The research and development (R&D) tax credit is a valuable incentive in the tax code, one that could mean thousands of dollars in savings for architecture and engineering (A&E) firms and the construction industry.

This federal credit can be claimed yearly to help offset tax liability. Many A&E firms naturally perform qualifying day-to-day activities, from evaluating designs to refining innovation efforts. Successfully claiming R&D tax credits for architects, engineers and construction workers requires proper documentation, as well as knowledge of which activities qualify.

This essential guide provides an overview of documentation methods and best practices for claiming R&D tax credits, as well as industry trends that may affect R&D credits.

R&D Tax Credit Overview for A&E and Construction

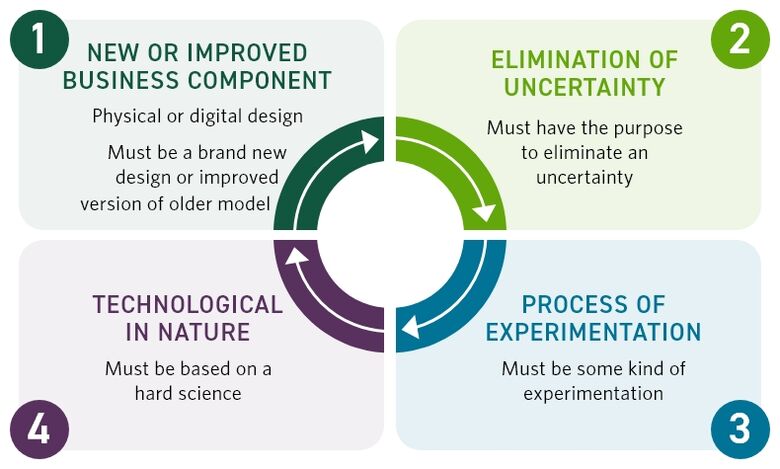

R&D tax credits provide dollar-for-dollar savings for construction and A&E companies performing qualifying research activities (QRA), which are outlined in the Internal Revenue Service’s (IRS) four-part test. Qualified start-up companies may use up to $250,000 of the credit against payroll taxes.

R&D Tax Credits for Architects

Credits for architects primarily focus on improving the design and performance of the built environment, which can involve:

- Creating and testing new concepts in sustainable and energy-efficient design

- Experimenting with advanced and recycled materials

- Developing resilient strategies to protect against environmental hazards

- Utilizing Building Information Modeling (BIM), computational design and digital fabrication

R&D Tax Credits for Engineering Firms

R&D tax credits for engineering firms are centered on developing the practical and technical solutions needed to make architectural visions a reality. Activities include:

- Creating and testing new high-performance materials

- Designing innovative structural systems

- Improving the efficiency of mechanical, electrical and plumbing (MEP) systems

- Pioneering new construction techniques

- Implementing automation and robotics

- Developing sustainable infrastructure like renewable energy

Qualified research expenses (QRE) can also qualify for the credit, including employee wages, supplies and materials, third-party contractor payments and cloud hosting costs.

R&D Tax Credits for Construction

Similar to A&E firms, construction companies are typically performing routine tasks that could qualify for the R&D credit, including:

- Analysis of alternative means and methods to construct a job

- Testing constructed systems to ensure requirements are met

- Developing shop models and computer-aided design (CAD) models for projects

As with architecture and engineering companies, construction businesses will have to check that their QRAs pass the four-part test.

How To Claim R&D Credits for Construction and A&E

To claim the R&D credit, construction and A&E firms will need to file IRS Form 6765, Credit for Increasing Research Activities. While taxpayers will need to provide “sufficient documentation” to support the QRE expense being claimed, the IRS does not specify exactly what that documentation should be. Examples of proper documentation may include:

- Payroll information for employees directly involved in R&D activities

- Contracts and invoices paid to third parties

- Documents detailing the research process

The amount of R&D credit that can be claimed depends on the value of QREs, meaning the more a company spends to innovate the more they may be able to save. Businesses may receive 10 cents for every dollar spent on qualifying research activities, and credits in the industry may range from hundreds of thousands per year to millions.

How Recent Court Decisions Impact Credits for A&E Firms

Recent tax court cases underscore the need for solid documentation and careful definition of R&D projects so their claims clearly meet the tax law’s definitions of QRAs, and only qualified expenditures are captured.

