Most Frequently Asked Questions (“FAQs”) about GASB 87 and What You Need to Know to Comply

Contributors:

Scott Anderson | Director, Assurance Services

Alex Wiley | Senior Manager, Risk & Accounting Advisory

Christian Fuellgraf | Principal, Government & Public Sector Leader

The Government Accounting Standards Board (GASB) has released its long-awaited lease implementation of GASB Statement No. 87 (GASB 87). While many governments with June 30th year-ends have already issued financial statements, many are still in the throes of it. For both groups, the most difficult step in implementing the new standard was often accumulating all existing lease information.

This lease standard significantly impacts entities with contracts that are leases or contain leases that support entity operations. Historically, operating leases have been “off the balance sheet,” but the GASB 87 standard requires all leases with terms exceeding one year to be recognized as both a “right-of-use” asset and a lease liability on the balance sheet, with certain exceptions.

With the new requirement, there are many lease compliance considerations, including writing new or revising existing policies, evaluating current leases, updating financial statement disclosures and establishing procedures to maintain future calculations. As the Firm has helped clients in state and local government and in the public sector, a few Frequently Asked Questions (FAQs) have emerged. Below we share what we believe to be their best answers:

- What is GASB 87 and how does GASB define a lease?

GASB 87 increases the usefulness of governmental financial statements by requiring recognition of certain lease assets and liabilities for all leases, including those that previously were classified as operating leases and recognized as income by lessors and expenditures by lessees. GASB 87 replaces the previous lease accounting methodology and establishes a single model for lease accounting based on the foundational principle that leases are a financing of the right to use an underlying asset.

GASB defines a “lease” as “…a contract that conveys control of the right to use another entity’s nonfinancial asset (the underlying asset) as specified in the contract for a period of time in an exchange or exchange-like transaction.”1

- What is considered a nonfinancial asset?

Examples of nonfinancial assets include buildings, land, vehicles, and equipment (including copiers, heavy equipment, hangars). Any definition meeting these examples should be considered when evaluating for GASB 87 compliance. Furthermore, certain non-financial asset-based lease agreements are out of scope, such as: Leases of intangible assets, leases of biological assets, inventory leases, supply contracts, service concession arrangements and other certain agreement types, such as assets financed with outstanding conduit debt.

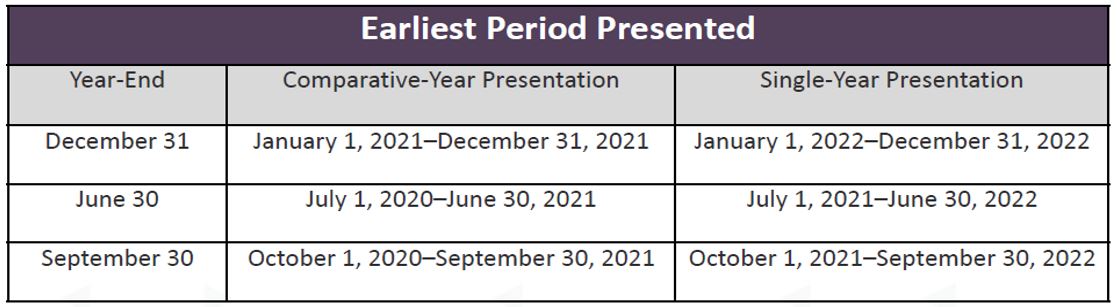

- What are the effective dates for GASB 87?

- How do you determine materiality? Do you look at each leased asset individually to determine whether it should be included?

Under GASB 87 there is not an established approach to determine materiality. It is a matter of judgement by management. However, when evaluating materiality, management should be thinking individually and, in the aggregate, if a lease or population of leases are material.

- How is short-term leases defined?

A short-term lease is defined as a lease that, at the commencement of the lease term, has a maximum possible term under the lease contract of 12 months (or less), including any options to extend, regardless of their probability of being exercised. Lessees and lessors should recognize short-term lease payments as outflows of resources or inflows of resources, respectively, based on the payment provisions of the lease contract.

- What steps should I take before implementing the lease standard?

