Key Observations

As 2025 reaches its midpoint, the private equity (PE) industry finds itself navigating a tale of two quarters — one marked by energetic growth, the other by cautious recalibration. While the year started with a burst of optimism, recent market turbulence has prompted PE firms to rethink their playbooks. Yet, even amid uncertainty, a renewed appetite for risk is quietly taking shape.

- Strong Start, Slowdown Follows: The first quarter delivered impressive deal flow and blockbuster transactions, but Q2 brought a slowdown as new tariff policies fueled volatility and uncertainty. The disruption sent ripples through global markets, leading to a 24% drop in deal value and a 22% decline in deal count in April compared to earlier months.

- Renewed Risk Appetite: After a hesitant opening to 2025, investors are rediscovering their taste for risk as they adjust to prevailing macro conditions — though underlying credit risks are still a watchpoint. A recent industry report shows nearly two-thirds of investors expect private equity deployment activity to rise over the next six months, with only 10% anticipating a decline.

- Expanding Use of Private Credit & Alternative Financing: Private credit continues its rapid expansion as a key financing tool. With assets under management rising sharply, PE firms are offering tailored capital solutions, reducing reliance on traditional banking and offering diversification.

- Exit Hurdles Remain: While some big exits were achieved, persistent uncertainty has limited overall exit activity, pushing PE firms and their investors to explore alternative strategies such as recapitalizations and continuation funds.

- Resilience in Action: Despite the headwinds, private equity continues to adapt — ready to seize the moment in both calm and choppy waters, even if overall deal volumes and exits remain subdued for now.

Overview

After initial worries about tariffs began to subside, investor confidence made a tentative rebound. Analysts believe any inflationary pressure from tariffs will be fleeting, with many still betting on an interest rate cut from the Federal Reserve later this year. Public markets have started to embrace risk once again, and the private sphere has seen some headline-grabbing deals, proving that opportunity still exists for those willing to look beyond the short-term turbulence.

Beneath the surface, though, cracks are appearing in credit quality — an undercurrent the industry cannot afford to ignore. Ideally, private equity would thrive in a stable environment, with clear trade policies, steady energy prices, controlled inflation and falling interest rates. Such conditions would make it easier for general partners (GPs) to exit old investments at attractive prices. But the perfect alignment of these factors remains out of reach for now. Instead, the most likely scenario is one of modest, tariff-driven inflation, slower economic growth, and ongoing uncertainty — a “sideways” market where deals are fewer and exits less frequent.

This isn’t a recipe for disaster, but it does mean investor expectations set at the start of the year may go unmet. In a more pessimistic scenario, a recession sparked by fiscal tightening and supply chain challenges could rattle confidence further. While that would push asset prices down and create buying opportunities for PE firms flush with cash, it would make it even harder to realize value over the near term through successful exits. Limited partners (LPs) are growing impatient for returns and, sooner or later, firms will need to deliver — possibly by turning to creative solutions like dividend recapitalizations or continuation funds. Whatever the road ahead, adaptability remains the sector’s greatest asset.

Private Equity Deal Activity Up Year-over-Year, but Momentum Slows in Q2

Despite a volatile market, private equity has shown remarkable adaptability in the first half of 2025 (H1). Yet, the pressure is on — firms must not only uncover elusive exit opportunities and satisfy capital-hungry investors, but also strategically deploy funds in an environment where every move counts. The challenge now is to seize those fleeting windows of opportunity, keeping a sharp eye on value creation amid shifting economic tides.

