at a recent news conference Chairman Powell remarked, “We can now say, I think, for the first time the disinflationary process has started.” He also acknowledged in that same conference that he does not expect the Federal Reserve to cut rates in 2023. Prolonged levels of higher interest rates will continue to make deal financing more challenging and expensive.

Following the 2020 trough, the post-pandemic catch-up was in full force in 2021. The outlook for 2023 suggests a continuation of 2022: that is, continued macro headwinds will likely suppress activity, affecting some sectors more than others, but by and large dealmaking will continue ahead of historic averages, relegating both 2020 and 2021 to “outlier” status and returning to something that can be considered “normal.”