Creating a Difference in the World Without Sacrificing Profits

Assumptions

An average annual U.S. factory’s electric bill is approximately $6M, or 60 GWHs total per year. Current factories average a purchasing grid power of approximately 20MW for their operations.

Actions

New 20MW solar array capital project costs estimated at $20M, are down from several times that amount a decade ago. Thus, choice is $6M per year in perpetuity to electric utility, or $20M one-time payment CAPEX to self-power with a 25-year useful life, with significant government incentives to offset this CAPEX.

Financial Results

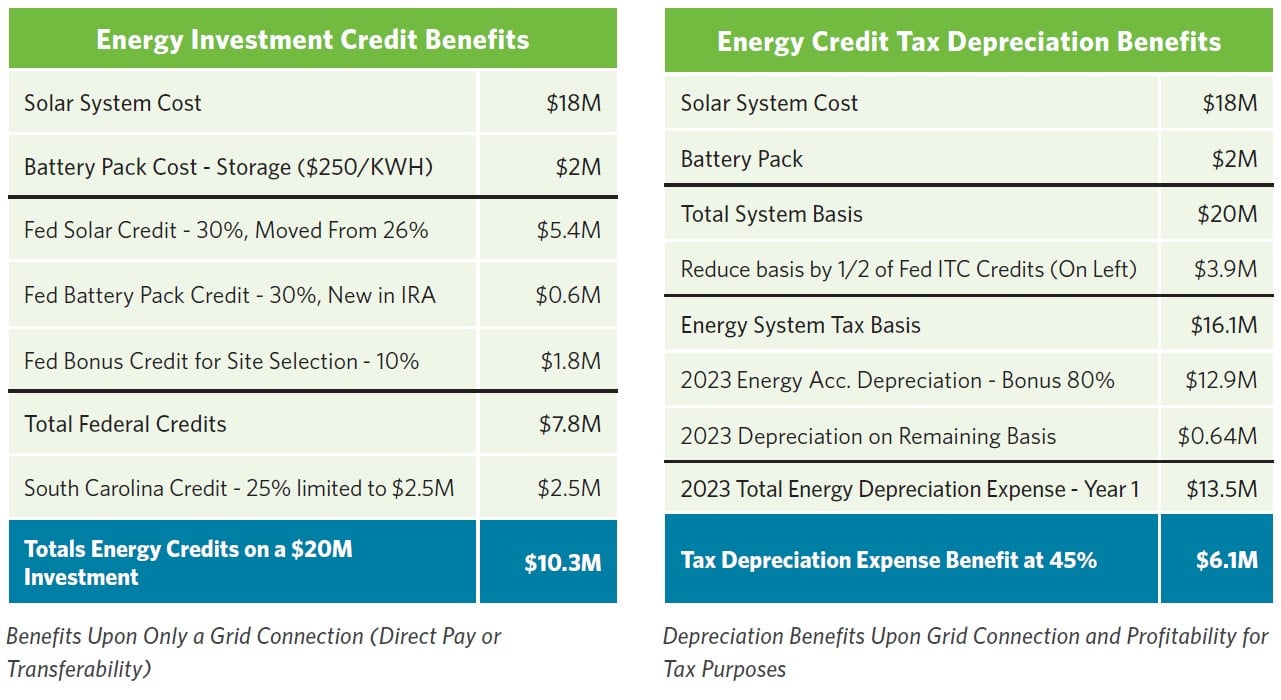

The Cherry Bekaert team estimated how much of the $20M CAPEX spend is eligible for Federal (I.R.A. of 2022), state and local incentives:

- Over 80% of the CAPEX cost is our targeted total cash recoupment in the first two years through year-one government credits (direct pay or transferability) plus the accelerated depreciation tax savings cash benefits

- To recoup this full investment cost offset, grid connection and parent profitability are assumed to enable the credits and accelerated depreciation expense monetization

- Plus, going-forward the business enjoys lower energy costs through renewable sourcing and avoiding peak energy costs through battery storage

Estimating Lifetime Battery Peak-Shaving Value

Battery storage is “turned on” during peak utility pricing hours to avoid high price energy. Battery storage is coupled with renewables footprints to store energy and provide backup when sun is not shining and/or when the grid is too costly or down.

Summary: The Full ROI Model Puts It All Together

- $20M capital investment yields $10.3M in credits upon grid connection.

- Year-one tax filing allows $13.5M in accelerated depreciation expense, worth $6.1M in cash.

- Raw energy savings are estimated at $4.8M per year.

- Battery peak-shaving benefits can provide another $2M in lifetime energy savings.

Yes, you can do both: CEOs and CFOs accomplish dual missions of reducing costs, and telling a leading carbon reduction story to the market and business stakeholders.