The 2026 midterms will determine the composition of the 120th Congress. Because the presidency is not up for election, control of the White House will remain unchanged, ensuring continued Republican leadership of the executive branch.

The outcome of the election will shape the governing structure for the 120th Congress, resulting in either:

- A unified government, in which a single party controls the executive branch (the presidency) and the legislative branch (both chambers of Congress).

- A divided government, in which one party controls the executive branch (the presidency) while another party controls at least part of the legislative branch (one or both chambers of Congress).

Implications of Election Results

The configuration of political control across the government plays a significant role in shaping fiscal policy, including government revenue, spending and tax decisions that influence economic outcomes.

Explore the sections below to better understand the varying election outcomes.

Unified Governments

As discussed in the Senate Midterm Elections explanation, most legislation is subject to the filibuster, which gives the minority party significant leverage in the upper chamber. As a result, even under unified government, advancing most legislative priorities requires bipartisan cooperation unless the controlling party has a 60-seat supermajority in the Senate.

However, unified government still confers the majority party with some important advantages. The controlling party can more readily advance certain actions that only require a simple majority in both chambers — such as budget reconciliation legislation, judicial and executive nominations, and certain other fast-tracked procedures. These mechanisms can reduce the need for bipartisan support and often contribute to more partisan policymaking.

The budget reconciliation process is particularly consequential for fiscal policy and has been used repeatedly over the last decade to enact major tax and spending changes. Reconciliation bills are limited in scope and frequency, but their privileged status has made them a critical tool for majority parties seeking to implement new fiscal policies.

Even with unified control, legislating can be challenging, particularly when the governing party holds narrow majorities. Intraparty divisions and slim vote margins can make internal consensus hard to achieve and can provide individual members with outsized influence over the legislative agenda — a dynamic that has been evident in the 119th Congress.

Because the presidency is not contested in the 2026 midterm elections, the only possible unified government outcome would be Republican control of both Congress and the presidency.

Divided Governments

In a divided government, policymaking authority is split between parties, either between the executive and legislative branches or between chambers of Congress. As a result, advancing legislation almost always requires bipartisan support.

Ideological divisions between political parties can complicate policymaking in a divided government. Some contend that split control can decrease legislative productivity by making it more difficult to build consensus, though that is not necessarily the case, as discussed below. Others point to potential benefits of divided government, noting that policy outcomes may be more moderate and that institutional checks and balances are often strengthened.

In recent years, most major tax bills have been enacted through party-line budget reconciliation, including Republicans’ Tax Cuts and Jobs Act of 2017 and the “One Big Beautiful Bill Act” (P.L. 119-21) in 2025, as well as Democrats’ Inflation Reduction Act of 2022. However, the United States does have a history of passing bipartisan tax and spending measures during periods of divided government — to include the landmark Tax Reform Act of 1986 as well as the more recent American Taxpayer Relief Act of 2012, Protecting Americans from Tax Hikes Act of 2015, and Coronavirus Aid, Relief, and Economic Security Act of 2020.

The 2026 elections would result in a divided government if Democrats were to regain control of the House and/or the Senate. A shift in control of either chamber would eliminate Republicans’ ability to pursue additional party-line reconciliation legislation. If Democrats were to take control of the Senate, President Trump would face greater difficulty confirming nominees, as that responsibility would fall to a Democratic-led chamber.

Legislative Productivity

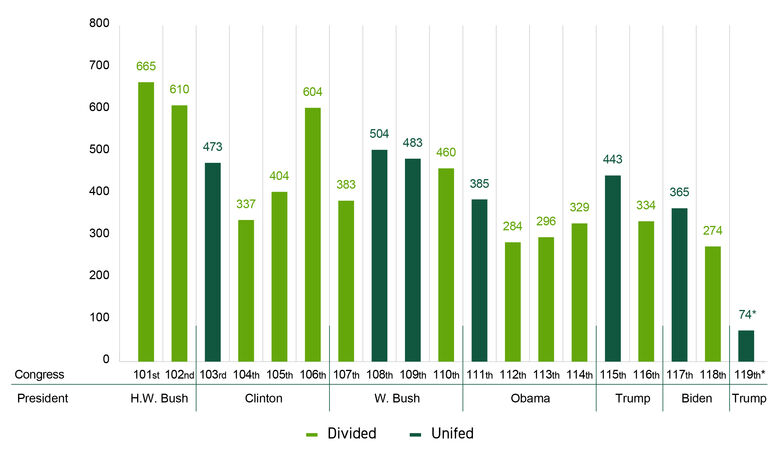

Whether government is divided or unified is just one of many factors that influence congressional legislative productivity; a divided government doesn’t necessarily result in lower output. The chart below shows the number of laws enacted by each Congress over the last 37 years:

Expectations for the 120th Congress

The 120th Congress will serve from January 3, 2027, through January 3, 2029. While it will not face a tax cliff comparable in scale to the one addressed by the previous Congress, it will nonetheless need to consider several provisions scheduled to expire at the end of 2028, including:

- The “no tax on tips” deduction,

- The “no tax on overtime” deduction,

- The “no tax on car loan interest” deduction,

- The enhanced deduction for seniors, and

- The eligibility window for acquiring property to qualify for the special expensing of qualified production property.

In addition, the expanded state and local tax (SALT) cap is scheduled to expire at the end of 2029.

The 120th Congress will also be responsible for two years’ worth of government funding legislation. While this is a core responsibility of every Congress, the appropriations process has grown more challenging and contentious in recent years.

These and other fiscal policy decisions must be made amid heightened partisanship, a large and rapidly growing federal deficit, the projected insolvency of social security in 2034, and a host of other complex dynamics.

Your Guide Forward

Cherry Bekaert will continue to bring you policy updates throughout the 119th and 120th Congresses and beyond.