The Evolution and Expansion of the Alternative Assets Industry

Over the last three decades, the alternatives sector has transformed from a niche, institutional-centered corner of finance into a large, diversified and commercially mainstream pillar of global capital markets. Investment vehicles once dominated by large pools of institutional capital have expanded to include non-institutional investors and various asset classes such as hedge funds, private equity (PE), private debt, commodities and futures, infrastructure, real estate, digital assets and secondaries.

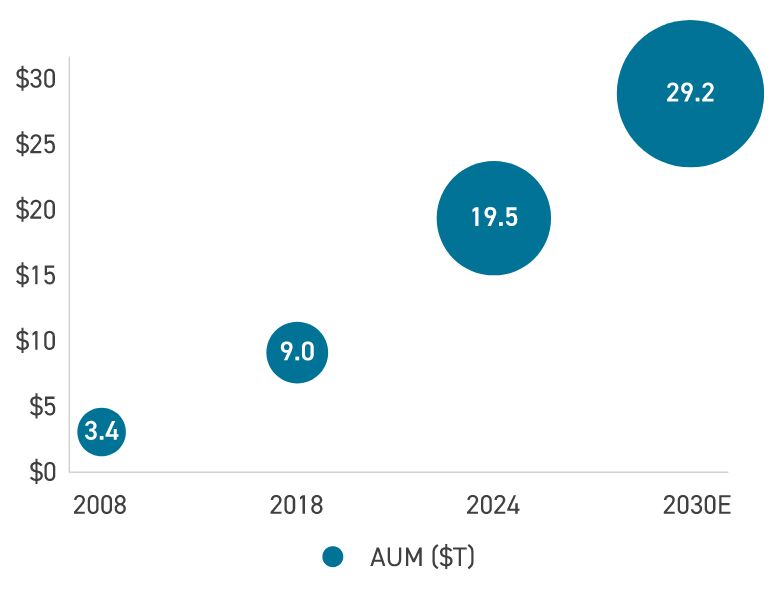

By the mid-2010s, alternatives were already growing rapidly with assets under management (AUM) rising from roughly $7.2 trillion in 2014 to currently over $20 trillion — nearly tripling over ten years.

Key Trends Among Asset Classes

- Private Equity (Buyouts & Growth) and Venture Capital: These are still the largest and most visible engines of alternatives’ growth. Private equity has benefited from large fundraising cycles, strong institutional allocations and the tendency of companies to stay private longer (reducing public-market supply). Fund size and the proliferation of general partner (GP) strategies (sector specialists, continuation vehicles, permanent capital) have driven scale.

- Hedge Funds and Liquid Alternatives: Hedge funds grew both in AUM and business model diversification (quant, multi-strategy, event-driven) and remain important for diversification and for banks’ prime-services businesses. While hedge funds continue to attract significant institutional capital, liquid alternatives have evolved to broaden access to sophisticated investment strategies, especially for retail investors.

- Private Debt: After the global financial crisis, private credit — vehicles that lend directly to companies rather than buying their equity — rapidly expanded as banks retrenched from some leveraged lending; private debt now fills yield and financing gaps for mid-market and corporate borrowers. Notably, private equity firms are increasingly launching private credit funds, which allows them to expand their investment platform, meet investor demand for yield, and capitalize on market gaps created by shifting macro conditions.

- Real Assets and Infrastructure: Pension funds and sovereign wealth funds have increased allocations to infrastructure and real estate for yield and inflation protection; many managers have launched larger dedicated funds and listed/private hybrids.

- Secondaries, Co-investments and Fund of Funds: Advancements in market structure — including active secondaries, GP-led continuation vehicles, fund of funds, and the expansion of co-investment programs — reflect the growing adoption of sophisticated investment strategies aimed at enhancing liquidity, market access and portfolio diversification within private markets.

- Illiquid Securities: Advancements in the market for illiquid securities — private company shares, private credit instruments, structured products, and other hard-to-trade assets — are creating more complex instruments, more active secondary markets and higher investor scrutiny. These changes have made independent, sophisticated valuation assessments critical for fiduciaries, fund managers and regulators.