Little Sandy Coal Co. v. Commissioner

In Little Sandy Coal Co. v. Commissioner (62 F.4th 287 (7th Cir. 2023), a shipbuilding company’s R&D credit claim was denied in full because it defined its project too broadly (an entire barge design) and could not show that “substantially all” of the work (at least 80%) was part of a true process of experimentation.

The courts found that not every activity in developing a new prototype was qualified research; routine engineering and production activities were not counted just because a “pilot” project was new. Importantly, the appellate court noted the company’s lack of detailed, usable documentation to substantiate its research process. The taxpayer failed to provide records that would let the IRS or court “shrink back” the analysis to smaller sub-components once the larger project didn’t meet the 80% test.

This case highlighted that A&E firms must clearly identify specific business components (e.g. particular systems or features) that meet the four-part qualified research test, rather than treating an entire building or vessel as one indivisible project. In short, if a project is only partly R&D, you need documentation at the component level to claim the credit for the qualifying portions.

Populous Holdings, Inc. v. Commissioner

Populous Holdings, Inc. v. Commissioner (T.C. Memo. 2022-105) involved an architectural design firm working under fixed-price client contracts. The IRS denied the taxpayer’s credits on the theory that the research was “funded” by their clients, since the clients paid for the work. In a taxpayer-favorable ruling, the Tax Court found that the taxpayer’s contracts left significant financial risk on the firm and allowed the firm to retain rights to use the research results — meaning the work was not “funded” by the client under IRC §41.

The fixed fees did not guarantee payment if the research was unsuccessful, and there were no clauses preventing Populous from reusing the design innovations in other projects. This precedent is encouraging for A&E firms. It confirms that architectural and engineering design work can qualify as R&D if the firm bears the risk of project failure and retains substantial rights in the innovations. However, it also warns that firms must examine contract terms. If a contract shifts all risk to the client or strips the firm of the right to use the research, those expenses may be disqualified as funded research.

R&D Documentation Methods Used To Meet IRS Requirements

Several key documentation methods can help ensure A&E and construction firms’ credits will be well substantiated.

Project-by-project Analysis

Each project (or business component) is evaluated against the four-part test. If an overall project contains both qualifying and non-qualifying elements, the firm applies the IRS shrink-back rule, examining the most significant sub-component that might qualify. This approach requires documenting the project at the appropriate level of granularity.

For example, if only a building’s innovative HVAC system design involved true experimentation, that subsystem is documented as the R&D business component (instead of the entire building).

- How Cherry Bekaert Helps: We identify these components and verify that detailed records are kept for each, so that even if a broad project fails the “substantially all” test, the qualifying subsets are still creditable.

Technical Uncertainty Narratives

For each qualifying project, draft a narrative explaining the technical uncertainties encountered at the onset of development and how the firm attempted to resolve them. These narratives describe what information was not known or readily available and document the process of experimentation used to overcome those uncertainties. The documentation shows a “systematic evaluation of alternatives” in accordance with IRS definitions, which helps prove that the activities go beyond routine engineering and constitute qualified research.

- How Cherry Bekaert Helps: Our professionals can assist with drafting narratives. Additionally, we work to gather design drawings, calculations, test reports and meeting notes as evidence of this iterative experimental process, reinforcing the narrative.

Contemporaneous Time Tracking and Expense Tracing

Ideally, companies implement time-tracking systems, including project codes or timesheets, so that employees log hours spent on qualified research tasks. This approach will provide precise documentation to ensure every dollar of claimed wage QRE is backed by documentation showing the employee’s role in R&D.

- How Cherry Bekaert Helps: Our R&D tax credit professionals assist clients in strengthening these systems to tie employee hours to the right projects. When precise time tracking isn’t available, the team uses time questionnaires and interviews to retroactively estimate the percentage of each individual’s time spent on qualifying activities. They also gather supporting documents like payroll records, W-2s and job descriptions for each employee to substantiate the wage allocation.

“One-Up, One-Down” Supervision Documentation

The IRS allows wages for those who directly supervise or support R&D to count as qualified expenses, but only if their involvement is immediate (one level removed from the experimentation). Clearly recording each person’s activities and relationship to the project helps prevent issues like those in Scott Moore v Commissioner (23-2681 (7th Cir. 2024)), where an executive’s wages were disallowed because the company could not prove his direct supervisory involvement.

