In the wake of corporate scandals like Enron and WorldCom, the U.S. Congress enacted the Sarbanes-Oxley Act (SOX) in 2002 to restore investor trust and reinforce corporate accountability. More than two decades later, SOX remains a cornerstone of financial governance, especially in an era defined by digital transformation and heightened regulatory scrutiny.

This article offers a practical guide to SOX controls for finance leaders, compliance professionals and internal auditors. We provide a comprehensive overview of SOX controls, how they function, and why they’re essential to maintaining financial integrity, managing risk and fostering a culture of transparency.

What Are SOX Controls?

SOX controls are internal processes and procedures designed to ensure the accuracy and reliability of financial reporting. Under Section 404 of SOX, both management and external auditors must assess and report on the effectiveness of internal controls over financial reporting (ICFR). The controls in place go beyond the ordinary reporting process, meaning there needs to be more than an input source (i.e., journal entry). Additionally, there should be a secondary layer of review.

SOX Control Example

For example, an accountant entering a journal entry would not be considered a control. However, an accounting manager reviewing and approving an entry routed to them by the accounting senior would be considered a control for SOX. The distinction between these types of activities is key to understanding SOX compliance.

Rather than prescribing a one-size-fits-all approach, SOX encourages organizations to tailor their controls to their specific risk profiles and operational structures. These controls often extend beyond finance into information technology (IT), cybersecurity and operations — particularly as digital systems increasingly support financial data management.

What Is the Difference Between Key Controls and Non-key Controls?

While all SOX internal controls support business integrity, key controls are directly tied to financial reporting and are subject to an external audit.

In contrast, non-key controls may address broader operational or compliance risks but are not directly linked to the accuracy of financial statements. Typically, non-key controls are incorporated into two primary capacities:

- As a control over a financially immaterial process.

- As a control identified to align with company objectives but not tied directly to financial reporting.

Assessing the state of key versus non-key controls can be important to establishing a strong internal audit function. This function can serve to achieve accurate financial reporting, creating a control environment that is stable across material changes to company structure or revenue streams, and as a tool to aid management in achieving their objectives.

Common Types of SOX Controls

Understanding the different types of SOX controls enables organizations to design a robust compliance framework. There are different ways to organize the control types, and they are not mutually exclusive, which influences how they should be implemented and tested.

By Function

Main control functions include:

- Preventive Controls: Prevent errors or fraud (e.g., segregation of duties, access restrictions)

- Detective Controls: Identify issues after they occur (e.g., reconciliations, audit logs)

- Corrective Controls: Address and resolve identified issues (e.g., policy updates, retraining)

By Implementation

Controls are implemented in a variety of ways, from manual to automated. Common implementation strategies include:

- Manual Controls: Require human input and judgment (e.g., physical inventory counts

- IT-dependent Manual Controls: Require human input and judgment, but are reliant on output by an IT system (e.g., reconciling a sub-ledger report to the general ledger)

- Automated Controls: System-driven and consistent (e.g., automated reconciliations)

By Significance

Control types can also be organized by their significance or purpose, such as:

- Committee of Sponsoring Organizations of the Treadway Commission (COSO): Controls in place are meant to address the key risks as defined by the COSO framework.

- Reconciliation: Controls are in place primarily to address the completeness and accuracy of one or more external sources of data.

- Management Reperformance: Controls designed for management to reperform certain tie-outs, roll forwards or analytic activities performed in the ordinary processes that may be subject to error.

- Management Review Controls (MRC): Controls that involve management reviewing key financial information or assumptions to ensure their accuracy. These controls, in particular, are held to a higher standard of evidence.

What Is the Role of IT Controls in SOX Compliance?

As organizations increasingly rely on digital systems, IT controls have become a critical pillar of SOX compliance.

Section 404 requires that internal controls encompass the IT systems supporting financial processes. Key IT controls include:

- Access Controls: Restrict system access to authorized users

- Change Management: Govern updates to financial systems

- Backup & Recovery: Ensure data availability and integrity

- SDLC Controls: Validate new systems before deployment

- ITGCs: Provide foundational support for automated financial processes

Weak SOX IT controls can lead to data breaches, unauthorized access or inaccurate reporting, jeopardizing both compliance and financial integrity.

