Compliant I-9 practices have been an essential part of the employee onboarding process since Form I-9’s inception in 1986. During the COVID-19 pandemic, the process became more flexible as exceptions were made to in-person document verification to accommodate remote work.

However, under the second Trump administration, there is increased focus on authorized employment, and employers should prepare for heightened scrutiny. Now is the time to review your I-9 documents and procedures to ensure compliance and minimize risk in the event of an audit.

The Basics of Form I-9 Documentation

What Is an I-9 Document?

The I-9 form is used to verify the identity and employment authorization of individuals hired in the United States, as required by the U.S. Citizenship and Immigration Services (USCIS).

Who Needs To Fill Out an I-9 Form?

The form must be completed by both the employee and employer and is required for every new hire.

When Should It Be Completed?

Employees must complete their section (Section 1) anytime between accepting a job offer and up to their first day of employment. Employers must complete their sections (Section 2) no later than three business days after an employee’s start date.

What Is E-Verify?

While E-Verify is not a mandatory step to the I-9 process, it can be a simple way to confirm identity and work authorization. This process takes place after an I-9 form is completed. E-Verify is a free, online service that can electronically confirm the information employees provide on their I-9s against millions of government records.

Employers who are enrolled with E-Verify will create a case in the system once they have the completed I-9. The system will check the entered information and provide a result within a few seconds. Results may vary from “Employment Authorized” to “E-Verify Needs More Time.” E-Verify can be incredibly helpful in ensuring compliant hiring practices.

I-9 Documentation Process Overview

Once a job offer is accepted, the new hire completes Section 1 of the I-9 form and provides one or two forms of identification, as noted on the List of Acceptable Documents. Employers cannot decide which documents new hires present. It is the employee’s choice to provide a document from List A or one document from both List B and List C. These forms of identification must be original, meaning they cannot be copies or photos of documents.

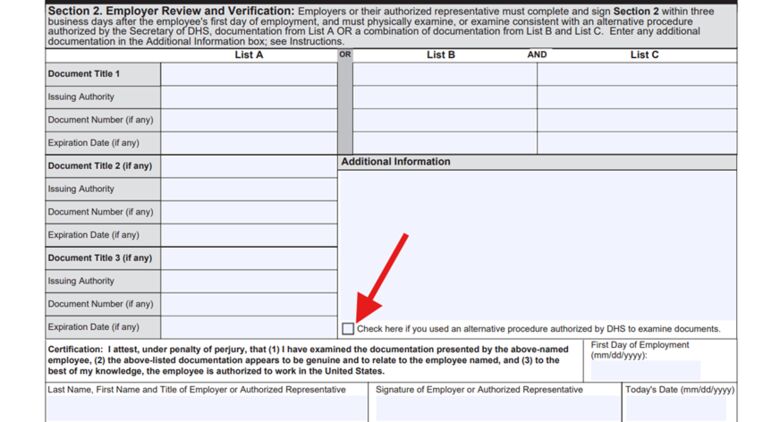

Employers will then complete Section 2 of the form and verify the documents provided. During this verification, employers should ensure the documents are not expired and are in their original form.

There are two options for verifying documents:

| In-person Verification | Live Video Verification (Only For E-Verify Users) |

| Organizations that are not enrolled with E-Verify must view documents in person. There are no other methods for verification. | For companies enrolled with E-Verify, there are two options for reviewing the employee’s acceptable form(s) of identification. In person or via live video call* (not a recording). |

*If your organization checks documents via live video, you’ll need to be sure to mark the box under “Additional Information” that reads “Check here if you used an alternative procedure authorized by DHS to examine documents.” Once this is complete, file your related I-9 paperwork and create a case in E-Verify.

Supplemental Forms

Form I-9 consists of two sections and two supplements:

- Supplemental Form A: Required if a translator or preparer assisted the employee in completing the form for Section

- Supplemental Form B: Used for rehires or reverifications when:

- A work authorization document has expired.

- An employee is rehired within three years of completing their original I-9.

- An employee has legally changed their name.

Common I-9 Mistakes and How To Avoid Them

Improper Filing

I-9s should be stored separately from other personnel records in a secure location. I-9s are also required to be retained for three years after the hire date or one year after employment ends, whichever is later.

Using an Outdated Form

I-9 forms are periodically updated by USCIS. But many organizations save the I-9 form in their own files and continue to use it, unaware that an update has been released. Updated and revised I-9 forms, as well as filing instructions, can be found on the USCIS website. The most current Form I-9 being used is Rev. 08/01/23 (found at the bottom of the form), with an expiration date of 05/31/2027 (found on the top right of the form).

Missing Information

If an internal audit reveals missing or incomplete I-9s, then corrective action should be taken as soon as possible. This includes having the employee fill out a new form, whether one was never completed, or missing information on the existing form needs to be added.

If information is missing, it’s important to remember that employers cannot fill out information meant to be completed by the employee and vice versa. Corrections should not be backdated either. Be honest about the actual date of completion. Employers should also include a signed and dated explanation regarding the corrective action taken.

Forgetting E-Verify (If Enrolled)

Employers have three business days after an employee’s start date to create an E-Verify case. If it is found an employee wasn’t entered when they should have been, then the employer should immediately create a case and contact the USCIS for any further information.

Written Errors

People are human and can make mistakes while filling out the form, whether that is checking off the wrong authorization status or incorrectly writing down the document number, date, etc. When errors like this occur, whoever is supposed to fill out that section should draw a line through the error, initial and write in the appropriate information.

If there are multiple errors on the form, the employer/employee may redo the section on a new form and attach it to the old form. Transparency is key, so mistakes should not be concealed with whiteout or black marker. USCIS does offer more information on common I-9 mistakes and self-audits.

Understanding the I-9 Audit Process

Employers selected for an I-9 audit will receive a Notice of Inspection (NOI) and must produce the requested forms within three business days. If the auditor finds technical or procedural failures, the employer has 10 business days to correct them and could receive a fine for each discrepancy. Knowingly employing unauthorized workers can result in severe penalties.

Let Cherry Bekaert Be Your Guide Forward With Compliance

Now is the time to ensure your organization is compliant with I-9 regulations. Being proactive in addressing any errors now can help reduce legal risk and financial liability in the event of an audit. If you have questions or need assistance with I-9 compliance, contact our HR Consulting Services team today for guidance.