R&D Tax Credit: The Innovation Incentive

The Research and Development (R&D) Tax Credit is a federal incentive designed to promote innovation in the design, development and improvements of processes, products and services. It allows companies to receive tax credits when certain expenses are incurred for the performance of qualified R&D activities in the U.S. For most companies, the R&D tax credit provides a dollar-for-dollar reduction of income tax liabilities. For some start-up companies, a portion of R&D tax credits can be used to offset federal payroll tax liabilities.

Why Investigate the R&D Tax Credit Now?

The R&D tax credit offers innovative businesses the opportunity to save money and generate cash to improve and expand operations, products and services. The credit continues to be expanded, opening the door for more companies to benefit from this incentive while expanding the credits available to past or current incentive recipients. Taxpayers may qualify for benefits from multiple tax years (current and prior). Startup companies can use the R&D tax credit to offset up to $250,000 of payroll tax liabilities. C corporations, S corporations, LLCs and partnerships can investigate the potential for tax liability reductions. Plus, many states offer additional refundable incentives for R&D activities.

Despite all these opportunities, most taxpayers continue to underreport potential qualified research expenses (QREs). Many businesses are not benefitting from this tax incentive because of false assumptions, such as that the R&D must be “groundbreaking” to qualify for the credit; claiming the credit will result in an audit; time tracking tools must be used to capture R&D efforts; or that the R&D tax credit is only beneficial to large organizations. We are able to walk you through the R&D process and assist you in navigating common misconceptions.

The IRS has established new disclosure requirements for filing amended claims for refund which must be followed. Employers that claimed the Employee Retention Credit in 2020 and 2021 can still apply for R&D tax credits, but need to be aware of the interplay between the two incentives.

How to Qualify for the R&D Tax Credit

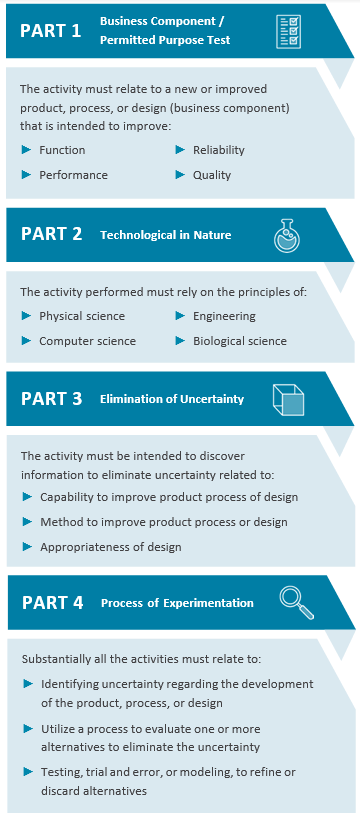

Determining which activities qualify for the R&D tax credit begins by passing the Four-Part Test created by the IRS.

R&D Qualified Activities / The Four-Part Test

How the R&D Tax Credit is Calculated

The R&D tax credit is an incremental credit. Accordingly, to determine what portion of the annual QREs are eligible for the credit, a taxpayer must analyze qualified spending in prior years. After the prior year analysis is performed, the taxpayer calculates a base amount of spending above which the current year QREs are multiplied by the statutory credit rate. Every year, the taxpayer has the option to choose between two separate calculation methods: the Traditional Method (20% statutory rate) or the Alternative Simplified Credit (ASC) Method (14% statutory rate). Most companies calculate credits under the ASC Method; however, a taxpayer should explore both methods and choose the one that yields the largest credit.

Which Activities Do Not Qualify for the R&D Tax Credit?

The IRS excludes some activities from consideration for the R&D tax credit. Non-qualifying categories include research after commercial production; funded research; foreign research; routine testing, quality control and maintenance; adaptation and reverse engineering; non- scientific research; and aesthetics.

