The credit markets are undergoing significant changes, driven by the explosive growth of private credit, the emergence of diverse asset classes and intensifying competition among lenders. As traditional senior lending channels face limitations due to regulatory capital requirements and risk appetite, alternative financing structures have emerged to meet investor and borrower needs.

Despite this transformation, Collateralized Loan Obligations (CLOs) have remained a staple product of the credit markets. While the most common type of CLO is Broadly Syndicated Loan (BSL) CLOs, private credit has surged as a dominant capital force, offering tailored lending solutions to middle-market and large borrowers alike through Private Credit (PC) CLOs (also known as Middle Market (MM) CLOs). This shift has led to increasingly bespoke deal terms, covenant-lite structures and flexible agreements that cater to institutional demand for yield and diversification.

Each CLO type presents distinct characteristics, opportunities and risks, making it essential for lenders and investors to understand their differences. Therefore, in this dynamic environment, CLO valuation plays an important role in ensuring transparency, supporting informed investment decisions, and building trust among market participants.

Collateralized Loan Obligations (CLOs) Structure

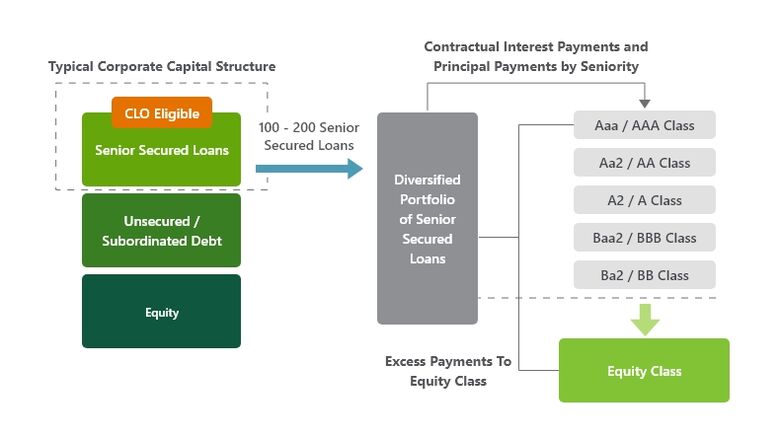

CLOs are structured financial vehicles that pool together a diversified portfolio of corporate loans, typically leveraged loans, and issue several tranches of securities to investors. Each tranche represents a different level of risk and return, ranging from senior (least risky, lowest yield) to equity (most risky, highest potential yield). The cash flows generated by the underlying loans are distributed to investors in order of seniority, ensuring that senior tranches receive payments first, while subordinate tranches absorb more risk but offer higher returns.

This structure enables CLOs to efficiently allocate risk and attract a wide range of investors, from those seeking stable income to those willing to take on greater risk for higher yield. CLO valuation is essential in assessing the fair market value of each tranche, providing transparency for investors and supporting informed decision-making in this complex credit market.

Broadly Syndicated Loan vs. Private Credit CLOs

CLOs are reflected by a bifurcation between Broadly Syndicated Loan (BSL) CLOs and Private Credit (PC) CLOs. These represent some of the largest investable asset classes available today. Understanding the nuances between the two segments is important, as each segment presents unique opportunities and potential challenges.

Broadly Syndicated Loan (BSL) CLOs

Imagine a bustling marketplace where large, high-yield bank loans are traded among multiple lenders. This is the realm of BSL CLOs. Known for their liquidity and transparency, these CLOs are a favorite among institutional investors. They offer a diversified portfolio of loans, which helps mitigate risk and enhance returns. Think of it as a well-balanced investment buffet, where you get a bit of everything to ensure stability and growth.

Private Credit (PC) CLOs

Now, picture a bespoke tailor crafting a suit specifically for you. That's the essence of PC CLOs. These loans are originated directly to corporate borrowers, tailored to meet their unique needs. While they offer higher yields, they come with increased complexity and less transparency compared to BSL CLOs. It's like having a custom-made investment that fits perfectly but requires a keen eye to manage.