- How Cherry Bekaert Helps: We work to document the contributions of managers and support staff in R&D projects. Our professionals capture evidence (org charts, project memos, meeting minutes, etc.) to show that a claimed supervisor oversaw the R&D work directly (e.g., an engineering manager guiding the design team’s experiments).

Best Practices To Avoid Disallowed R&D Tax Credits

To strengthen an R&D tax credit claim and avoid pitfalls that have tripped up others, it is recommended that construction and A&E firms follow these best practices.

Maintain Detailed, Contemporaneous Records

Consistently keep project files, design documents, test results and technical reports. Maintain logs or meeting minutes that record research decisions and iterations.

Come audit time, organizations will need to “substantiate that the expenditures claimed are eligible for the credit” with usable detail. The more contemporaneous evidence tying expenses to qualified research activities, the better.

Define R&D Projects (Business Components) Thoughtfully

Identify the specific products, processes or components that are being improved. If an entire project is not uniformly experimental, be ready to apply the shrink-back rule to focus on the qualifying subset. Properly scoping the business component prevents the IRS from disqualifying everything just because part of the project was routine.

In other words, document the project at the right level (e.g., a novel structural system or engineering solution within a larger building design) and show that at least 80% of the activities on that component were part of a process of experimentation.

Demonstrate the Process of Experimentation

Simply developing a new building or product is not enough. It must show how technical uncertainty was resolved. Retain documentation of design alternatives considered, simulations or calculations performed, prototypes built and results learned. Demonstrate that engineers engaged in evaluating alternatives and testing hypotheses, not just doing routine calculations or following established formulas.

If code compliance or standard practices dictated a design choice, that portion is not R&D. Focus the documentation on the truly uncertain and innovative aspects. The goal is to prove a systematic process was undertaken to overcome unknowns, satisfying the IRS’s definition of qualified research.

Document Employee Roles and Time in R&D

When claiming wages, there needs to be support as to why each person’s time counts as a QRE. If a project manager or executive is included, keep records (e.g., project schedules, oversight meeting notes) showing they were directly supervising R&D or actively solving problems — remember the IRS’s “one-up” rule (direct supervision only).

Implement time tracking by project and task, if possible, so reports can be produced showing hours spent on qualified activities. If precise time data is not available, use surveys or affidavits to corroborate estimates of R&D involvement. Be conservative — do not claim 100% of an employee’s time if some was spent on non-R&D tasks. Keeping clear distinctions between R&D and non-R&D activities will protect tax credit if examined.

Review Contract Terms for Funded Research

If R&D work is performed for clients (a common scenario in A&E via design contracts), examine the agreements. To claim the tax credit, the organization must bear the financial risk of the research and retain rights to use the results. That typically means using fixed-price or capped contracts rather than cost-plus and not signing away all intellectual property rights.

It’s best practice for firms to keep copies of contracts regarding payment terms and ownership of deliverables. In the Populous case, having fixed-fee contracts with clauses that put the onus on the firm (and no restriction on reusing the research) was key to winning the R&D tax credit. If the contracts are structured differently, be cautious — you may need to negotiate terms or be prepared to show the IRS why you still had risk and rights. Always document those contract details as part of the study workpapers.

Your Guide Forward to Properly Substantiating Credit Claims

Cherry Bekaert’s Tax Credits and Incentives Advisory (TCIA) team uses an audit-ready approach to R&D tax credit documentation for A&E clients. This approach begins with thorough fact-finding as our professionals review the company’s financials and project records, including:

- Prior Credit Studies

- Organization Charts

- Wage Data

- General Ledger Info

- Initial Approval of R&D projects

The TCIA team then work closely with the client’s technical staff to identify which projects or activities qualify, applying the IRS’s four-part test (per IRC §41) to each potential business component.

Cherry Bekaert emphasizes collecting time tracking data, project files and technical documentation that tie employees’ efforts and expenses to specific R&D projects. Where necessary, our team conducts interviews with engineers, architects and other subject matter experts to understand the uncertainties and experimentation specific to each project. From these, we prepare detailed narratives and memoranda demonstrating how each project meets the tax law criteria.

All of this is compiled into comprehensive, IRS audit-ready documentation delivered to the client. By following IRS standards closely and thoroughly documenting each element of the credit calculation, we help A&E firms create a solid defense file for their R&D credits. This structured approach not only supports the credit in an audit, but also often uncovers additional qualified activities the company might have overlooked, thereby maximizing the benefit.