Growth Bolstered by Scalable Alternatives

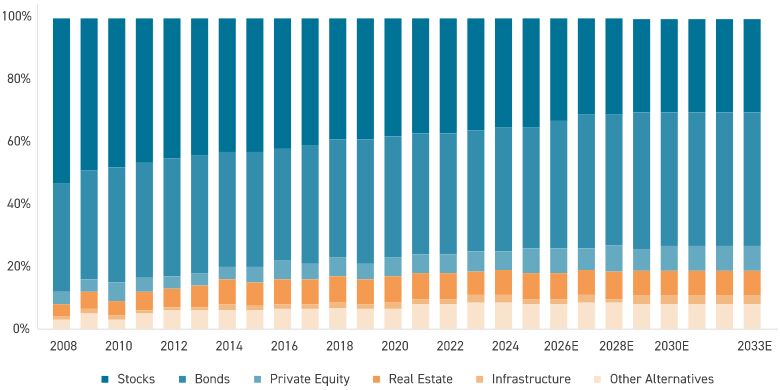

Institutional demand and reallocation have been pivotal to the industry’s growth. Large pensions, endowments and insurers have steadily increased their allocations to alternatives in pursuit of greater long-term returns and diversification, a trend analysts expect to continue driving future growth.

At the same time, new pools of capital — particularly from private wealth, high-net-worth advisors and sovereign wealth funds — have emerged as influential forces, which are expected to account for a sizable part of future expansion in the alternatives market.

Persistently low yields in public fixed income, alongside higher return targets, have further propelled both institutional and retail investors to seek income and total-return enhancement in alternatives. Product innovation and expanded distribution channels, such as interval funds, registered alternatives, and advisor-intermediated illiquid offerings, have broadened access for a wider investor base, while more bespoke institutional solutions continue to proliferate.

Additionally, operational improvements, including enhanced data, benchmark indexation, more sophisticated risk management, and scale efficiencies among leading managers, have reduced market frictions and made alternatives increasingly operationally scalable.

The use of offshore funds, which are typically formed in tax-neutral jurisdictions such as the Cayman Islands, Luxembourg or Bermuda, has also contributed to the growth of alternative investments by allowing managers to pool capital from both U.S. and non-U.S. investors in a single, efficient structure.

These vehicles provide tax neutrality (so investors are taxed only in their home countries), flexible regulations suited to sophisticated strategies and streamlined access to a global investor base. For U.S. tax-exempt or non-U.S. investors, offshore funds can also help avoid certain U.S. tax filings and unrelated business taxable income. Offshore funds have enabled alternative asset managers to raise larger, more diverse pools of capital while preserving after-tax returns for investors.

Alternative Asset Industry AUM: 2008 – 2030 (US$ Trillions)

Source: Preqin | Future of Alternatives 2029 and KKR | Insights Vol.14.4

As of September 2024

While the expansion of alternatives has been impressive, it is important to note that growth in the industry has not been linear or free of risk. Fundraising cycles, fee pressures, regulatory scrutiny, mark-to-market volatility, and liquidity mismatches (especially as some fund types adopt hybrid structures) create episodic stress.

Performance dispersion across managers, for example, means money tends to flow to top talent, leaving mid-tier managers vulnerable in tougher markets. Similarly, macro shocks and rising rates can compress valuations and slow deal pipelines temporarily, as seen in recent years.

Notwithstanding the risks, frictions and caveats, the consensus among analysts and industry insiders forecast continued industry expansion.