Distinguishing Characteristics Between BSL CLOs and PC CLOs

|

U.S. BSL CLOs |

U.S. PC CLOs |

|

|

Market Size |

The BSL CLO universe is larger in size (~$1+ trillion) and thus more liquid, involving loans syndicated to a broad base of institutional investors. | PC CLOs are smaller (~$150+ billion) and less liquid, involving loans that are not broadly syndicated, but rather tailored to specific private borrowers. |

|

Credit Quality |

BSLs typically have higher credit ratings (re: BB/B), reflecting their broader investor base and more stringent underwriting standards. | PC loans often have lower implied credit ratings (re: B-/CCC) but offer higher yields (typically +125-200+bps higher than BSL), attracting investors seeking higher returns. |

|

Issuance Trends |

BSL CLO issuance has faced challenges due to market volatility, causing an increase in innovative structuring to attract investors. | PC CLO volume has grown, driven by the demand for higher yields and the relative resilience during economic downturns. The 2023 bank crisis created voids that added to the PC growth. |

The Imperative of Independent Valuations in CLO Markets

As deal structures become more complex and less transparent, the importance of accurate and unbiased CLO valuations cannot be overstated. Independent valuations are not just a regulatory checkbox — they are the backbone of trust and transparency.

Regulatory Compliance

Independent valuations are essential for complying with the following regulatory requirements, one being fair value disclosures. When sponsors use horizontal or equity risk retention, they must disclose fair value calculations and methodologies. This is crucial for credit risk retention pre-pricing/post-closing disclosures, ensuring that investors have a clear understanding of the value of their investments.

Additionally, accounting standards (GAAP/IFRS) require fair value measurement and impairment testing, which often necessitate independent valuations. Accurate valuations are vital for financial reporting and maintaining investor confidence.

Furthermore, the credit risk retention rule in Section 941 of the Dodd-Frank Act mandates that PC CLO sponsors retain at least 5% of the credit risk of the assets they securitize. Stringent valuation practices are required to protect investors and maintain market stability. Independent valuations ensure that these valuations are unbiased and reflective of true market conditions.

There are also SEC requirements, specifically private fund adviser rules. While CLOs may be exempt from certain SEC rules targeting private fund advisers, other private credit vehicles are subject to enhanced disclosure and compliance obligations. Independent valuations play a key role in meeting these requirements.

Market Confidence

Beyond regulatory compliance, independent valuations contribute to industry best practices, risk mitigation and are integral to building and maintaining investor relationships.

For one, independent valuations support transparency and trust. Independent valuations provide a transparent view of the underlying assets in both BSL and PC CLOs, fostering trust among investors. Accurate valuations are crucial for making informed investment decisions and maintaining the integrity of the financial markets.

Independent valuations also improve risk management efforts. Regular, independent valuations help identify and manage risks associated with the underlying loans in CLOs. This is particularly important in the PC CLO market, where the loans are less liquid and require more hands-on independent valuations.

Valuation Considerations of BSL CLOs and PC CLOs

| U.S. BSL CLOs | U.S. PC CLOs | |

|

Nature |

BSL CLOs benefit from greater transparency due to the public nature of the syndicated loans and more liquid CLO tranches, allowing for more accurate and timely independent valuations in more senior tranches. | Valuing PC CLO tranches and underlying collateral is more complex due to the illiquid nature of private loans and less frequent trading for PC CLO tranches. |

|

Regulatory Oversight |

BSL CLOs are subject to rigorous regulatory scrutiny, including requirements from the SEC and other bodies, which incentivize regular and independent valuations to ensure market integrity and investor protection. | Independent valuations are critical in private credit and PC CLO markets to ensure adherence to the industry best practices and to provide transparency to investors. Regulations, such as the Credit Risk Retention Rule and Accounting Standards, emphasize the need for accurate and independent fair value measurements/timely impairment testing to mitigate risks associated with less liquid and more opaque markets. |

We Can Guide You Forward

As the market continues to evolve, the role of independent valuations will remain pivotal in maintaining market integrity and investor confidence. Cherry Bekaert’s Valuation practice stands ready to assist you and your organization with experienced professionals who wield in-depth knowledge of the structured credit and securitized assets realm.