In today's rapidly evolving business landscape, chief financial officers (CFOs) face unprecedented challenges. Legacy financial systems — once the backbone of their operations — now pose significant risks to compliance, scalability and the ability to provide strategic insights to the business. With month-end closes stretching beyond 10 days, data trapped in departmental silos and teams buried in manual reconciliations, the warning signs of outdated financial operations are clear.

For middle-market organizations, these inefficiencies aren't just operational headaches — they represent existential threats to business agility. When competitors can close their books in five days and deliver real-time insights to decision-makers, operating with antiquated financial systems puts organizations at a distinct competitive disadvantage.

This article provides CFOs with insight into the importance of early-stage planning and evaluation for new enterprise resource planning (ERP) systems and multi-entity accounting software, such as Sage solutions.

ERP Accounting Software Implementation Checklist: Best Practices

To help ensure the selection and deployment of your ERP accounting software goes smoothly, consider adding the following action items to your checklist:

1. Assess Your Finance Function

As you start your ERP implementation journey, an assessment of your current finance function is essential. This financial health check establishes your baseline and identifies the highest-priority improvement areas.

Evaluate Financial Close & Reporting

To successfully evaluate financial close and reporting, it’s important to map your current month-end close process with timestamped activities, which are tasks or events that are recorded with specific times at which they occur. Timestamped activities are useful for tracking progress, scheduling or analyzing patterns over time.

Next, identify manual reconciliation steps and spreadsheet dependencies. This process is useful because it helps identify discrepancies between records, such as mismatched transactions or incorrect amounts. You will also want to examine and document compliance and audit trail gaps. This process is beneficial because it can reveal vulnerabilities in internal controls.

Determine average close time and variance over the last 12 months. Variance analysis reveals inconsistencies and outliers in close times. Evaluate reporting timeliness and the accuracy of your metrics. Accurate and timely reporting allows for early detection of potential risks and opportunities.

Assess Your System Inventory

Taking the time for this type of assessment provides the foundation for your transformation strategy. In our experience, CFOs who invest time in this diagnostic phase typically identify more improvement opportunities than those who rush directly to system selection. This can save your organization time and money in the long run.

Make sure to:

- Catalog your financial systems and their integration points: A robust ERP system should easily integrate into your systems and streamline workflows by automating processes and reducing manual data entry.

- Document spreadsheet-dependent processes and associated risks: Understanding dependencies and risks helps streamline workflows, reduce redundancies and improve overall efficiency.

- Assess data quality issues and their business impact: Poor data quality can lead to significant financial losses due to incorrect decisions, inefficiencies and the need for data correction.

- Evaluate your current automation capabilities and limitations: Understanding the strengths and weaknesses of your automation systems helps identify areas for improvement, ensuring processes are streamlined and resources are used effectively.

- Review existing system maintenance costs and support requirements: Assessing maintenance costs helps identify areas where expenses can be reduced, ensuring budgets are optimized.

Gather Stakeholder Feedback

You can do additional groundwork to prepare for ERP selection by collecting comments and concerns from your different departments:

- Survey accounting team pain points and efficiency opportunities: Feedback from the accounting team helps pinpoint areas where processes are slow or cumbersome, allowing for targeted improvements.

- Interview financial planning and analysis leaders on forecasting and budget development challenges: Interviews can reveal opportunities to streamline workflows, reduce manual tasks and improve process efficiency.

- Consult IT regarding system maintenance and security concerns: Consultation helps identify potential vulnerabilities and address them before they can be exploited.

- Gather feedback from auditors on control environment improvements: Auditors provide an independent perspective, helping identify gaps and weaknesses in the control environment that internal teams might overlook.

- Document executive reporting requirements and current gaps: Clear documentation helps ensure that reports meet the specific needs of CFOs, providing accurate and relevant information for decision-making.

2. Build a Strategic Technology Roadmap

You have assessed your financial function. Now, it’s time to create an ERP strategy and roadmap. This will help you select the right ERP and accounting software solution, which is perhaps the most critical decision in your transformation journey.