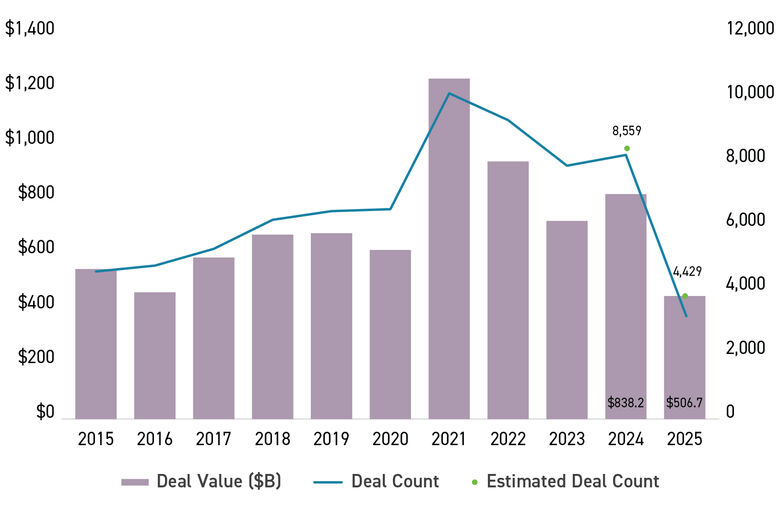

U.S. Private Equity Deal Activity ($B)

Source: Pitchbook | Geography U.S.

As of 6/30/2025

The unfolding story of private equity in 2025 is one of dramatic contrasts. The year opened on a high note, propelled by a surge of optimism left over from 2024. In those early months, everything seemed aligned in the sector’s favor: credit markets were wide open, borrowing costs were dropping, inflation stayed in check and interest rates continued their gentle descent.

In this environment, buyout activity flourished. The first quarter didn’t just keep pace with last year — it sparked new energy, driving deal value to heights not seen since Q2 2022. Blockbuster transactions grabbed headlines, including Sycamore Partners’ massive $23.7 billion purchase of Walgreens Boots Alliance. Exits surged as well, thanks to a string of strategic sales: GTCR’s majority stake in Worldpay found a new home with Global Payments for $24.25 billion, while Calpine Corp. was acquired by Constellation Energy Corp. for an impressive $26.6 billion, with backing from Energy Capital Partners and CPP Investments.

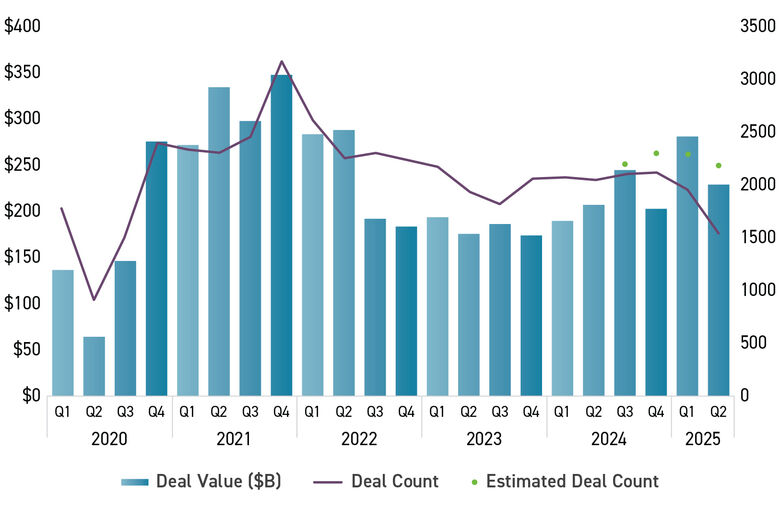

U.S. Private Equity Deal Activity by Quarter ($B)

Source: Pitchbook | Geography U.S.

As of 6/30/2025

Yet as the second quarter dawned, the bright optimism that had colored the start of the year began to flicker. Sudden tariff announcements on April 2 sent fresh waves of volatility through the capital markets, leaving dealmakers recalibrating their strategies in real time. The fallout is still unfolding — after all, deal cycles have their own momentum — but there’s a palpable sense of anticipation across the industry.

Private equity firms are eager to put their dry powder to work and clear the mounting backlog of exit-ready businesses. Encouragingly, the landscape for exits is showing signs of life: corporate buyers are stepping up, sponsors are becoming more flexible in their valuations and new dealmaking opportunities are emerging from the noise. The stage is set for a potentially dynamic rebound as the year progresses.

Notable Transactions in Q2 2025

Despite the Q2 slowdown, transactions continued to occur in various sectors, including some of significant size.

Top U.S. Private Equity Deals in Q2 2025

Source: Pitchbook | Geography U.S.

As of 6/30/2025

Growth Equity Continues as a Key Investment Strategy

Growth equity investments generally rely on all-equity structures, minimizing the use of debt and emphasizing companies poised for expansion. Rather than piling on leverage, sponsors inject capital to fuel revenue growth, scale operations, and boost margins through operational improvements.