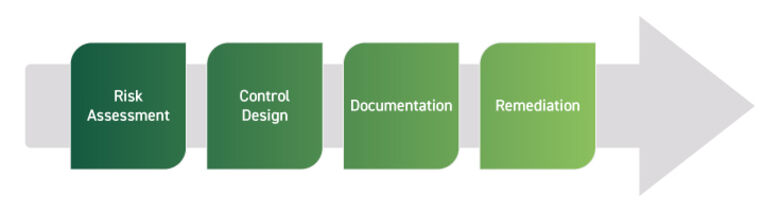

Phases of the SOX Controls Compliance Lifecycle

Designing and implementing controls is just the beginning. Maintaining compliance requires ongoing vigilance. Here’s the lifecycle of the control framework in real-world settings:

- Risk Assessment: Identify financial reporting risks and map them to controls

- Control Design: Tailor controls to systems and organizational structure

- Documentation: Maintain clear, consistent records for audit readiness

- Testing & Monitoring: Regularly evaluate control effectiveness

- Remediation: Address deficiencies and document corrective actions

Compliance is not a one-time project — it’s a continuous journey. As business operations evolve, so must the controls that support them. Continuous monitoring and improvement are essential to maintaining compliance and resilience.

How To Implement SOX Controls

Implementing SOX controls is often more complex than anticipated, with challenges ranging from fragmented processes and unclear ownership to evolving regulatory expectations.

A resilient SOX framework not only ensures compliance but also reinforces trust and operational discipline. Despite best efforts, organizations frequently encounter recurring issues such as:

- Limited segregation of duties (SoD)

- Overreliance on manual processes

- Inconsistent documentation

- Gaps in change management

- Unclear control ownership

- Difficulty integrating new technologies

- Constantly evolving regulatory requirements

To strengthen their SOX programs, organizations should focus on the following areas:

Governance and Accountability

- Clearly assign ownership for each control and ensure accountability across teams.

- Align change management processes with control updates to maintain consistency.

Process Optimization

- Standardize documentation to support audit readiness and reduce redundancy.

- Continuously monitor and refine controls based on risk assessments and audit findings.

- Conduct mock audits and dry runs to identify gaps before formal reviews.

Culture and Training

- Foster a culture of compliance through leadership engagement and regular training.

- Promote awareness of ethical standards and the importance of internal controls at all levels of the organization.

Risk-based Focus

- Prioritize key controls that address material risks and are subject to SOX audit.

- Use a risk-based approach to allocate resources efficiently and strengthen high-impact areas.

SOX Compliance Controls FAQs

SOX controls are critical tools that help ensure the accuracy of an organization’s financial reporting. Additionally, they help maintain compliance, bolster investor confidence and prevent fraud.

The number of SOX controls a company implements and operates varies based on a variety of factors, including industry, company size and risk mitigation strategy. There is no required number of controls an organization must implement, and more is not always better.

SOX controls should be tested on a yearly basis, although more frequent testing and reviewing may be necessary if a company undergoes significant changes in personnel, systems or processes.

Penalties for non-compliance with SOX controls include fines up to $5 million, reputational damage and possible imprisonment.

Key controls are considered the primary controls in risk mitigation and are often tested and reviewed more frequently. If a control mitigates a low-risk component of the business, it is not a key control.

How Can Cherry Bekaert Help?

Our Risk Advisory practices provide comprehensive SOX Compliance Services, including helping organizations design, implement, and optimize SOX compliance programs tailored to their size, industry, and risk profile. Whether you are preparing for your first SOX audit or enhancing an existing program, our advisors provide end-to-end support from readiness assessments and control design to remediation and long-term optimization.

Our SOX Services Include:

- SOX readiness assessments

- Internal control design and documentation

- Automated control implementation

- Risk assessments and gap analysis

- Ongoing testing and monitoring support

- SOX audit preparation and remediation guidance