Critical Integration Points

Modern finance, ERP and accounting solutions should integrate seamlessly with your operational systems. Your technology roadmap should include the following critical integration points:

- ERP to CRM: Connecting customer data to financial planning is crucial, as it ensures seamless data flow between business operations and customer interactions, enhancing overall efficiency, improving customer satisfaction and enabling better decision-making.

- Production Systems to Financial Forecasting: Real-time cost tracking and variance analysis is important, enabling more accurate financial planning, optimizing resource allocation and enhancing business profitability.

- Supply Chain to Accounts Payable: Streamlining procurement-to-payment cycles is essential as it streamlines processes, reduces error, and ensures timely and accurate financial transactions.

- HR/Payroll to General Ledger: Automating labor cost allocation is important as it streamlines payroll processing and provides a comprehensive view of labor costs for better financial management.

- Business Intelligence Tools to Financial Reporting: Creating dynamic dashboards for management is essential because it enhances data analysis, providing deeper insights and improved data accuracy.

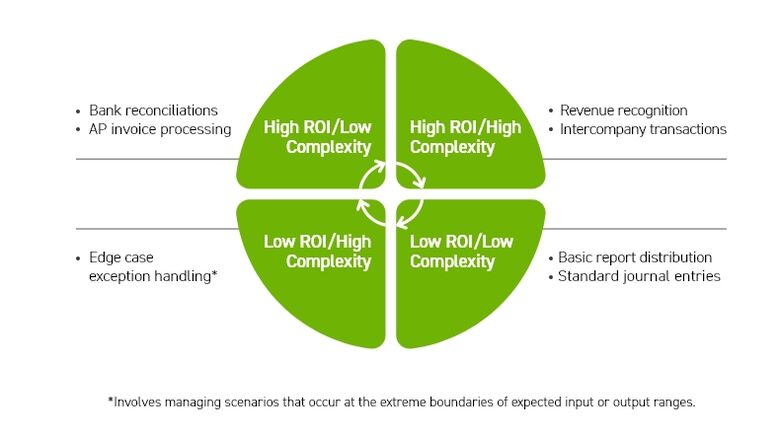

3. Prioritize Your Automation Needs

This checklist item requires you to assign importance to different automation tasks within your organization. Here are a few high and low priority items to consider along with their potential return on investment (ROI):

4. Compare and Contrast the Available Solutions

With your foundational analysis work done, it is time to select the right ERP software for your needs, based on your roadmap and automation requirements.

For many middle-market organizations, Sage offers several purpose-built solutions. Below, we examine the best manufacturing ERP solutions for middle-market companies:

| Sage Solution | Ideal for: | Key Strengths: | Limitations: |

|

Sage Intacct |

Fast-growing manufacturers with complex multi-entity requirements | Native cloud architecture, dimensional reporting, AI-powered close automation | Less manufacturing-specific functionality without integration |

|

Sage 100cloud |

Middle-market manufacturers with moderate complexity needing strong local control | Manufacturing-specific workflows, cost accounting integration, flexible deployment | More implementation effort for multi-entity configurations |

|

Sage X3 |

Larger middle-market manufacturers with global operations and complex requirements | End-to-end ERP capabilities, multi-country compliance, advanced manufacturing features | Higher implementation complexity and resource requirements |

Cherry Bekaert will work with you to evaluate and determine the best solution for your needs. Here are just a few questions to consider when evaluating solutions:

- Does your organization need multi-level cost accounting and variance analysis capabilities?

- Does your organization need production scheduling integration with financial forecasting?

- Is your business struggling with inventory valuation?

- Does your organization need regulatory compliance for a specific manufacturing subsector?

- Do you need supply chain financial integration points?

Your Guide Forward

Early steps lay the groundwork when choosing to move to a new ERP and accounting software system. Proper planning helps identify and address potential issues early on and can prevent costly mistakes and delays later in the project. With extensive experience in Sage ERP system implementations, Cherry Bekaert would like the opportunity to learn about your needs and help you on your ERP journey.