In an environment where organic earnings before interest, taxes, depreciation and amortization (EBITDA) growth and cost efficiency are prized above financial engineering, this approach remains highly relevant. Growth equity firms partner with management teams to unlock new markets, accelerate product development, and support transformative initiatives — helping promising companies reach the next level while keeping balance sheets resilient and nimble.

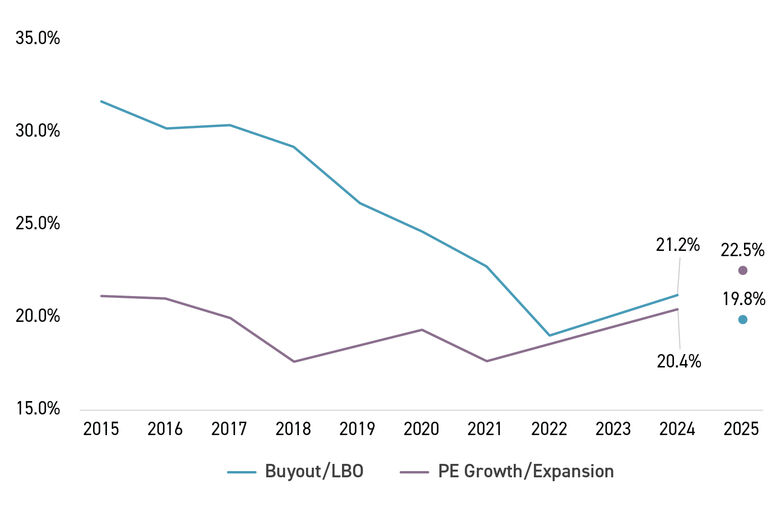

Platform LBO and Growth Equity Deal Count As a Share of All U.S. Private Equity Deals

Source: Pitchbook | Geography U.S.

As of 6/30/2025

Growth equity investment within private equity continued to play a dynamic, if slightly shifting, role in the deal landscape. In Q2, growth equity made up 22.3% of all PE transactions — a marginal dip of 30 basis points from the previous quarter yet still hovering above the five-year average of 19.2%.

Owing to their typically leaner deal sizes, growth equity investments have long held a smaller slice of overall deal value compared to buyouts. This trend persisted in Q2, with growth equity accounting for just 8.3% of total PE deal value, the lowest since Q2 2022 and falling 350 basis points shy of the five-year benchmark of 11.8%. Such a drop can largely be traced to a flurry of blockbuster add-on deals that stole the spotlight this quarter. But with volatility comes opportunity: these numbers are rarely static, and it wouldn’t be surprising to see a resurgence in growth equity activity as the year unfolds, and market conditions evolve.

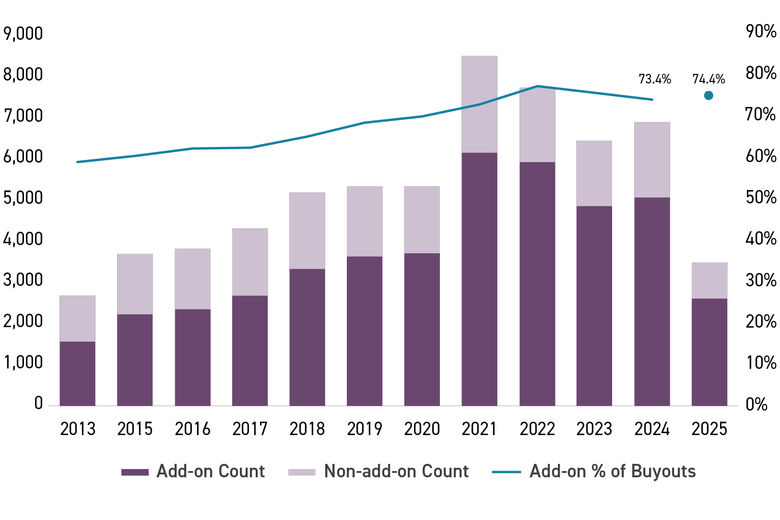

Large Add-on Investments Drive Deal Activity in H1 2025

During the second quarter of 2025, despite heightened economic uncertainty, private equity players doubled down on large-scale add-on deals, defying the notion that headwinds would force a pivot to the lower middle market. In fact, sponsors pushed forward with several major add-on acquisitions, some of which, under former regulatory regimes, might have faced stricter antitrust scrutiny. Today’s evolving policy landscape, however, has opened the door for PE firms to pursue strategic combinations designed to boost their operational capabilities, streamline costs and enhance pricing power.