The Maturation of Alternative Assets in a Dynamic Era

Established Institutional Allocations Drive Private Capital Growth

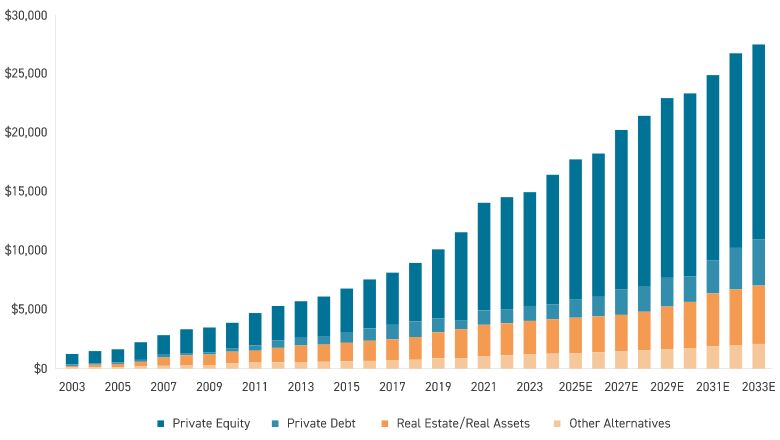

Private capital’s ascent in recent years is not solely the product of new wealth creation or emerging asset managers — it is being propelled in large part by the steady, deliberate commitments of established institutional investors. Pension funds, sovereign wealth funds, endowments, and insurance companies have spent the past two decades building deep allocations to alternative assets, including private equity, private credit, real estate and infrastructure. Today, these allocations are not only holding firm, but in many cases, they are even expanding.

A key driver is the search for enhanced returns in a persistent, low-yield environment for traditional fixed income. Many institutions view alternatives as a proven source of long-term alpha, with historical data demonstrating outperformance relative to market benchmarks during down periods. Institutional allocation models now routinely earmark upwards of 20% to 30% of capital to alternative assets, up from single-digit levels in the early 2000s.

Institutional Investor Portfolio Allocation Percentages by Product: 2008 – 2033E

Source: Morningstar | Industry Landscape

As of November 2024

Moreover, the “denominator effect” from public market volatility, which temporarily constrained allocations in 2022 – 2023, has normalized, freeing institutions to recommit capital at pace. Mature governance structures, experienced in-house investment teams, and established GP relationships allow these investors to successfully deploy billions in capital with a long-term view.

The impact is self-reinforcing: steady institutional inflows give managers the confidence to scale funds, explore more specialized strategies and commit to longer investment horizons. This capital stability has been especially critical in private credit and infrastructure, where multi-year commitments are essential.

As a result, the growth of private capital in alternative assets is less a speculative surge and more a structural evolution — one built on the predictable, disciplined allocations of institutional investors having established alternatives as a core pillar of their investment strategies.

Total Private Capital AUM by Alternative Asset Class: 2003 – 2033E (US$ Billions)

Source: Morningstar | Industry Landscape

As of November 2024

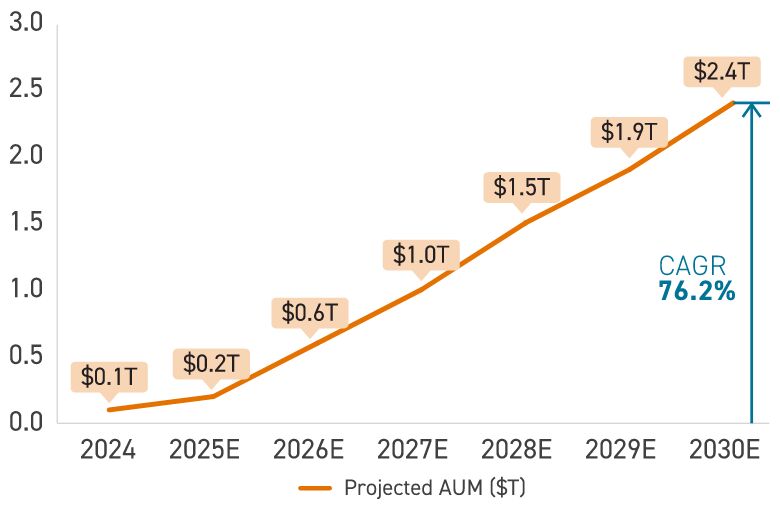

Shifting Strategies To Capture Retail Capital Investments

The growing demand for alternative products in the retail market, together with a substantial base of qualifying investors, is creating many opportunities for continued expansion in alternative assets. New investment vehicles are being designed and marketed specifically to high-net-worth individual retail investors, providing access to various alternative assets that they could not previously include in their portfolios.

The financial industry now defines this increased market access to a broad range of investors as the democratization of assets, which has been aided by technological innovations, public financial literacy and a growing investor demographic.

U.S. Retail Investors’ Allocations to Private Capital (US$ Trillions)

Source: The Business Research Company

As of December 2024

In addition, regulators are becoming increasingly flexible in expanding access to private investments to include retail investors, holding a cautious yet evolving attitude toward private asset democratization — balancing the potential for increased investor access and economic growth against significant risks to retail investors.

