Consistent with the private equity (PE) industry’s strategy to gain deep, industry-specific operating expertise to improve valuation over time, fund managers are pursuing fragmented sectors that are ripe for consolidation. The home services sector fits this mold, as it is comprised of many small to mid-sized, independently operated companies.

Learn more about the benefits to home service company roll-ups and how private equity investors can navigate the potential risks to better ensure a successful transaction.

Home Services Businesses Provide Opportunity for Private Equity Firms

According to our Private Equity 2024 Year-In-Review and 2025 Industry Outlook, PE firm investors continue to seek opportunities to consolidate these smaller players to unlock economies of scale, drive technological transformation and create larger, more efficient operations. Companies operating in sectors such as home repair , heating, ventilation and air conditioning (HVAC), plumbing, electrical, pest control, landscaping, pool services and the like all exhibit the key characteristics that make them attractive targets for private equity roll-up strategies.

Five years ago, only a limited universe of buyers were interested in these businesses, whereas today the interest has exploded. There are now three times as many buyers with active investments in the home services sector, with many more anticipated to join the chorus. Additionally, with tariff pressures making near-term prospects in many sectors unclear, we expect even greater investment acceleration in the home services industry, given its minimal tariff exposure.

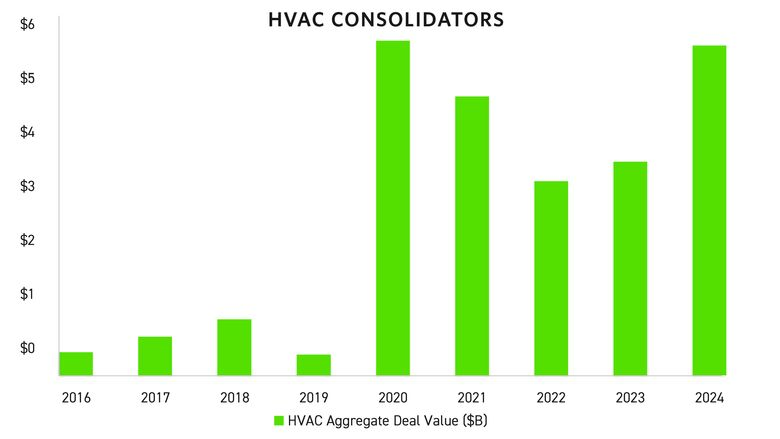

HVAC Private Equity Aggregate Deal Value

Source: Pitchbook | Geography: U.S.

As of 1/31/2025

The potential for efficiency gains is clear, but it's crucial to recognize key principles that could hinder a home services company's growth.

5 Potential Risks for Private Equity Funds Operating in the Home Services Sector

Having worked on over 100 home services deals, Cherry Bekaert has identified several risk factors that can impact growth in home services consolidation, including:

1. Poor Talent Acquisition and Retention Can Prevent Growth

Since the home services talent market is highly competitive, companies must develop effective hiring and retention strategies to attract top talent.

Seasonal demand adds another layer of complexity, as it's essential to have enough capacity during peak times while maintaining stability during slower periods. For example, landscaping demand drops meaningfully in winter months, so shrewd landscaping businesses must be ready to capture seasonal highs while weathering winter lows.

2. Poor Customer Engagement May Erode Your Base of Business

Reputation and word-of-mouth are critical in the home services industry. Even with sufficient talent, the quality of service must be exceptional.

Technicians should consistently deliver high satisfaction through fair pricing, clear communication and efficient visits. In regulated industries like HVAC, keeping technicians updated with the latest regulations is vital to ensure homeowner satisfaction and reduce callbacks.

3. Lack of Focus on New Business Development Is a Silent Killer

While keeping customers satisfied remains paramount, it is just as critical for home services companies to continuously and effectively expand their book of business.

Many companies are comprised of excellent “farmers” (order takers) who can retain business well. Without strong marketing and “hunting” capabilities, however, natural attrition (e.g., a pool services customer moves homes) will lead to a steady decline in revenue that is difficult to overcome.

4. Systems Aimed at Adding Efficiency May Just Add Cost

Home services companies often maintain lean operations, achieving high delivery rates and revenue gains with minimal distractions from management systems (e.g., ERP, CRM). Introducing new technology and management processes must be done thoughtfully to avoid constraining contractors' ability to deliver. It's crucial to assess the company's readiness for new technological advancements and work from their true maturity level.

For example, a new CRM may provide exceptional data for the investment team, but heavy data entry requirements for sales and service team members can cut into time that should be spent selling and delivering. Missteps in this area can lead to increased costs and decreased revenues, rather than efficiency gains.

5. Offerings Expansion Can Be Valuable, but Only With the Right Team

Expanding services offered is a common strategy for meaningfully increasing platform revenue potential and hedging against market-specific risks. For example, a basement waterproofing company may be able to expand to service parking decks.

That said, it is critical to ensure the management team of the service platform company is ready to take on these expansion efforts. Without the right leadership and experience with scaling, expansions can often fall flat. Core business declines and limited bolt-on company growth are common symptoms.

Planning for Success With Cherry Bekaert

Many of these risks can be assessed and planned for pre-acquisition. Working in tandem with the Transaction Advisory Services practice, Cherry Bekaert’s Strategy & Transformation team excels in providing targeted commercial due diligence insights by conducting voice-of-customer interviews and identifying growth drivers.

The team also supports private equity-backed portfolio companies by leveraging its value creation capabilities to help accelerate growth post-close. This includes assessing and implementing commercial expansion opportunities and driving bolt-on acquisitions. By addressing these risks with qualified advisors, companies set themselves up for successful consolidation and integration.

Related Insights

- Report: Renewed Optimism: Private Equity 2024 Year-In-Review and 2025 Industry Outlook

- Podcast: Amplify Post-Acquisition Growth Through Voice of Customer in Commercial Due Diligence

- Article: Voice of the Customer in Commercial Due Diligence: Maximizing Post-Acquisition Growth and Strategic Decisions