Add-on transactions accounted for a striking 75.9% of all buyout activity in Q2 2025. That’s a notable uptick — 250 basis points higher than the previous quarter and 150 basis points above last year’s figure. It also surpasses the five-year annual average of 72.5% by 340 basis points. Industry analysts expect this trend to continue, as sponsors race to scale up for better economies and stronger negotiation leverage.

The message is clear: in an environment marked by unpredictability, private equity is seizing the moment to combine assets, build resilience and position portfolios for lasting competitive advantage.

Add-ons As a Share of All U.S. Private Equity Buyouts

Source: Pitchbook | Geography U.S.

As of 6/30/2025

Amid this dynamic landscape, the strategic rationale for scaling up has never been clearer. With global trade uncertainty and supply chain disruptions posing persistent challenges, private equity sponsors increasingly view larger platforms as a means to boost resilience and unlock competitive advantages. Scale empowers portfolio companies to smooth over supply chain friction, spread costs across broader revenue bases, and wield greater influence when negotiating with vendors or setting prices to protect margins during turbulent periods.

Q2 2025 provided vivid examples of this strategic pivot toward size and synergy. Noteworthy transactions included:

- Moss Adams’ landmark merger with Baker Tilly, which formed the sixth-largest CPA firm in the United States with a combined value around $7 billion.

- Churchill Management Group’s $9.6 billion acquisition by Focus Partners Wealth signaled a powerful expansion of wealth management capabilities.

- Hometown Food Company’s $600 million cash purchase of Chef Boyardee capitalized on stabilized input costs — pricing the brand at roughly 1.3x EV/sales.

These deals underscore how, in today’s unpredictable environment, sponsors are combining forces to drive operational efficiencies, extend market reach and position their portfolios for sustained outperformance.

Such aggressive consolidation efforts dovetail with the rise in large-scale add-on activity and the strategic imperative for resilience described in the prior paragraphs, illustrating how private equity continues to adapt and thrive under shifting market conditions.

Carve-outs Accounted for Largest Share of Overall PE Buyouts Since 2020

Carve-outs / Divestitures As a Share of All U.S. Buyout Deals by Quarter

Source: Pitchbook | Geography U.S.

As of 6/30/2025

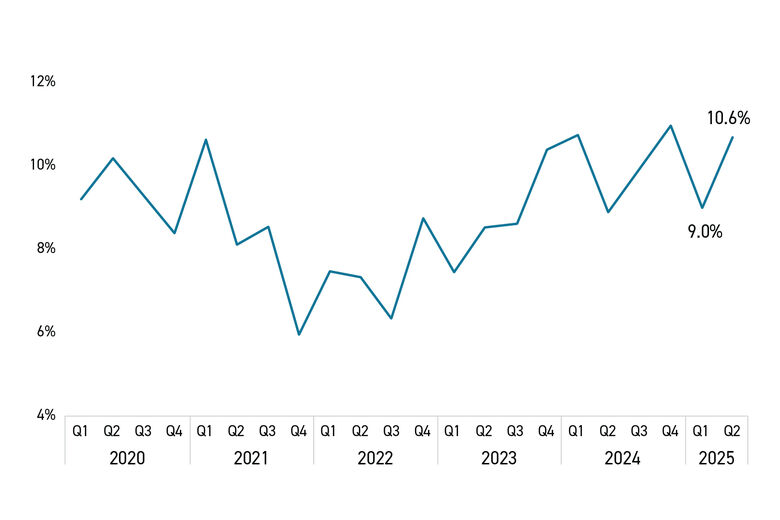

So far in 2025, carve-outs have claimed an outsized share of private equity buyout deals, representing an estimated 10.6% — well above the five-year average of 8.7% and up from 10.1% last year. However, despite this elevated activity, many companies are pressing pause on divestitures, choosing to wait for a more normalized macro environment.