Regulators like the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA) are expanding access through new rules and technologies, while remaining focused on strengthening investor protections, transparency, and oversight to mitigate the risks of illiquidity, complexity and fraud for a broader investor base.

Key Retail Investment Regulatory Themes

- Expansion of Accredited Investor Definition: The SEC has expanded the definition of an "accredited investor" to include individuals that demonstrate financial sophistication through professional knowledge and experience, rather than just wealth.

- Retail-facing Funds: Regulators are clearing the way for registered funds, such as certain closed-end funds and interval funds, to hold more private, illiquid assets. This allows retail investors to gain exposure through a more familiar, regulated vehicle.

- 401(k) Access: Policy changes, sparked by a presidential executive order in August 2025, are pushing regulators to make it easier for 401(k) plans to include alternative investments in their offerings. This could open the door for “everyday investors” to access alternative investment classes.

Growth in Accredited Investors

Source: Convergence | Asset Management Industry Research

As of December 2024

The Rise of Private Fund Specialization

The alternatives marketplace has experienced increased competition as asset managers expand client portfolio allocations to the segment. Managers have begun to address their clients’ changing needs by offering different investment options that use specific strategies to reach investment goals, leading to the rise of specialization, a trend that has reshaped fund strategies, investor allocations, and the overall sophistication of the asset class.

In its early years, investments in alternative assets were dominated by generalist funds: large buyout shops, hedge funds and real estate managers that pursued broad mandates. While this model created scale and diversified portfolios, it left opportunities for more targeted approaches. As the market has matured and competition has intensified, managers are increasingly tailoring strategies to specific sectors, asset types or geographies.

Fund specialization is also a key driver of the continued growth in new fund managers and new fund offerings. Increasing investor demand for unique offerings coupled with the increasing sophistication within the alternatives industry has led to an ideal environment for organic growth in the variety of investment vehicles being offered.

Each of the private asset class types within the alternatives industry has experienced an increase in the number of investment offerings over the past five years, with the exception of public funds, which have realized a flat growth trajectory over the same period.

The Number of Public and Private Funds: By Fund Type

|

Fund Type |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

5 yr CAGR |

| Public Funds | 26,690 | 27,169 | 25,413 | 25,540 | 26,138 | 24,366 | -1.8% |

| Hedge Funds | 14,098 | 14,167 | 14,711 | 15,372 | 15,236 | 15,239 | 1.6% |

| PE LBO Funds | 21,062 | 23,115 | 26,807 | 30,638 | 33,104 | 35,776 | 11.2% |

| PE Credit Funds | 986 | 1,030 | 1,253 | 1,335 | 1,428 | 1,546 | 9.4% |

| Private Credit Funds | 1,549 | 1,816 | 2,137 | 2,489 | 2,757 | 2,795 | 12.5% |

| VC Funds | 9,829 | 11,651 | 15,644 | 19,578 | 21,825 | 24,794 | 20.3% |

| RE Funds | 4,773 | 5,080 | 5,684 | 6,127 | 6,431 | 6,709 | 7.0% |

| SAF | 1,787 | 1,913 | 2,205 | 2,510 | 2,646 | 2,975 | 10.7% |

| Other Funds | 6,058 | 6,581 | 7,278 | 8,376 | 9,060 | 9,958 | 10.5% |

| Total Private Funds* | 60,142 | 65,353 | 75,719 | 86,425 | 92,487 | 99,792 | 10.7% |

| Total Public and Private Funds | 86,832 | 92,522 | 101,132 | 111,965 | 118,625 | 124,158 | 7.4% |

Source: Convergence | Asset Management Industry Research

As of December 2024

The rise of specialization has created both opportunities and challenges. For investors, it offers greater choice and the ability to tailor allocations to bespoke portfolio objectives. However, it also requires more intensive due diligence to assess manager skill, strategy scalability and risk exposure. For fund managers, specialization provides a competitive edge but demands deeper expertise, operational excellence and the ability to differentiate in an increasingly crowded marketplace.

Specialization is likely to intensify in the decade ahead as the alternative assets industry continues to expand. Emerging areas such as decarbonization, artificial intelligence, secondary markets, and private wealth distribution are expected to spawn new specialized strategies. In this environment, both investors and managers will need to balance the pursuit of niche opportunities with the risks of over-concentration.

