As the chief financial officer (CFO) of a middle-market company, your leadership shapes the financial discipline and strategic direction of the entire organization. You must balance the need for a rigorous, formal process with the agility required to succeed in a dynamic market.

The modern budget focuses equally on transparency and accuracy, transforming finance from a transactional back-office role to a strategic partner that drives growth and value. For middle market companies, where resources are often lean, an optimized budget process is a competitive necessity.

For CFOs, successful budget planning starts with clear timelines and achievable targets for all stakeholders. Partnership between finance and business leaders is crucial, as this ultimately drives value creation. Once that partnership is established, companies can integrate robust processes and data automation, shifting focus from accuracy to insights.

Building a Budget Roadmap Aligned With Long-term Goals

An optimized budgeting process is more than a financial exercise; it's a strategic imperative. By implementing a disciplined, three-quarter cycle, fostering strong partnerships and strategically choosing scalable technology, you can transform finance from a reporting department into a strategic value driver.

Budget processes often fail when companies focus too much on accuracy and not enough on variance tracking. Instead of striving for perfect numbers, organizations prioritize understanding the reasons behind deviations . This shift enables finance teams to move beyond transactional reporting and toward strategic value creation. The transformation doesn’t happen overnight, but with the right people and a clear roadmap, companies can optimize their budget processes for long-term success.

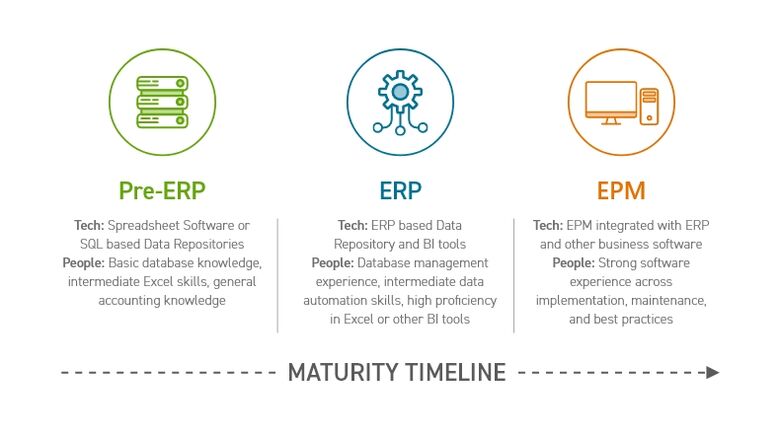

To support this evolution, companies should begin by creating a budget process roadmap aligned with long-term strategic goals. This roadmap helps identify:

- The people needed to support each stage of development

- The technology required to scale effectively

- The processes that ensure consistency and transparency

A strong foundation also starts with evaluating the company’s data environment. Ensure there is a single source of truth for historical data used in tracking actuals and building projections. Identify data silos as well as gaps in data accessibility and quality. Prioritize tools that enhance data automation, reduce manual effort and support real-time insights.

The Three-quarter Budgeting Cycle: A Strategic Framework for Agility

While leading practice companies routinely complete core budgeting work in a two-to-four-month window, the entire cycle is a three-stage process spanning three quarters. This cadence ensures the process is deliberate, collaborative and aligned with the company's strategic goals. The CFO owns the budget planning process end-to-end, ensuring discipline, accountability and consistency across the organization. This approach balances strategic foresight with efficient execution, and typically includes:

- Defining a strategic plan, which includes business objectives and financial goals.

- Aligning resources, setting targets and establishing key performance indicators (KPIs).

- Establishing processes to monitor progress and adjust budget-to-actual performance as needed.

Having defined processes, roles and responsibilities ensures clarity, accountability and alignment across teams. In practice, we typically see this process play out over Q3, Q4 and Q1.

Q3: Strategic Alignment and Financial Targets

The budgeting cycle begins long before the numbers are finalized. By the end of the third quarter, leadership should roll out the strategic plan, including key business objectives and financial targets, to the entire organization. In the middle market, this is a crucial step for preventing "budgeting by spreadsheet," where departments simply roll over last year's numbers without a strategic filter.

This timing is also critical to ensure alignment and meaningful dialogue from key stakeholders. Companies with successful strategic planning have employees who can easily answer the following questions:

- Vision and Market Position: Does the company have a clear vision for the future and an honest understanding of its current position in the market?

- Strategic Alignment: Do business and finance leaders understand the company’s long-term strategy and business model?

- Segment Contribution: Do leaders understand how their business segment contributes to achieving the company’s vision of the future?