Organizations are holding back on spinning out assets until there’s greater clarity around U.S. tariff policies and the broader international trade landscape. This patient approach could set the stage for a wave of carve-out deals in the latter half of the year, particularly as strong public equity markets and improving valuations boost confidence.

Looking forward, the pace of carve-out transactions is expected to pick up as the new Trump administration’s early regulatory and policy moves settle in. As trade and regulatory uncertainty fades, corporate leaders are likely to revisit their business segments, identifying non-core or underperforming units for sale.

For sellers, this streamlining means a sharper focus on core business and smarter capital deployment. For private equity sponsors, it opens the door to compelling opportunities — whether launching new platforms or bolting on assets to existing ones. Carve-outs frequently benefit from clean audits and strong operational histories, making them attractive targets with solid financing options.

With policy direction becoming clearer, public markets holding firm, and dry powder at the ready, the pipeline for carve-out deals is poised for renewed energy. Those investors who move decisively — and can deftly navigate lingering supply chain challenges — stand to acquire high-quality businesses at favorable valuations. As market uncertainty recedes, these bold moves could deliver strong returns and position firms for long-term growth.

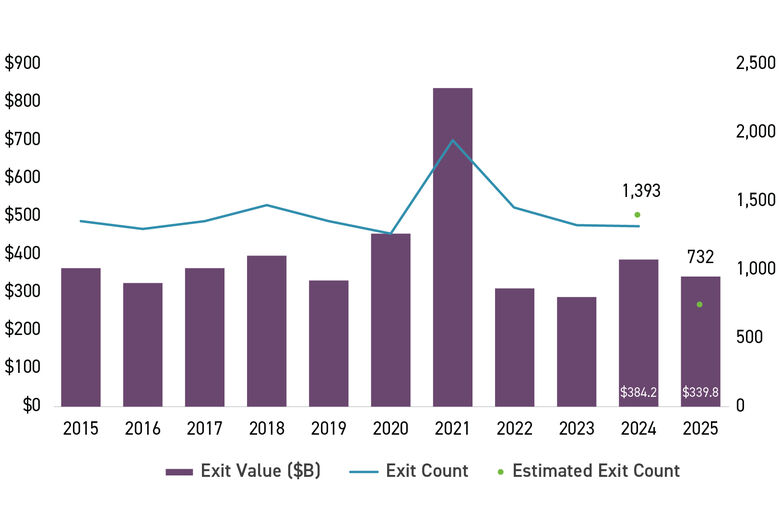

Exit Value Surges to Near Record Highs, Even As Volume Slips

In the second quarter of 2025, private equity exit activity saw a notable slowdown, reversing much of the momentum gathered earlier in the year. According to estimates referenced in the prior analysis, Q2 posted approximately 314 exits with a combined value of $118.5 billion, a significant quarter-over-quarter drop of 46.4% in exit value and 24.9% in deal count.

This sharp decline follows a Q1 that was buoyed by the high-profile public listing of Venture Global LNG, credited with $58.7 billion in value; when this extraordinary transaction is excluded, the fall in exit value from Q1 to Q2 narrows to roughly 27.1%. The contraction in the number of completed exits further underscores shifting dynamics in the private equity landscape. Both exit value and count landed below pre-pandemic quarterly norms, with exit counts about 10% shy of historical averages.

These figures paint a vivid picture of a market in flux. After an energetic start to the year, the sector encountered renewed headwinds, highlighting the critical role played by megadeals in propping up overall exit value. As the industry adapts to these shifting currents, all eyes remain on whether the rest of 2025 will usher in renewed activity — or more cautious waiting on the sidelines.

U.S. Private Equity Exit Activity ($B)

Source: Pitchbook | Geography U.S.

As of 6/30/2025

Building on the cautious optimism and strategic repositioning already underway, annualized projections for the first half of 2025 suggest private equity exits are on track to outpace 2024 levels. This momentum, fueled by a strong start to the year — even after adjusting for the extraordinary Venture Global IPO — signals an encouraging shift in market activity.

When comparing the first halves of 2025 and 2024, exit value has climbed an impressive 69.3% (excluding the Venture Global transaction) and soared 104.6% when it is included. Exit counts, while still trailing exit value, have risen by 18.3% year over year. This dynamic underscores a key trend: buyers are focusing on select, high-quality assets, while many portfolio companies remain on the sidelines, poised to re-enter the exit pipeline as market confidence and deal certainty continue to build through the balance of the year.