There are several key actions you want to consider before implementing the lease standard, including reviewing your inventory for all leases, re-examining all of your service contracts for embedded assets – replacement rights, etc., capturing as much data as you can around lease term and rents, renewal options, purchase options, service elements in leases, and contingent rent / percentage rent. Lastly, you may want to consider lease software to ensure full compliance, data integration and validation, calculation accuracy, and other advanced reporting options.

- We have a ten-year lease that is in its last year with an end date of June 30, 2022. All other aspects of the lease make it applicable to GASB 87 reporting. Is it still categorized as short-term for FY2022?

When evaluating the remaining lease terms of an applicable lease, management should consider if there are 12 months or more remaining of the lease term in the FY of reporting. In other words, if as of the beginning of the fiscal year to the reported on there are 12 months or month, then such lease is considered longer greater than 12 months. If less than 12 months at the beginning of the fiscal year, then it is considered short term.

- Would gas cylinders be considered embedded leases where there is a service for gas and rent payments for the cylinders?

Yes, when you have a contract for length of 12 months or more to lease an asset you control the right and use of it, it is considered an embedded lease.

- What are the categories for lease agreements?

With the implementation of GASB 87, there are three distinct categories represented as short-term leases, contracts that transfer ownership and other all other leases. Previously, there were only two categories classified as “operating” and “capital.”

- What are the differences between GASB 87 and 96?

GASB 87 uses terms specific to lease agreements and GASB 96 uses terms specific to subscription-based information technology arrangements (“SBITAs”).

GASB 87 is the new lease accounting standard for government organizations.

GASB 96 establishes accounting guidelines for subscription-based information technology arrangements, including defining what a SBITA is. The goal of this standard is to improve government financial reporting by providing uniform guidance for IT subscriptions which are a growing resource for many state and local government organizations.

- When leasing is part of the principal operating activities, where should I record lease activity on proprietary fund statements of revenues, expenses and changes in net position?

Enough people have asked this question that the GASB included it in an implementation guide (IGU No. 2021-1, paragraph 4.13). The short answer is that lease interest revenue should be reported as nonoperating. “If the principal ongoing operation…is leasing property to other entities, the principal ongoing operation is conveying control of the right to use an underlying asset. Because the interest revenue related to a lease is recognized from financing that operation, rather than from the operation itself, the interest revenue from a lease should not be reported as operating.”

- Where should I record lease activity on cash flows statement?

GASB 87 did not specifically change how cash flows should be reported. GASB’s Implementation Guidance Update (IGU No. 2016-1, paragraph 5.2) still applies to cash flows reporting. However, you should refer to the codification (2450.707-16), rather than the original IGU because the conforming amendments will make more sense.

- Are leases included in the calculation of net investment in capital assets?

Yes, paragraph 20 of GASB 87 identifies intangible right-to-use lease assets as capital assets. GASB 87 does not amend paragraph 9 of GASB Statement No. 63, Financial Reporting of Deferred Outflows of Resources, Deferred inflows of Resources, and Net Position, so it should be included in the calculation. However, in most cases, the effect on that calculation should be minimal as the balances for the right-to-use lease asset and the lease liability will be similar.

- During the year of implementation, what should lessees report in the governmental fund statement of revenues, expenditures and changes in fund balance?

There has been a lot of discussion about this. Paragraph 36 of GASB 87 states that an expenditure and other financing sources should be reported in the period during which the lease is initially recognized. Some have interpreted this to mean that during the year of implementation, all outstanding leases (including those entered in previous years) should be reported on the governmental fund flows statement.

An opposing interpretation is that paragraph 36 is not a transition provision and only applies to new leases entered during a reporting period. Paragraph B35 of GASB 87 states, “This Statement carries forward without significant change the accounting for leases in governmental funds in NCGA Statement 5, as amended.” Those who have taken this view believe that the inception of a lease requires the reporting of expenditures and other financing sources because that is when the flow of financial resources occurred. The implementation of a standard is not a flow of financial resources.

Ultimately, the GASB has not taken a position. If you were to reach out to the GASB through their technical inquiries form, someone will tell you that either way is correct.

- During the year of implementation, how should I present the capital asset and long-term liability rollforwards?