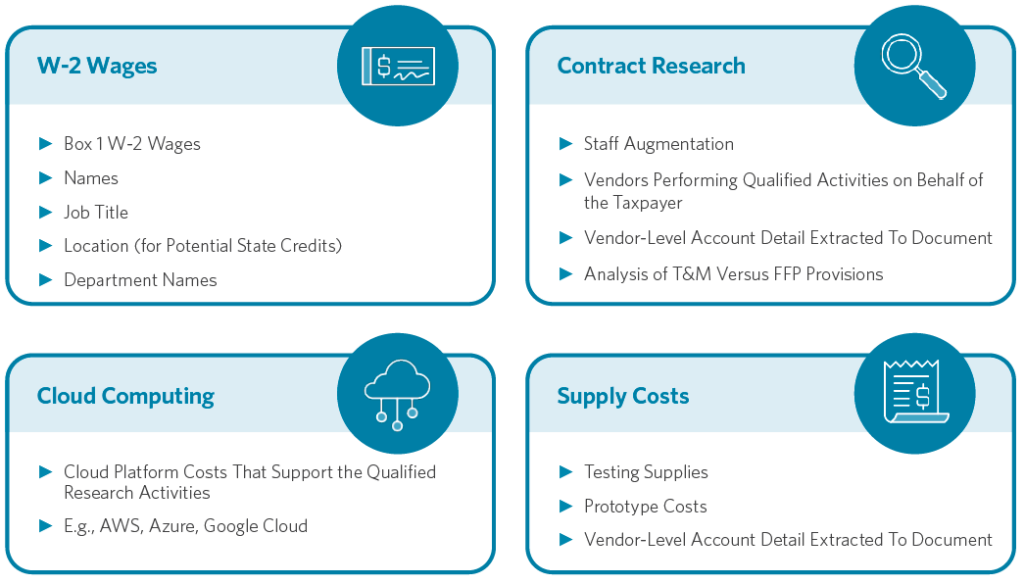

What are Qualified Research Expenses?

Specific expenditures incurred during the R&D process can be used to qualify for the credit. These QREs typically fall into four categories:

R&D Expense Capitalization Requirements

Beginning in 2022, Section 174 requires taxpayers to capitalize and amortize specified research or experimental expenditures. Amortization for expenses related to domestic activities is five years and amortization for foreign-related expenses is 15 years.

While contemplating a process to track Section 174 expenses, many taxpayers are focusing first on QREs captured under Section 41 for the R&D Tax Credit. QREs, however, are just the starting point, as they only include taxable box 1 W-2 wages, certain supply costs and 65% of contract research. Additional R&E costs to track include:

- Gross wages for labor instead of Box 1 W-2 wages

- 35% of contract research costs not treated as QREs

- Facility costs

- Costs subject to depreciation

- Costs of obtaining a patent

- Off-shore R&D

Cherry Bekaert works with clients to analyze the general ledger accounts to identify expenses that are incidental to the research process. It is important to analyze the activities of the individuals at the company to not capitalize costs that have no association with research activities.

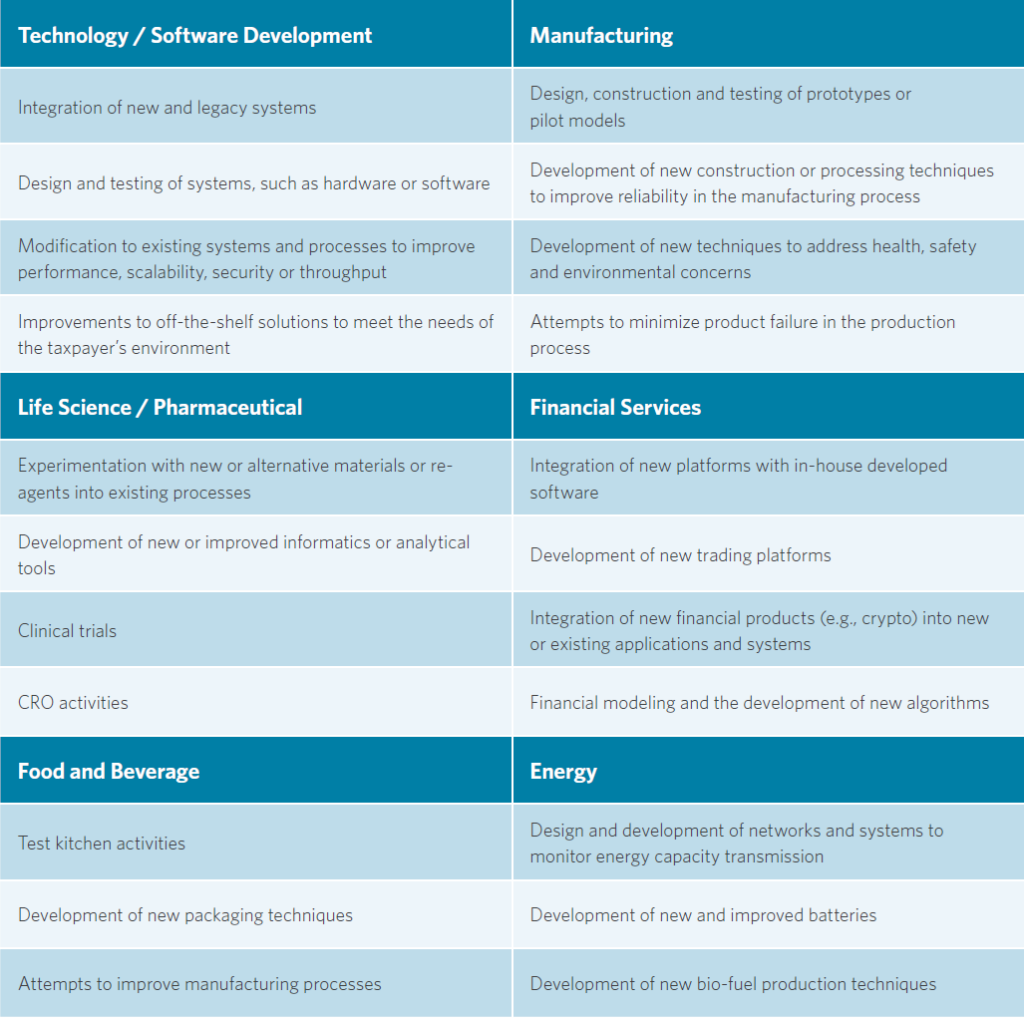

Sample Credits by Industry

Cherry Bekaert Process

Scoping the R&D Credit

- Gather relevant information.