The median exit size has continued its upward climb through 2023 and 2024, reaching new heights again in Q2 2025. Meanwhile, the stockpile of PE-backed companies has swelled to 12,552 as of Q2 2025 — enough to represent nearly nine years’ worth of inventory at last year’s exit pace or about 8.5 years if H1 2025’s momentum holds. Shrinking this backlog will require not just more exits, but an industry-wide upgrade in asset quality.

When it comes to hold times, the story is shifting, too. Although the median hold time for exited U.S. PE companies peaked at seven years in 2023, it has since eased down to six years for deals closed in the first half of 2025, which is still notably higher than the pre-pandemic average of 5.2 years. For assets still in portfolios, the median hold time now stands at 3.8 years, the highest level since 2011. This signals an aging pool of PE-backed businesses on the sidelines as exit activity remains subdued.

To clear out this growing pipeline, the market will need a spark — either a return to more predictable conditions or a burst of renewed confidence that unleashes a fresh wave of exits in late 2025. Otherwise, the wait could stretch into the following year, leaving investors eager for that long-awaited acceleration.

Sector Highlight

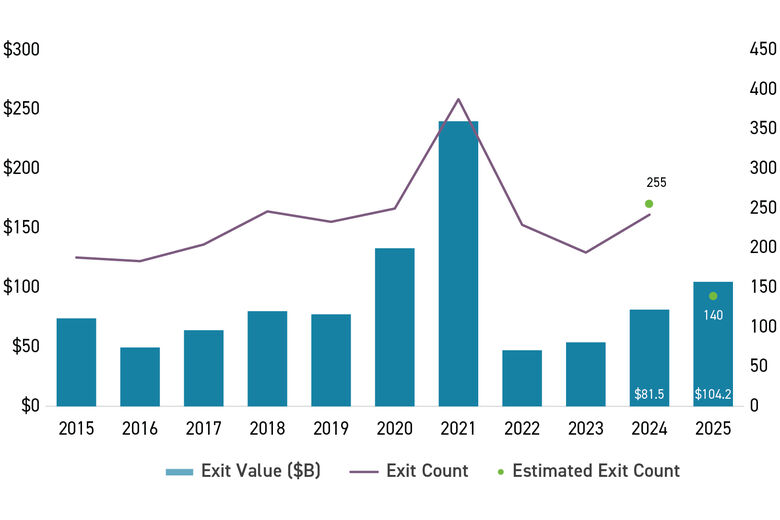

Insulated from Tariff Fallout, Technology Sector Experienced Surge in Exit Activity

U.S. Technology Private Equity Exit Activity ($B)

Source: Pitchbook | Geography U.S.

As of 6/30/2025

Although several sectors reported a dip in exit activity during Q2, the technology sector bucked the trend, notching its most impressive quarter since late 2021 with a series of headline-worthy exits. While looming tariffs could send ripples across the market, technology stands relatively shielded compared to other industries, thanks to its resilience, scalability and ongoing digital transformation tailwinds. This sector continues to draw investor enthusiasm, making it a focal point for both deal flow and exit momentum as the year progresses.

Q2’s tech highlights were nothing short of remarkable. Three exits topped the $5 billion mark, led by GTCR and FIS's massive $24.3 billion sale of Worldpay to Global Payments — a transaction that ranks among the largest private equity–backed tech exits ever and the biggest since AppLovin’s $26.8 billion IPO in 2021.

This blockbuster deal allows Global Payments to sharpen its focus on merchant services amid an increasingly competitive payments landscape. As part of the agreement, Global Payments sold its issuer solutions unit, which handles card processing and account services, back to FIS for $13.5 billion. Other notable deals included Insight Partners’ $5.1 billion sale of Dotmatics to Siemens, and TJC’s $5 billion sale of Silvus Technologies to Motorola Solutions.

Private Equity Emerging Trends and Outlook

Sectors to Watch: Where the Spotlight Shines Brightest

- Healthcare and Life Sciences: With last year’s resilience as a springboard, biopharma, digital health, and new “platform-enabled platform” models are drawing sustained private equity focus.