Emerging Managers Unlocking Opportunity in the Face of Challenges

Emerging managers — firms with their first to third funds — are gaining traction in the private assets landscape thanks to their potential for outperformance and the diversification benefits they bring to investor portfolios. These up-and-coming firms are drawing sophisticated investors, such as family offices and institutional capital, who are keen on higher returns and unique investment strategies that established asset managers often overlook.

“Emerging managers bring fresh perspectives and niche expertise to the alternative investment sector, often uncovering overlooked opportunities and driving innovation that challenges established market norms.”

Yet, emerging managers face substantial hurdles as they set out to build their presence, especially in today’s fiercely competitive fundraising environment and persistent macro uncertainty. The challenges begin with significant startup costs; launching a new fund entails considerable expenses related to legal, regulatory, and operational infrastructure, which can weigh heavily on smaller entities.

Building robust back-office systems for managing risk, trading, and reporting is another demanding endeavor, requiring not only financial investment but also specialized knowledge. Attracting and retaining skilled professionals is no less challenging, as these nimble firms must compete with larger organizations offering greater compensation and resources.

Despite these obstacles, emerging managers present compelling advantages to investors and are well placed for success through strategic execution. Empirical research demonstrates that top-performing emerging managers frequently achieve superior net internal rates of return (IRR) relative to established peers. Their flexibility and smaller fund sizes often translate to more robust performance.

Moreover, these managers typically invest a sizable portion of their own capital, aligning their interests closely with those of their investors. By operating with smaller pools of capital, they can target niche sectors and underexplored strategies that are often neglected by larger institutions, introducing meaningful diversification and uncorrelated sources of return.

Despite Sustained Growth, Alternatives Face Both Challenges and Opportunities

The Twists and Turns of Compliance

The regulatory environment for alternative investments has undergone profound shifts since the 2008 financial crisis, with each administration leaving its own imprint on the balance between oversight and market flexibility.

The Great Financial Crisis and Obama Administration (2008 – 2017)

- The Dodd-Frank Act of 2010 pulled private funds and their advisers from the periphery into the center of U.S. financial regulation

- Mandatory SEC registration imposed with systemic-risk monitoring via Form PF under the Financial Stability Oversight Council’s (FSOC) oversight

- Introduced bank-risk restrictions through the Volcker Rule, among other reforms

- Created a durable post-crisis regulatory “infrastructure” that continues to shape industry expectations

First Trump Administration (2017 – 2021)

- Marked a shift toward deregulation and cost reduction, emphasizing “tailoring” rather than sweeping reform

- Bank regulators streamlined Volcker Rule compliance and eased certain “covered fund” restrictions, enabling the expansion of credit and intermediation strategies

- The Commodity Futures Trading Commission (CFTC) advanced the phased implementation of uncleared-swaps margin, with direct implications for hedge funds and credit funds

- SEC enforcement under Chair Jay Clayton focused messaging on “Main Street” harms and retail protection, with 862 actions filed in fiscal year 2019

The Biden Era (2021 – 2025)

- Ushered in a more prescriptive oversight posture, with faster reporting and a materially heightened regulatory tempo

- The modernization of the marketing rule consolidated decades-old solicitation and advertising restrictions and imposed strict regulations

- Form PF obligations expanded significantly, mandating current-event reporting for large hedge fund advisers and more detailed disclosures for private equity

- SEC adopted sweeping Private Fund Adviser Rules, which the Fifth Circuit later vacated, signaling judicial skepticism of expansive SEC authority over private funds

- SEC adopted, then paused, climate disclosure rules, leaving fund managers with fragmented state, federal and international regimes

- Record-breaking penalties tied to “off-channel communications” and crypto-related cases

- The Department of Labor’s (DOL) 2022 ESG rule — which allowed ERISA fiduciaries to consider financially relevant environmental, social, and governance (ESG) factors — was upheld in 2025.