- Collect electronically available financial information.

- Identify QREs.

- Conduct interviews with key personnel.

- Estimate the federal and state research credits.

- Prepare a work plan for the research credit study.

Performing the R&D Credit Study

- Accumulate financial / cost accounting information.

- Organize documentation associated with the qualified research activities

- Conduct interviews with technical subject matter experts.

- Analyze current and prior year expenses to substantiate the base amount and the credit-eligible QREs.

- Prepare a methodology memorandum and interview memoranda to demonstrate how taxpayer’s R&D activities meet the requirements for qualification under IRC Section 41.

- Prepare an IRS audit-ready deliverable.

Our Technology-Driven Survey Process

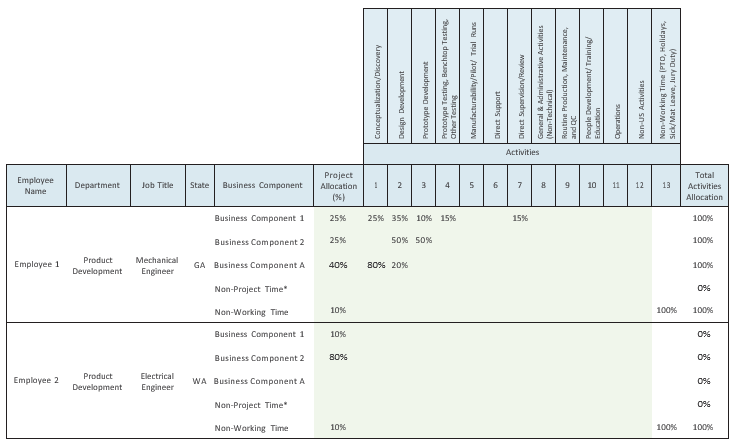

Cherry Bekaert’s R&D survey process includes use of a proprietary, easy-to-use, survey tool that allows Cherry Bekaert to allocate taxpayer QREs among multiple employees by business component and by activity.

Cherry Bekaert’s R&D Tax Credit Services

Cherry Bekaert provides a systematic approach to claiming your R&D tax credit. Our goal is to maximize the incentive and provide qualified and detailed documentation that meets IRS standards. When assessing the potential for R&D tax credit benefits, we analyze your: tax returns for the prior four years; prior research credit studies; organization charts, employee W-2 wage amounts, general ledger information time tracking data; and any internal documents defining how potentially qualifying projects are approved at the company. We also look at any contracts defining the payment terms between the company and its customers and the company and its contractors.

Our Tax Credits & Incentives Advisory professionals begin by providing a complimentary analysis of your operations to identify QREs and estimate federal and state R&D tax credits. Then we map out a plan to implement your research credit study. The next step is conducting a thorough, detailed study that addresses IRS requirements, followed by preparing a comprehensive memorandum documenting how these requirements are met. Finally, Cherry Bekaert provides each client with an IRS audit-ready deliverable.

Value-added Benefits

- Complimentary Analysis of Federal and State R&D Incentive Benefits

- IRS defense services

- Consultation and Analysis Regarding Credit Utilization by the Company, Partners and Shareholders

- Analysis of Whether R&D Credits Can Be Used Against Federal and State Payroll Tax Liabilities

- Deliverables Designed to Address Potential IRS Inquiries

- Proprietary Technology Tools To Survey R&D Subject Matter Experts

- Identification of Other Credit Benefits Specific To Alternative Energy Investments, Hiring and Capital Investments

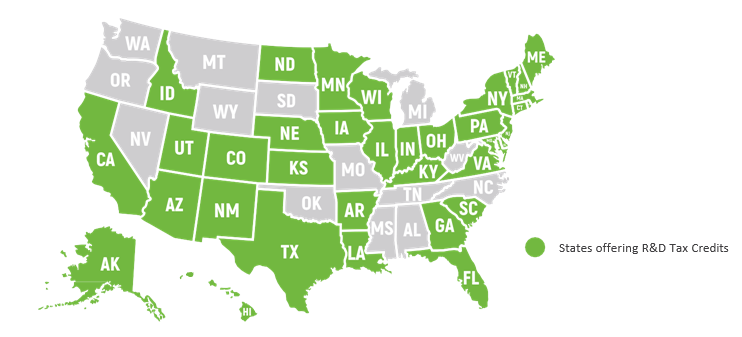

States Offering an R&D Tax Credit

In addition to the federal R&D tax credit, many states offer similar R&D tax credits.