The tax provision process, estimating and recording a company’s income tax expense, is among the most complex and scrutinized aspects of corporate finance. With the financial landscape rapidly evolving, tax technology and automation are reshaping the tax provision process. These advancements minimize risk, enhance accuracy and accelerate reporting, streamlining operations while delivering reliable financial insights and stronger compliance.

For companies aiming to boost efficiency and stay compliant with evolving regulations, leveraging tax automation and modern tax provision software is increasingly essential.

Key Benefits of Tax Provision Automation

Implementing tax automation and advanced tax provision software delivers a range of strategic advantages for tax teams and finance departments. Here are five key advantages that tax teams can expect from automation:

- Reduced Manual Errors: Automation minimizes spreadsheet mistakes and ensures consistent calculations across entities and jurisdictions.

- Faster Close Cycles: Real-time data integration and automated workflows enable earlier book closures and timely reporting.

- Improved Audit Readiness: Automation tools offer detailed audit trails, version control and change tracking for greater transparency.

- Better Scalability: Automated solutions adapt to increasing complexity from acquisitions, expansion or regulatory changes.

- Strategic Insights: With less time spent on manual data entry, tax teams can focus on planning, scenario modeling and risk management. As tax departments adapt, embracing automation is not just a technical upgrade; it is a strategic imperative.

Popular Tax Provision Software Tools

Finance and tax departments across industries rely on a variety of tax provision software tools to streamline compliance, automate ASC 740 calculations and integrate with enterprise resource planning (ERP) systems. Below are several widely adopted platforms and their capabilities:

|

Tool |

Highlights |

Typical Use |

| Bloomberg Tax Provision | Automates ASC 740 calculations, integrates with tax work papers and supports audit-ready reporting. | Commonly used for research, workflow management and audit preparation. |

| Corptax | Known for robust compliance and provision capabilities, especially for large enterprises. | Often implemented to support complex tax provision and compliance needs. |

| Longview | Offers scalable tax provision capabilities and ERP integration. | Preferred by global or enterprise-level businesses managing multi-entity tax operations. |

| ONESOURCE Tax Provision | Offers real-time provisioning, scenario analysis and seamless integration with other tax solutions. | Frequently selected for consolidated tax provision processes and broader tax implementation and support strategies. |

| Oracle Tax | Enterprise-grade platform with strong ERP integration. | Typically used in environments with Oracle ERP systems for tax provisioning and reporting. |

| SAP Tax Compliance | Deep ERP integration and multi-entity support. | Utilized by companies with complex SAP environments for tax compliance and automation. |

| Avalara | Focuses on sales and use tax automation, managed returns and application programming interface (API) integrations. | Commonly adopted for indirect tax automation and integration with e-commerce platforms. Avalara helps automate the tax provision process by integrating real-time tax calculations and compliance workflows, reducing manual errors and creating accurate audit-ready reporting. |

Automated Workflow Stages

A successful tax provision automation strategy involves several key workflow stages. Each stage leverages technology to improve accuracy, compliance and efficiency:

- Data Collection: Extracts trial balances and forecasts from ERP systems, then cleans and transforms data to prepare it for tax calculations.

- Workpaper Preparation: Applies standardized templates with embedded tax law updates, tracks changes and supports compliance.

- ASC 740 Calculations: Automates deferred tax calculations, valuation allowances and rate reconciliations using built-in logic.

- Audit Support: Generates audit-ready reports with detailed trials and cell-level change tracking.

- Footnote and Journal Entries: Exports provision results for financial statements and U.S. Securities and Exchange Commission (SEC) filings.

Addressing Key Challenges With Automation

Modern tax technology solutions are designed to address common challenges in the tax provision process. By automating key tasks, these tools help tax teams improve accuracy, streamline workflows and stay compliant. Below are some of the ways automation can address these common pain points:

- Data Consolidation: Harmonizes inputs from multiple systems and jurisdictions.

- Regulatory Complexity: Tracks evolving tax laws and accounting standards to assist with compliance.

- Resource Constraints: Enables small tax teams to manage large volumes efficiently.

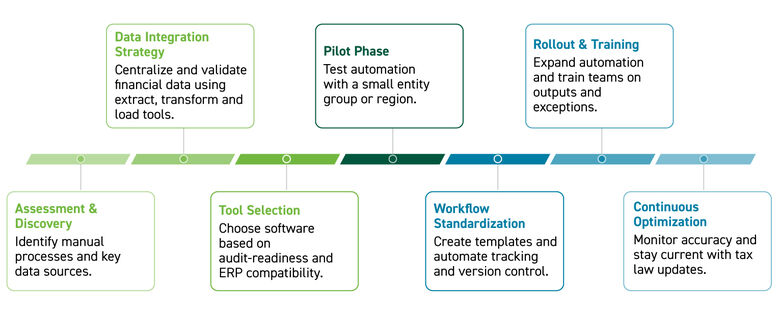

Tax Provision Automation Roadmap

To support a successful implementation, organizations can follow this roadmap for tax provision automation. This approach facilitates a smooth transition and sustainable results:

Your Guide Forward

As tax technology and automation continue to reshape the tax provision process, organizations face both new opportunities and challenges. Implementing the right solutions requires a strategic approach that considers company size, structure and specific operational needs.

A successful automation journey typically involves assessing current processes, selecting software aligned with audit and ERP requirements, and building internal capabilities to manage change. Experienced tax professionals play a key role in guiding teams through each stage — from discovery and tool selection to rollout and optimization.

For organizations looking to align tax provision automation with broader planning strategies, exploring corporate tax planning frameworks can provide valuable context.