Second Trump Administration (2025 – Present)

- Capital formation is a priority, in addition to selectively tightening anti-illicit-finance measures

- Aims to rollback or de-prioritize Biden-era disclosure and ESG initiatives at the SEC and DOL

- Enacting policies to expand retail access to alternatives through executive direction and legislative proposals

- Creating a more innovation-friendly approach to crypto markets under the CFTC, and targeted adjustments to anti-money laundering (AML) and beneficial-ownership rules

- Fund GPs and portfolio companies facing compliance uncertainty due to FinCEN’s 2025 suspension of beneficial ownership reporting under the Corporate Transparency Act

- SEC withdrew support for climate disclosure rule, elevating the importance of state and European Union regulations

- FinCEN’s new AML requirements for all-cash real estate transactions are effective December 1, 2025

- Administration intends to revisit the 2022 ESG fiduciary rule

New Opportunities in an Evolving Environment

The prevailing regulatory environment presents both challenges and opportunities for fund managers and investors. Firms must now meet demands to scale data collection and controls to satisfy the marketing rule, Form PF expansions, and heightened enforcement around recordkeeping. They also face regulatory fragmentation as U.S. federal requirements diverge from EU and state-level standards, particularly around climate disclosures, and must adapt to new AML reporting burdens for real estate acquisitions. At the same time, the evolving environment creates openings:

- Private credit and specialty finance continue to benefit from Volcker tailoring and bank balance sheet constraints.

- Firms that invest in compliance technology can convert regulatory burdens into operational alpha.

- Secondaries and continuation vehicles can stand out through transparent governance.

- ESG can be reframed as material risk analysis, aligning with f iduciary obligations and institutional investor expectations.

- Real estate managers who build AML readiness early can gain an edge in deal execution.

The trajectory of regulation since 2008 demonstrates that the core infrastructure of post-crisis oversight is here to stay, even as the pendulum swings between deregulatory tailoring and prescriptive expansion. For managers, the winning strategy lies in engineering systems for accurate, timely reporting, building resilient compliance frameworks, and treating regulation not just as a cost, but as a potential source of competitive advantage in fundraising, dealmaking and investor trust.

A Word Regarding the One Big Beautiful Bill Act

In July 2025, P.L. 119-21, commonly known as the “One Big Beautiful Bill Act” (Act), was enacted — a comprehensive tax bill affecting almost all participants in U.S. commerce, including alternative investments. Key provisions of the Act directly affecting alternative investments include:

- Business Interest Limitation: Primarily restores and makes permanent a more favorable method for calculating the limitation on deductible business interest expense.

- Bonus Depreciation and Domestic Research & Experimental (R&E) Expense Deduction: Provides significant tax incentives through immediate expensing of investments and domestic R&E costs.

- Qualified Small Business Stock Exclusion: Prospectively expands benefits of the exclusion, making investments in QSBS more attractive.

- Carried Interest: Carried interests remains unchanged and those meeting a three-year holding period continues to be taxed as long-term capital gains, rather than ordinary income.

- Gift and Estate Tax Exemptions: Increases the federal gift and estate tax exemptions, providing the ability to make tax-free transfers of assets.

- International Taxes: Implements targeted updates to U.S. international tax rules for improved predictability and alignment with global standards.

- Disguised Sales: Clarifies these rules apply regardless of whether regulations are in effect. This is particularly relevant to disguised sales of partnership interests.

- Excess Business Loss (EBL) Limitation: Permanently extends limitations on the deductibility of EBLs.

“The OBBBA has proven to be more of a gentle nudge than a seismic shift for the alternatives, introducing adjustments that refine existing practices without disrupting established strategies or capital flows.”

Cybersecurity in the Digital Marketplace

The securities industry is currently experiencing significant challenges regarding data privacy and security. Common cybersecurity threats include malware affecting computer systems, phishing for confidential information, data breaches, and social engineering tactics targeting individuals.

Asset management systems and platforms used by managers store sensitive, client-specific data that needs to be protected against cyber-attacks and unauthorized access. Attacks involving cryptocurrencies, non-fungible tokens (NFTs), smart contracts and digital wallets are becoming more frequent and complex. Regulatory frameworks for digital assets are still developing, and additional changes are expected as this asset class evolves.

Compliance with data privacy regulations, such as the federal Gramm-Leach-Bliley Act (GLBA) and the California Consumer Privacy Act (CCPA), presents significant challenges for managers and often requires substantial investments of both financial and human resources. It is essential for managers to thoroughly understand these and other emerging regulations and implement robust policies and procedures within their organizations to maintain compliance. Ongoing diligence is necessary to ensure systems remain updated, secure and transparent. Managers are increasingly expected to perform regular reviews and updates of data security practices to maintain effective protection.