This question is similar to the last, but the bases for interpretations are different. One interpretation is that the right-to-use assets and lease liabilities for all leases, including pre-existing leases, should be reflected as “additions” in the respective rollforward schedules. This is based on an interpretation of paragraph 94 of GASB 87 which states “Leases should be recognized and measured using the facts and circumstances of the period of implementation.” This broad interpretation of paragraph 94 is shared by the Government Finance Officers Association (GFOA), who reflects this presentation in examples shared with its members.

The opposing interpretation of paragraph 94 is that it applies to the recognition and measurement of lease assets and liabilities, rather than the presentation in the notes. Paragraph B124 expresses the Board’s concern about the difficulty of governments returning to the commencement of each lease to determine what the balances would have been if the Statement had been in effect from that time. Paragraph 94 allows governments to use the discount rate, for example, as of the first day of the implementation year, rather than determining what that rate was on the first day of the lease. Additionally, the opposing view believes that retroactively implementing a new GASB Statement would reflect the financial statements as if that GASB Statement has always been in place. It would seem contrary to that transition provision to reflect all leases as current year additions.

As with the governmental funds presentation, the GASB has not taken a position and accepts both approaches. Additionally, the GFOA has confirmed that a government that submits an Annual Comprehensive Financial Report for the Certificate of Achievement for Excellence in Financial Reporting program will not be penalized for reflecting preexisting leases as beginning balances.

- Should lease assets and liabilities be separately presented and disclosed?

Many governments have broken out the right-to-use assets on their statements of net position and have created a separate rollforward schedule in their notes. The right-to-use asset is a capital asset and there is no requirement to break it out from other capital assets. Similarly, there is no requirement to disclose separate rollforwards (capital assets and long-term liabilities) and right-to-use lease assets can be reported in the same rollforward schedules. The only requirement is to disaggregate them within the rollforward schedule by major classes of underlying assets.

At this point, there is also no requirement stating that they can’t be broken out. The GASB has considered this question in an ongoing project on Classification of Nonfinancial Assets and has tentatively decided that right-to-use assets should be disclosed with other capital assets.

- How does GASB 87 affect previously capitalized leasehold improvements?

GASB 87 does not affect leasehold improvements, which are costs incurred by tenants to upfit leased property. Those costs are capitalized if they exceed a certain threshold and have a useful life longer than a year. Some leases may result in the lessor paying for the improvements on behalf of the lessee. In such cases, those payments may be considered lease incentives. Otherwise, leasehold improvements should continue to be capitalized and amortized over the life of the lease.

- What happens to unearned rent that was recorded under the old guidance?

Under the old guidance (which originated from FASB guidance), unearned rent resulted from a difference between straight-line rent expense and actual payments. Often this was a result of rent holidays or rent escalations. Unearned rent was then amortized over the life of the lease. GASB 87 has no requirement to recognize rent expense or rent revenue over a straight-line basis. Therefore, when implementing GASB 87, any unearned rent would need to be written off as part of the restatement of beginning balances. Note that this may be a different treatment than what FASB requires in Topic 842.

- Should I restate the prior year balances in the MD&A?

Currently there is no explicit guidance about restating required supplementary information. It would be acceptable to do what many governments did when implementing the pension and OPEB standards, which was to add an asterisk to the prior year information and explain why the information is not comparable. Although not effective yet, paragraph 36 of GASB Statement No. 100, Accounting Changes and Error Corrections—an amendment of GASB Statement No. 62, states “For reporting periods that are earlier than those presented in the basic financial statements, information for those prior periods that is presented in RSI (including MD&A) or SI should not be restated for a change in accounting principle…” Because that guidance is creating new guidance, it would be acceptable to follow it now.

We will continue to monitor all GASB 87 developments and share additional Lease Accounting Standard guidance. If you have questions or want to learn more about GASB 87 compliance, consult your Cherry Bekaert advisor or Cherry Bekaert’s Accounting Advisory practice professionals.

Additional Resources:

Website: Lease Accounting Services (ASC 842 and GASB 87)

Podcast: GASB 87 Impacts on Airports

Webinar: Implementing ASC 842 and GASB 87 Lease Standards

Alert: GASB 87 Lease Accounting Implementation Tool for Governments

1Source: GASB.org: https://gasb.org/page/PageContent?pageId=/standards-guidance/pronouncements/summary–statement-no-87.html&isStaticPage=true