- Technology and Industrials: AI infrastructure and cybersecurity are at the heart of dealmaking, fueled by strong digital transformation tailwinds and insatiable demand for innovation.

- Consumer Services, Manufacturing and Energy: These sectors are riding a wave of regulatory clarity and fresh tax incentives; manufacturing, in particular, is set to soar on the wings of domestic production provisions in P.L. 119-21, commonly referred to as the “One Big Beautiful Bill Act.”

A Key Development: Retail Access To Private Equity via 401(k)s

On August 7, 2025, President Donald Trump signed an executive order enabling increased inclusion of private equity, real estate, cryptocurrency and other alternative assets in 401(k) retirement accounts. This change allows alternative asset managers greater access to a portion of Americans' retirement savings, which have traditionally been restricted to institutional investors.

Proponents note that it may increase market liquidity, while some critics highlight concerns about illiquidity, higher fees and challenges in asset valuation transparency. This key development will require close attention from fund managers, as well as investment advisors, in the weeks and months ahead.

Operational Strategy and Liquidity Solutions: Navigating the New Normal

Persistently high interest rates and extended holding periods have changed the game for PE sponsors, who now must deliver annual earnings growth north of 4% to hit internal rate of return (IRR) targets. The result is a relentless focus on transformative change — think smarter pricing, sharper product strategy and a surge in AI adoption across portfolios. Meanwhile, aging funds are being revitalized through secondaries, continuation vehicles, dividend recaps, and net asset value (NAV)-based solutions, as sponsors seek innovative ways to unlock liquidity in a choppy exit market.

Regulatory Landscape: The 2025 Tax Reform Ushers in a New Era

Signed into law on July 4, 2025, P.L. 119-21 introduces sweeping tax changes that significantly affect PE and their portfolio companies, including:

Qualified Small Business Stock (QSBS) Reforms

Previously, a 100% exclusion applied to C corporation stock acquired at original issuance (depending on the acquisition date), when the issuer was engaged in a qualified business, if the issuing corporation’s gross asset value never exceeded $50M (at the time the stock was issued) and the stock was held for five years. With P.L. 119-21, exclusion limits has been increased to the greater of $15 million-or-ten-times basis, with gross asset caps raised to $75 million.

Most notably, partial exclusion can now be claimed after just three years — 50% at three, 75% at four, and full at five years — up from a rigid five-year rule. These reforms will have a net positive impact for PE funds focused on smaller, high-growth companies, offering earlier partial tax benefits, larger caps and expanded eligibility. However, realizing these benefits will require deliberate deal structuring, precise recordkeeping and LP-specific tax planning.

Accelerated Deductions Restored

The permanent reinstatement of Sections 174 (R&D) permits a current deduction for domestic research and development (R&D) costs vs. required capitalization, and 163(j) (interest), as well as deductions for 30% of EBITDA vs. EBIT. This greatly enhances deductibility of interest, particularly in capital-intensive businesses. These provisions should boost early-period cash flow and ease tax obligations — helping companies deleverage or reinvest quickly.

Return of 100% Bonus Depreciation

Bonus depreciation allows a taxpayer to immediately deduct a portion of their investment in depreciable property. The P.L. 119-21 permanently restores the bonus depreciation deduction to 100% for any qualified property acquired and placed in service on or after January 20, 2025. This change is a powerful cash flow accelerator for PE-backed businesses with meaningful capital expenditures. It favors asset-heavy sectors, acquisition structures that allow basis step-ups, and early-year debt reduction strategies, but requires careful exit and tax planning to avoid value erosion when tax shields run out.

These and other tax benefits in the legislation act to broaden the pool of eligible targets, make earlier exits more attractive, and have prompted some firms to favor C corp structuring for flexibility and maximum tax efficiency. With favorable tax policy underway and robust investment themes in health, technology and industrial sectors, PE is strategically positioned for growth — provided sponsors can deliver operational excellence and responsibly manage emerging regulatory obligations.

Your Guide Forward

Have questions about the 2025 Private Equity Mid-Year Report or how these trends might shape your next move? Cherry Bekaert’s Private Equity Industry professionals are ready to be your partner every step of the way — empowering your investments with industry expertise and unwavering support tailored to your unique business needs.