The growing importance of cybersecurity has contributed to an industry-wide trend toward outsourcing operational functions in asset management. Engaging specialized third-party providers can help mitigate compliance challenges and address other cybersecurity risks, but the general threat cannot be ignored.

Market Opportunities for Managers and Individual Investors

Portfolio Diversification: Allocating to Alternatives

The growth and sophistication of the alternatives market have led to alternative assets being able to demonstrate correlations to traditional liquid assets while earning alpha. As a result, alternative investments are often able to maintain or increase in value when traditional markets decline, potentially reducing portfolio volatility while aiding in further asset diversification.

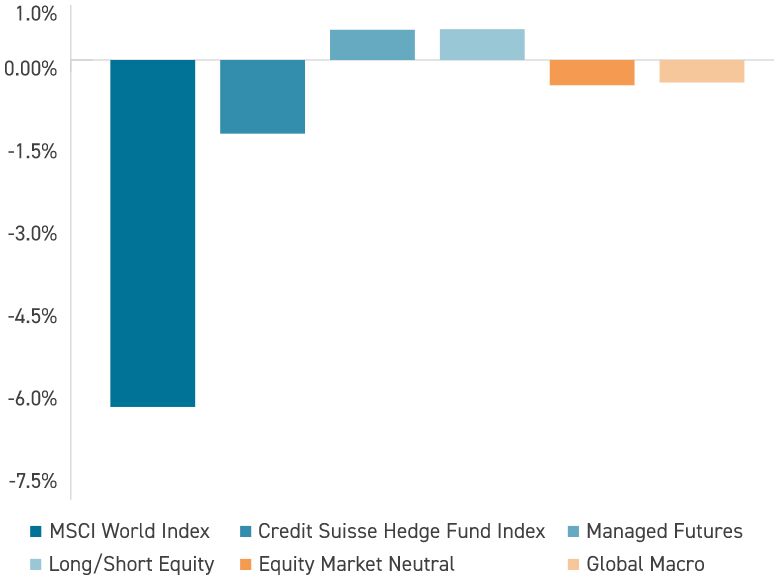

Average Asset Performance During the Largest Monthly Equity Decline

January 1994 – June 2019

Source: CAIA Association | 2020 Member Survey

As of March 2020

Adding alternatives to an investment portfolio can change its risk-return profile. Moreover, the lack of liquidity associated with alternative assets is often accompanied by an illiquidity premium. Investors are compensated for committing their capital to assets that cannot be readily sold, which they speculate will result in higher long-term returns.

“Regulators are sharpening their focus on how firms value complex, illiquid securities, signaling that transparency and rigorous, defensible methodologies are no longer optional, but essential to market integrity.”

Additionally, alternatives provide access to investment opportunities that further diversify a portfolio’s risk while offering greater upside potential. For instance, private equity firms investing in private companies can seek value through operational changes, restructuring or growth strategies. This method of investing enables managers to pursue value creation independent of overall market movements.

Certain alternative assets, such as real estate funds and commodity pools, can help mitigate the effects of inflation on portfolio value. These types of assets may retain or gain value during periods of rising prices, offering protection not always afforded by traditional assets.

The market for alternative assets continues to develop, influenced by innovation and advances in technology, which improve accessibility and operational efficiency. For investors with longer-term perspectives and the ability to accept illiquidity and complexity, diversified investments in alternatives may provide returns during times of market inefficiency.

Artificial Intelligence and Emerging Technology

In the securities industry, artificial intelligence (AI) has begun to influence numerous aspects of operations. Data research, fund strategies, trading algorithms and real-time investment decisions all currently have AI applications employed.

AI-based asset management platforms provide a wide range of data analytics, including historical market prices and volumes, risk assessments, strategy model testing and trade execution analyses. AI is also capable of analyzing substantial amounts of unstructured data, such as social media posts, news articles and other industry data.

AI-focused companies go well beyond trading platforms and stock analysis. Private capital invested in AI-focused companies has experienced a substantial surge over the last decade, with a peak investment year occurring in 2021.