- Projection Depth: Do the company’s long-term projections consider more than just historical performance and available cash?

- Stakeholders Buy-in: How difficult will it be to achieve buy-in from finance and business leaders? Are there clearly defined success criteria and KPI benchmarks that business leaders can use to measure their execution and success?

Leading Practices for Q3

Establish Guiding Principles

Define the core tenets for the upcoming budget, such as a focus on profitability, market share growth or operational efficiency. These principles must be clearly communicated and aligned with the corporate strategy. This sets the stage for a purpose-driven process, avoiding the trap of simply "building a budget to spend what we have."

Conduct a Mid-year Performance Review

Compare actual performance against current-year targets and evaluate the effectiveness of existing strategies. This provides a data-driven foundation for next year's assumptions.

As one of our clients, a middle-market manufacturing CEO, said, "We don't want to just forecast what's coming; we need to understand what's worked and what hasn't so we can double down on our winners."

Initial Stakeholder Engagement

The CFO should meet with business unit leaders to discuss high-level strategic priorities and their implications for resource allocation. This proactive engagement builds a sense of ownership and partnership from the outset.

Outputs and Value Delivered for Q3

- Outputs: A finalized strategic plan with clear financial goals, a summary of key assumptions for the upcoming year and a communication plan for rolling out the budget process.

- Value: Establishes a "single source of truth" for strategic direction, ensuring the entire organization is aligned before detailed budget planning begins. It secures early buy-in from key stakeholders, minimizing friction later in the cycle.

Q4: Planning Sessions With Leadership

With the fiscal year drawing to a close, the fourth quarter is the critical period for translating strategic intent into operational reality. As CFO, you will lead the charge in facilitating budget planning sessions that align financial targets with actionable plans.

These sessions should be grounded in reality and anchored to the assumptions and targets established in the strategic plan. This is the time to:

- Ground assumptions in historical performance. This includes agreeing upon historical run rates to use as carry forward into the new year.

- Build forecasting models that project reasonable future outcomes. A driver-based financial model can be easily rolled forward, measured and compared to risk, and tied back to the strategic plan.

- Incorporate upcoming events and market opportunities to ensure agility. This includes identifying recent new wins, opportunities or events expected in the next year that did not occur previously (new markets, new products, new customers, etc.) and the riskiness or likelihood of each.

Overcoming Common Budget Challenges

During budget planning sessions, we often see finance and business leaders struggle to commit to plans months in advance. As a result, seemingly endless refreshes and consolidations occur. This can be overwhelming in an environment where bandwidth is stretched from the beginning of the process. Here are some steps you can take to minimize friction throughout the budget process to overcome these challenges:

- Maintain Year-round Budget Conversations: Budgeting should not be a once-a-year exercise. Ongoing dialogue between finance and business leaders fosters alignment, encourages proactive adjustments, and builds trust.

- Pressure-test Assumptions: Identify and quantify key risks by modeling best- and worst-case scenarios. This helps leaders prepare for uncertainty and make informed decisions under varying conditions.

- Automate Consolidations and Reporting: Use data analytics platforms or ERP-integrated software to automate repetitive tasks. This not only saves time but also improves accuracy and frees up resources for strategic analysis.

Leading Practices for Q4

Utilize Driver-based Budgeting

For middle-market companies, moving beyond simple percentage increases is a game-changer. Tie budget assumptions to operational levers and KPIs (e.g., revenue per salesperson, units produced per hour) rather than applying a percentage increase to last year's numbers. This creates a more dynamic and defensible budget.

Conduct Scenario Planning

Develop and model best-case, base-case and worst-case scenarios. This helps leadership prepare for uncertainty and make more informed decisions under varying conditions. A simple, three-scenario model can provide a significant advantage without requiring a complex enterprise performance management (EPM) system.

Standardize Your Approach

Ensure all business units use consistent templates and forecasting methodologies. This eliminates confusion, improves comparability and accelerates consolidation.

Outputs and Value Delivered for Q4

- Outputs: Detailed departmental budgets, a consolidated enterprise-level budget, and a comprehensive set of financial models for scenario analysis.

- Value: Creates a robust, bottom-up plan that is both realistic and strategically aligned. The process improves accountability at the departmental level and provides the CFO with a comprehensive view of the company's financial roadmap.

Q1: Budget Finalization and Implementation

By early in the first quarter, ideally before the prior year closes, executive management and the board should finalize and approve the company’s budget. This milestone sets the foundation for operational execution and performance tracking throughout the year. Once approved, the finalized budget and company-wide targets must be clearly communicated.