Private Equity Investment in AI & Machine Learning (ML)

Source: PitchBook PE Middle Market Report

As of March 2025

While AI offers significant advantages, human insight remains crucial for setting strategies and defining risk levels. The limitations of these innovative technologies cannot be ignored, and the integration of AI requires a balanced approach. As technology continues to mature, the best initial uses are in areas related to enhanced data efficiency, client engagement and risk management. Although AI supplies managers with improved data management and analysis, client relationships and trust are still far from being well-integrated components.

Outsourced Services To Enhance Business Operations

Financial managers are under continuous pressure to refine and systematize operations, reduce expenses and increase overall return on investment (ROI) for investors. With the increasing expense of acquiring and maintaining assets, organizations are implementing forward-looking asset management systems that utilize technological innovations.

Complementing these asset management system advances, fund advisory companies and administrators have responded by providing highly sophisticated services specific to the needs of fund managers.

In today's alternatives marketplace, it has become customary practice to engage a third-party administrator for fund accounting services. In general, outsourced service providers can help reduce the demands on an asset manager’s business while allowing the manager more time to focus on clients, investment decisions, and capital activities.

Managers engaging service providers may realize reduced costs over time when compared to using internal processes and employees to complete the tasks. Technology costs associated with investor reporting could decrease as outsourced fund administrators can spread the high costs of these systems across their large client base.

Between alternative investments’ considerable AUM growth over the past decade and strong market competition, asset managers have quickly realized that outsourcing key operational services can have numerous benefits. Most typical industry service providers include third-party administrators, trade processing services, financial audit and tax services, compliance oversight, valuation, and reporting, as well as other crucial investment focused activities.

Outsourcing Trends by Alternative Asset Class Type

|

Fund Type |

2020 |

2022 |

2024 |

| Hedge Funds | 86% | 88% | 89% |

| PE LBO Funds | 53% | 59% | 62% |

| PE Credit Funds | 64% | 68% | 73% |

| Private Credit Funds | 79% | 78% | 80% |

| VC Funds | 49% | 59% | 65% |

| RE Funds | 40% | 45% | 49% |

| SAF | 92% | 95% | 96% |

| Other Funds | 75% | 75% | 77% |

| Total | 63% | 66% | 69% |

Source: Convergence | Asset Management Industry Research

As of December 2024

It is important to choose any outsourced service providers wisely. To best support business operations, due diligence and careful consideration of these providers’ experience and success are critical prior to engagement. Replacing an existing service provider causes many disruptions and adds additional non-investment operational risk to a risk category that already ranks as critical.

Alternative Investment Industry Outlook

- Allocation levels of institutional invested capital to alternative assets are expected to peak near 25% in 2025. However, sector expectations for total AUM committed to alternative assets are estimated to near $30 trillion by 2035. Organic AUM growth in the coming years is expected to be driven primarily by retail investors.

- Large capital investments in modern technologies across industries have increased the attractiveness of private equity and venture capital investments. Institutional and retail capital are both engaging in “classic, return to roots” small company investments, employing hold-and-grow strategies. Additionally, private credit has proven to be a strong investment for the institutional market and is expected to continue to be an asset class of focus.

- Increased access to alternative assets for a broad range of retail investors, referred to as the democratization of assets, will continue to be of critical importance as managers improve business operations and strategies to capture private capital. Educating retail investors is of vital importance to increase awareness and familiarity with various alternative investment options.

- Investors’ sophistication, and their demand for transparency and increased ROI, has led to the specialization of funds and core strategies. To continue to stand out, managers should aim to differentiate their offerings through unique value propositions, innovative investment strategies and superior performance metrics.

- The tokenization of assets is redefining ownership models within alternatives, providing investors numerous opportunities for owning various forms of digital assets, including cryptocurrencies, NFTs and tokenized “real” assets. Regulatory oversight will continue to be a priority as these types of alternatives continue to evolve in form and function.

- Advanced technological systems, incorporating innovations such as AI and ML, will continue to be marketed to asset managers. Advancements will continue as these systems are supported by federal funding, institutional and private investors and are being adopted by businesses across industries.

- Forecasts are sensitive to market returns, interest-rate paths, regulatory changes and how far retail channels open to illiquid products. However, barring a sustained industry shock, the structural trends — institutional reallocation, private wealth inflows, product innovation and yield seeking — make further growth the base case, but timing and magnitude remain uncertain.