Leading Practices for Q1

Communicate With Transparency

Clearly articulate the approved budget and the rationale behind key decisions to all stakeholders. Communication and collaboration are especially critical for organizations where compensation is tied to budget performance or forecasting accuracy.

Implement a Rolling Forecast

For middle-market companies, a static annual budget can quickly become obsolete. A rolling forecast provides a continuous 12-month view, allowing for real-time adjustments and a more dynamic planning process that keeps pace with a rapidly changing market.

Establish a Financial Dashboard

Create a dashboard for each business leader that provides real-time visibility into their KPIs and budget-to-actuals performance. This empowers business leaders to own their numbers and make data-driven decisions without waiting for the monthly close.

Outputs and Value Delivered for Q1

- Outputs: A Board-approved budget document, a communication packet for all stakeholders and a set of updated financial dashboards.

- Value: Ensures that all teams are operating with a clear, approved financial plan. The transition to rolling forecasts and real-time dashboards transforms the budget from a yearly event into an ongoing management tool that drives agile decision-making.

Annual Budget Tracking and Reporting

The budget is a living document. Controllership and financial planning and analysis (FP&A) teams should lead monthly performance reviews with business leaders to:

- Compare actuals against the budget.

- Explain variances to uncover root causes as well as identify operational and financial levers to minimize or prevent future deviations.

- Discuss new opportunities and necessary adjustments to existing plans.

For these reviews to be effective, finance must act as a trusted business partner. This requires not only strong financial acumen but a deep understanding of the business model and long-term strategy. With the right people and technology in place, the budget process becomes more reliable, minimizing large, unexplainable variances and enhancing decision-making.

Technology and Resource Considerations

In the middle market, the question of technology is not "if" but "when and how." Optimizing the budget process doesn't always require a multi-million dollar EPM system or fully automated FP&A function.

EPM software can be a valuable investment, especially for companies with complex consolidations and reporting needs. However, it’s crucial to recognize the resource demands these tools often carry and make decisions that align with your complexity and capacity. When not properly scoped or managed, they can become a drain on time, budget and personnel.

To avoid this, companies should take a strategic and scalable approach to budget process design. Leaders should assess whether their consolidation and reporting needs are truly enterprise-grade, whether the tool can scale with the business, and whether internal resources are available to implement and maintain the system effectively.

Alternatives to a Full-scale EPM System

Alternatives to a Full-scale EPM System

Implementing a full-scale EPM system can be a resource-intensive undertaking . Before committing to a large-scale project, consider the following alternatives, which can offer a strong return on investment for middle-market companies.

Data Aggregation Platforms

Tools that focus on centralizing data from multiple sources (like your ERP, CRM and HR systems) can provide a single source of truth without the heavy lift of a full EPM implementation. These platforms enable automated data collection, reducing manual effort and improving data integrity.

Advanced Spreadsheet Solutions with Automation

For many middle-market companies, a robust, well-structured spreadsheet model is the right solution. By leveraging tools like Power Query, Visual Basic or linked data sources, you can automate manual processes and reduce the risk of errors, making your spreadsheet-based process more reliable and efficient.

Business Intelligence (BI) Tools

Implementing a BI platform (e.g., Tableau, Power BI) can significantly enhance your reporting and analysis capabilities. While not a planning tool, it allows you to visualize performance, track KPIs, and identify trends in real-time, helping to answer the critical "why" behind variances.

Quick Start Budget PlanningGuide for CFOs

To begin your journey toward budget optimization, consider the following next steps:

- Assess Your Current State: Conduct an honest evaluation of your existing budgeting process. Identify key pain points — from data collection challenges to a lack of buy-in from business leaders.

- Define Your Roadmap: Create a multi-year roadmap that aligns budget process improvements with your company's long-term strategic goals. This roadmap should outline a phased approach for people, process and technology.

- Prioritize Quick Wins: Identify one or two high-impact areas for improvement that can be addressed immediately. This could be standardizing templates, automating a single consolidation report or improving variance analysis for a key business unit.

- Engage the Right Partners: Whether it's internal resources or external advisors, ensure you have the expertise needed to execute your roadmap effectively.

Your Guide Forward

Cherry Bekaert’s CFO Advisory practice helps finance teams modernize their budgeting processes by aligning strategy, people and technology. Through tailored FP&A support, automation of reporting and forecasting, and hands-on execution of transformation roadmaps, our experienced professionals enable finance leaders to shift from manual tasks to strategic insight generation. Our scalable solutions empower teams to improve forecasting accuracy, streamline operations and unlock value through data-driven decision-making.